Satans Mark/Cashless

See other Satans Mark/Cashless Articles

Title: Bitpoint Hack Shows That Regulators’ Scrutiny Does Not Equal Safety

Source:

[None]

URL Source: https://cointelegraph.com/news/bitp ... scrutiny-does-not-equal-safety

Published: Jul 19, 2019

Author: Stephen O'Neal

Post Date: 2019-07-19 05:39:49 by A K A Stone

Keywords: None

Views: 4342

Comments: 11

On July 12, 2019, Tokyo-headquartered cryptocurrency exchange Bitpoint promptly suspended its services after noticing an error in the outgoing funds transfer system. Soon, an official announcement followed, revealing that the trading platform had lost around 3.5 billion yen (roughly $32 million) as a result of a security breach. The exchange’s administration has managed to find a portion of the missing funds since the initial announcement was published. Nevertheless, the security breach seems to continue the streak of hacks targeting Japan-based exchanges.

Details of the hack According to the breakdown of the hack published by Bitpoint’s parent firm, Remixpoint Inc., Bitcoin (BTC) accounted for the highest share of total losses. The total amount of stolen BTC (1,225) is worth over 15 billion yen (just over $138 million). Further, over 28 million XRP (10 billion yen, or $92 million) and 11,169 ETH (3.3 billion yen, or $30 million were taken away by the hackers. Additionally, the fraudsters stole 1,985 Bitcoin Cash (BCH) and 5,108 Litecoin (LTC), worth 1,2 billion yen, or $11 million.

The breach occurred due to unauthorized access to the private keys of its hot wallet, Remixpoint Inc. indicated in the document. Bloomberg has reported that shares of the company shed 19% after the news of the incident surfaced and became untraded in Tokyo at some point due to what the publication called “a glut of sell orders.”

Later, on July 14, local English-language publication The Mainichi reported that Bitpoint has discovered over 250 million yen (around $2.3 million) in cryptocurrency on overseas exchanges that were using a trading system provided by Bitpoint Japan. The exchange’s spokesperson reportedly told The Mainichi that the recent discovery brings the total sum of lost founds down from 3.5 billion yen (about $32 million) to 3.02 billion yen (approximately $28 million).

Related: Round-Up of Crypto Exchange Hacks So Far in 2019 — How Can They Be Stopped?

Genki Oda, founder and CEO of Bitpoint, told Cointelegraph that his platform is going to compensate its users, although without mentioning any specific time frame. Additionally, Oda said it was in touch with fellow exchanges Binance and Huobi regarding the freezing of stolen funds that have allegedly ended up in their wallets following the security breach. Such collaboration with other trading platforms is a common method of mitigating cryptocurrency hacks, as it prevents fraudsters from cashing-in on their loot. “If you know other way for locking or getting back the hacked crypto, please let us know the ways,” Oda added.

Moreover, Bitpont has announced it is going to compensate customers in cryptocurrencies rather than in their equivalent fiat value.

The FSA and Japan’s regulatory regime Although Japan is one of the very few countries where cryptocurrencies can be used as legally accepted means of payment, the Japanese Financial Services Agency (FSA) — the country’s financial watchdog — has been noticeably nervous ever since the infamous Coincheck and Mt. Gox hacks. Since the amendment of Japan’s Payment Services Act in April 2017, all crypto exchanges in the country are required to register with the FSA.

Notably, Bitpoint was one of the approximately 16 local exchanges that has been licensed by the regulator as a result of its rigorous inspections of industry players, which include on-site inspections. According to Nikkei Asian Review, Bitpoint received an operational improvement order from the FSA last year, as the regulators concluded that “its internal controls were flawed,” but it was lifted at the end of last month — just two weeks before the hack occurred.

