Economy

See other Economy Articles

Title: Sorry America, Your Taxes Aren’t High

Source:

Bloomberg

URL Source: https://www.bloomberg.com/news/arti ... america-your-taxes-aren-t-high

Published: Apr 12, 2017

Author: Ben Steverman

Post Date: 2017-04-12 09:04:46 by Willie Green

Keywords: None

Views: 1872

Comments: 3

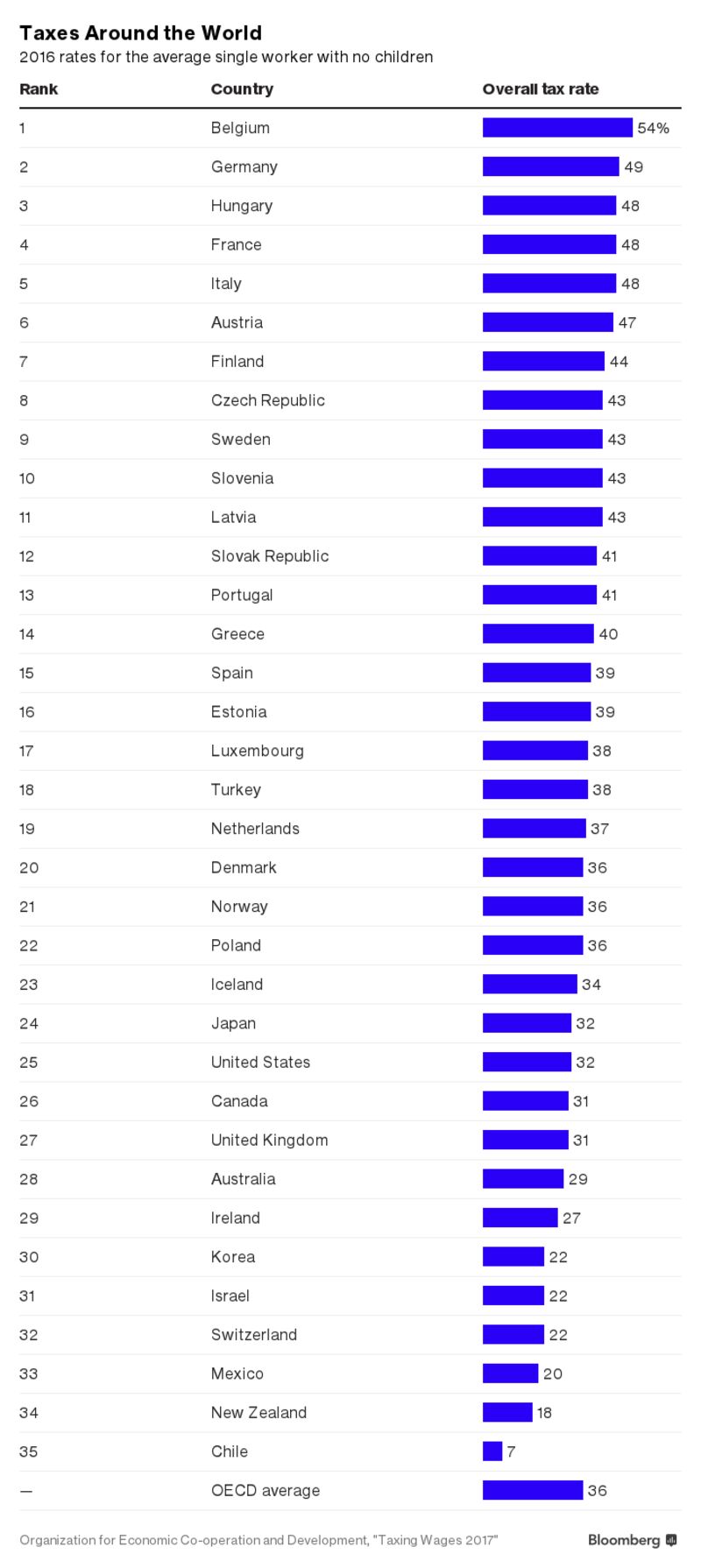

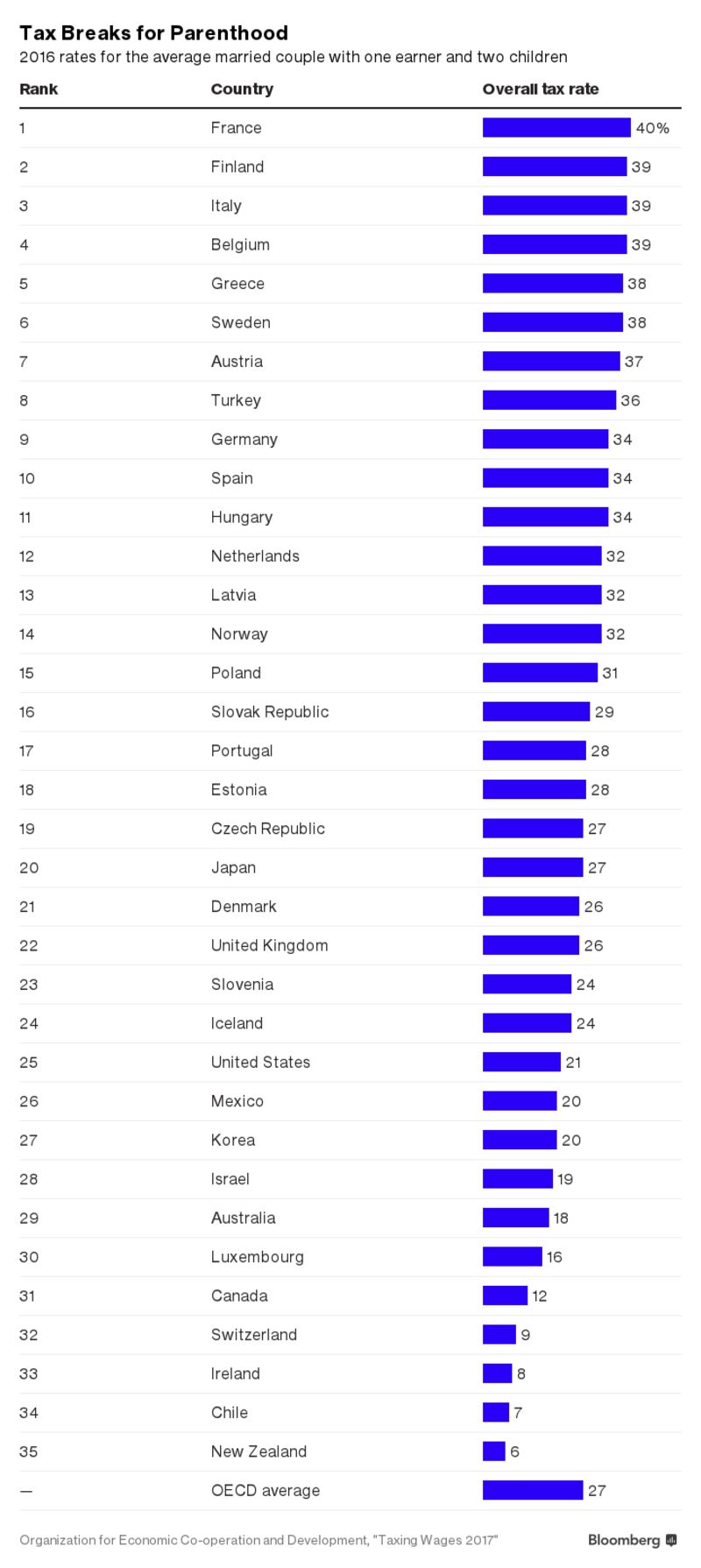

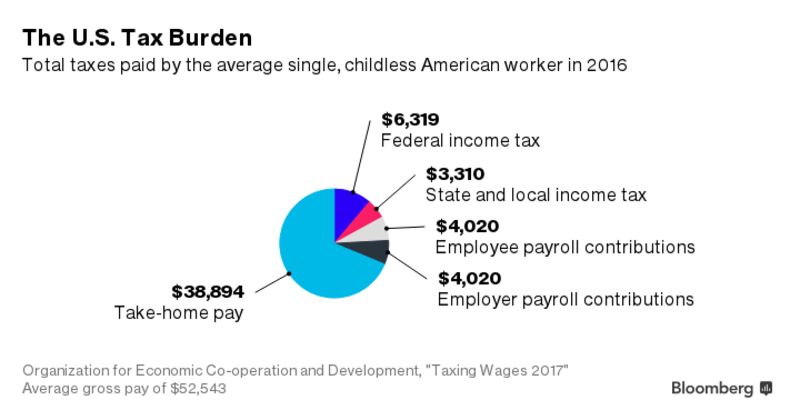

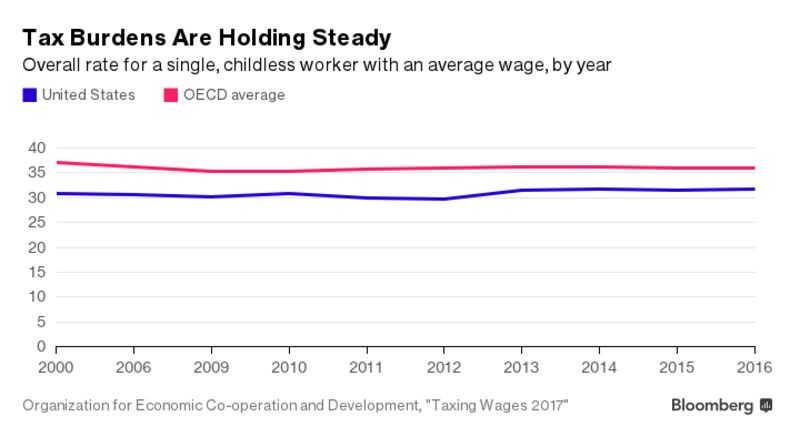

Americans generally feel they’re being over-taxed, especially around this