Related: Grand Theft Crypto: The State of Cryptocurrency-Stealing Malware and Other Nasty Techniques

Koji Higashi, a Japanese market analyst and the founder of Koinup, told Cointelegraph that the FSA’s scrutiny does not necessarily ensure that its subjects have stronger protection in place. Conversely, it could lead to a reduction in safety, Higashi continued:

“I don't think it's a reasonable assumption that being regulated by the FSA closely ensures safety of exchanges. After two major hack incidents that took place in Japan, the FSA tightened the enforcement significantly to prevent any more hacks, but they are by no means security experts. Also, as far as I understand, their main focus seemed to be more on KYC/AML. In some situations, I have heard before that their scrutiny is the reason to put pressure on exchanges financially and lose its focus on security.”

Maurizio Raffone, CEO at Tokyo-based Finetiq Ltd., sees these hacks “as teething problems for a developing market.” He told Cointelegraph:

“Japan’s cryptocurrency exchanges are suffering from their own success as volumes are strong and attract the unwanted attention of cyber attacks. The FSA is actively reviewing the exchange’s operations, issuing improvement orders and so forth but there will always be human error, particularly in an industry that has grown so much, so quickly.”

Jeff Wentworth, co-founder of Curvegrid, another blockchain startup based in Tokyo, seems to agree with that statement, stressing that the hacking problem is not exclusive to Japan:

“I don’t think any country has been immune to financial system hacks, including crypto exchange hacks. Japan is probably seen to be more targeted because it has a larger number of well-capitalized crypto/fiat exchanges versus other jurisdictions.”

Some experts believe the FSA might strengthen its regulation even further as a result of the hack. Wentworth told Cointelegraph:

“I’m sure there will be additional regulatory scrutiny which could lead to tighter requirements for getting licensed. The FSA has shown itself to be both fairly pro-active and fairly fluent in cryptocurrency, so it might just mean an acceleration of already in-flight measures. Computer security is hard, and just as traditional banks will continue to battle hackers, so will crypto exchanges.”

Higashi, on the other hand, is not certain it could be the case, saying:

“According to this website which tracks and compares BTC stock trading volume in Japan, Bitpoint ranks just 7th and their reported BTC trading share is just 2.5% in June. From that standpoint, this incident was minor compared to the Coincheck and Zaif hacks and thus it's possible that the incident may have a minimal impact on the regulation.”

As for now, it seems safe to assume that the level of the FSA’s scrutiny does not necessarily correlate with the safety of the exchanges it oversees. Nevertheless, this year has seen an unprecedented amount of security breaches in the crypto space, which means that some proactive steps should be taken by both players and participants.

Poster Comment:

Who wants money that needs to be updated like Windows and never really works. Satan would like that money system.

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

#1. To: A K A Stone, Pinguinite (#0)

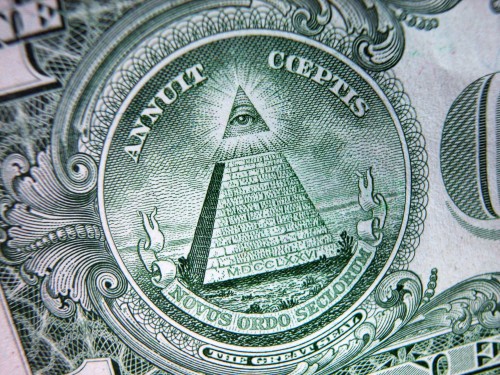

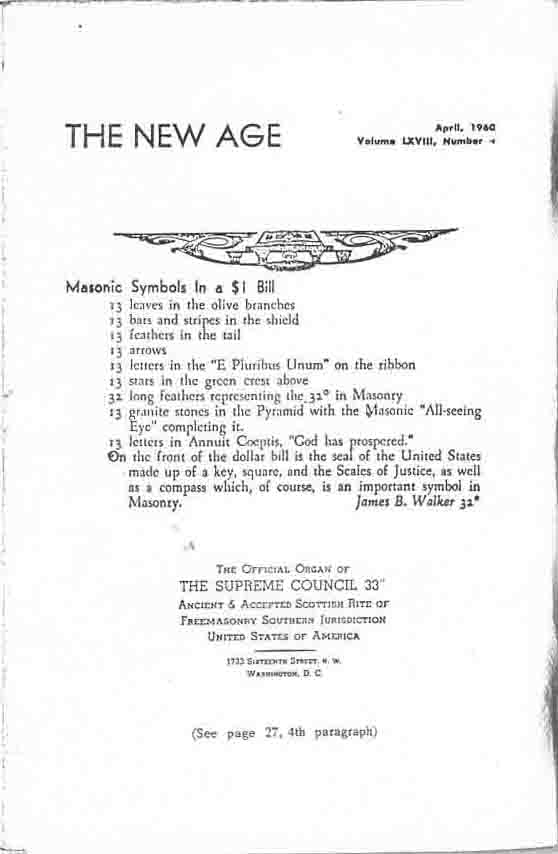

Sounds like you're talking about the dollar. The $20 bill currently shows Andrew Jackson. They're getting ready to change it to Harriet Tubman. Sounds like an update to me. And, of course, we should mention that the dollar has been "updated" with inks that held resist color-copier counterfeiting as well as hidden shading patterns that help to defeat counterfeiters. And the embedding of those tiny colored threads. The dollar has been "updated" quite a few times just in the last 20 years. So your dollar seems pretty Satanic. And it is the preferred currency of the wicked global elite. And every bad guy in the world wants dollars more than any other currency. And Tubman is a bad choice, only picked because she was female. Frederick Douglass was far more important historically. Douglass is being robbed of his rightful place in history, shoved aside so they can promote a relatively minor figure of the era only because she was a female.

Government is in the last resort the employment of armed men, of policemen, gendarmes, soldiers, prison guards, and hangmen. My goodness, that dollar is looking more Satanic by the minute. Feel free to mail me any of your Satan-promoting dollars and I'll safely dispose of them for you.

Crypto hacks are things that really piss me off. Of course. Because yes, you are right that in addition to the damage done to the parties from which it was stolen, it damages the credibility crypto of which I'm obviously biased in favor. The more hacks there are, the more it is damaged. At the same time I would echo this sentiment from the above article: Not to downplay the seriousness of the hacks, but yes, this is new. How much credit card fraud occurred before they started putting the 3 digit codes on the back of the cards to thwart abuse? Did that make CC fraud a thing of the past? Did people stop using CC's when thefts began? It's not a perfect world. Not for CC's not for cash and not for crypto.

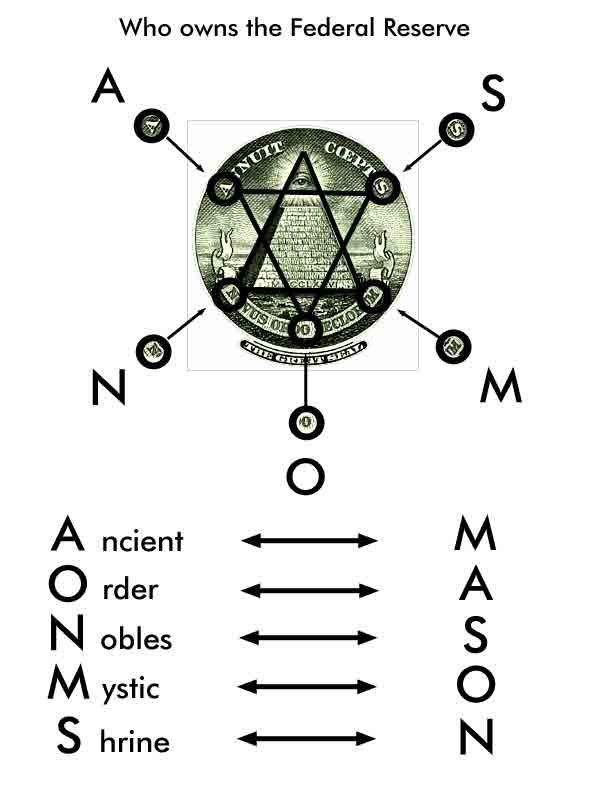

Crypto obviously does work. A quote attributed to one of the Rothchilds bankers: Centralized control of the creation and issuance of money is among the best friends Satan could ever ask for and you have that in the US dollar and all contemporary fiat currencies, with no exceptions whatsoever. Crypto money is decentralized and objectively anti-Satan. I can see the commercial now with an animated mascot showing how Satan runs away in terror when crypto comes along! But seriously, decentralization of the monetary system is the most overwhelming advantage crypto offers. The USA used to have that with the gold and silver based money, and the US became a world power with that monetary system prior to 1913. Before then, anyone could take silver & gold to the mint and be compensated in value for it with minted coin, so while coin was centrally minted, it was not centrally controlled or issued. I see crypto as potentially giving us that same advantage back that America used to have back in the day.

What is lessor known in that Andrew Jackson was vehemently anti central-bank. As president he destroyed the "Second Bank of the United States", which was the Fed Reserve's predecessor, and destroyed it so well it didn't come back until the early 1900's. My personal theory is that the decision to put his likeness on the $20 bill was to mock him, not to honor him. Either way, he certainly would be rolling in his grave over the decision, and removing his face from it would be very much over due as far as he is concerned. Based on that, I think it's likely Andrew Jackson would be very much in favor of crypto, and the images on current US dollars would be more appropriately be of central bankers themselves or of convicted felons, which Jackson would consider synonymous. fromthetrenchesworldrepor...vipers-and-thieves/235971 Edit: That quote is very applicable to what happened with the 2008 financial crisis, though wasn't the central bankers but the standard commercial players of JP Morgan, Bank of America and the like that did the deed. Though I don't know specifically the roles each had in it.

I know the history. You might recall that Jackson went after them so hard because they were threatening to crash the entire national economy deliberately if he tried to take action against them. I wouldn't be surprised if the Federal Reserve would do the same thing if a prez or Congress ever decided to take action against them. Or Goldman-Sachs.

It wasn't all fun and games. The value of money and inflation changed sharply based on Colorado mining, then Nevada mining, then the California gold rush, then the Alaskan gold finds. And there was the era of bimetallism. Farmers and small business favored silver as money (huge finds like in Nevada drove down the value of silver, making it easier for borrowers to pay off debts). Bankers preferred the rarer and more stable gold money. So we split the difference and had both, not to the entire satisfaction of anyone. This situation continued until FDR's seizure of gold money.

JFK was no friend of central banking. Nor was Lincoln. Both issued United States Notes, bypassing the need to borrow from banks. Both got bullets in the head. Gadaffi and Saddam Hussein, according to alternate sources, were both threatening the petrodollar in their respective countries.

I think it's safe to say there is no perfect monetary system. I wouldn't even say crypto is perfect. Even so, I think it's better than what we have now, and is the future of money.

Iraq? Certainly. Publicly. Libya? Nope. They gave up their weapons program and embraced the Empire. Until our pathetic NATO mini-Me's decided (a la Yugoslavia/Bosnia/Herzegovina/Kosovo) to meddle and strut around like they were still the Great Powers they once were. After they exhausted their puny missile stockpiles and their jets were ready to fall into the ocean for lack of spare parts, they whined until 0bama moved in an aircraft carrier to help murder Ghaddafi. At which point Hitlery gushed, "We came, we saw, he died", thinking this would be her ticket to foreign policy expertise and the presidency. Libya won't recover from the war crimes of NATO/Hitlery/0bama for generations, perhaps never. Libya might simply dissolve and become another Somalia. And EU NATO's reward? They exhausted their tiny stockpile of useful arms and brought on the huge exodus of "refugees" that have invaded Europe along with the refugees from the Syrian civil war (which was also instigated by Brit/French intel services in combination with wealthy Saudis/Kuwaitis/Qataris, of which some of the support was for jihad against the non-Sunnis and the Alawite regime but with a goal of building natural gas pipelines to Europe across Syria to sell Saudi and Qatari natural gas to the EU, undercutting the Russian near-monopoly on energy in the EU which helps explain the insane level of dedication that Russia has to keeping Assad in power, just to block those pipelines which would, effectively, destroy Russia and what little prosperity it has). It just didn't work out the way poor Hitlery had hoped. Those wascally brown people just won't cooperate. Instead, she and Bill are despised by the new hard Left, get booed at concerts, have to sell tickets to their sad-ass tour at 10% of asking price, and now she's facing the expansion of the Epstein probe which may reveal that she's married to a pedophile as well as a rapist, and Hitlery may have to sing yet another chorus of Stand By Your Man. Then she'll die. And she still won't be president.

Who wants money that needs to be updated like Windows and never really works. Satan would like that money system.

#2. To: Tooconservative, A K A Stone, Pinguinite (#1)

So your dollar seems pretty Satanic. And it is the preferred currency of the wicked global elite.

The essential feature of government is the enforcement of its decrees by beating, killing, and imprisoning.

Those who are asking for more government interference are asking ultimately for more compulsion and less freedom.

#3. To: Deckard (#2)

#4. To: A K A Stone (#0)

Maurizio Raffone, CEO at Tokyo-based Finetiq Ltd., sees these hacks “as teething problems for a developing market.” He told Cointelegraph:

“Japan’s cryptocurrency exchanges are suffering from their own success as volumes are strong and attract the unwanted attention of cyber attacks. The FSA is actively reviewing the exchange’s operations, issuing improvement orders and so forth but there will always be human error, particularly in an industry that has grown so much, so quickly.”

#5. To: A K A Stone (#0)

Who wants money that needs to be updated like Windows and never really works.

Satan would like that money system.

Permit me to issue and control the money of a nation, and I care not who makes its laws!

#6. To: Tooconservative (#1)

(Edited)

The $20 bill currently shows Andrew Jackson. They're getting ready to change it to Harriet Tubman.

“Gentlemen, I have had men watching you for a long time and I am convinced that you have used the funds of the bank to speculate in the breadstuffs of the country. When you won, you divided the profits amongst you, and when you lost, you charged it to the bank. You tell me that if I take the deposits from the bank and annul its charter, I shall ruin ten thousand families. That may be true, gentlemen, but that is your sin! Should I let you go on, you will ruin fifty thousand families, and that would be my sin! You are a den of vipers and thieves. I intend to rout you out, and by the Eternal God, I will rout you out.” – Andrew Jackson (1767-1845)

#7. To: Pinguinite (#6)

#8. To: Pinguinite (#5)

The USA used to have that with the gold and silver based money, and the US became a world power with that monetary system prior to 1913. Before then, anyone could take silver & gold to the mint and be compensated in value for it with minted coin, so while coin was centrally minted, it was not centrally controlled or issued. I see crypto as potentially giving us that same advantage back that America used to have back in the day.

#9. To: Tooconservative (#7)

I wouldn't be surprised if the Federal Reserve would do the same thing if a prez or Congress ever decided to take action against them. Or Goldman-Sachs.

#10. To: Tooconservative (#8)

The value of money and inflation changed sharply based on Colorado mining, then Nevada mining, then the California gold rush, then the Alaskan gold finds.

And there was the era of bimetallism. Farmers and small business favored silver as money (huge finds like in Nevada drove down the value of silver, making it easier for borrowers to pay off debts).

#11. To: Pinguinite (#9)

(Edited)

Gadaffi and Saddam Hussein, according to alternate sources, were both threatening the petrodollar in their respective countries.

Top • Page Up • Full Thread • Page Down • Bottom/Latest

[Home] [Headlines] [Latest Articles] [Latest Comments] [Post] [Mail] [Sign-in] [Setup] [Help] [Register]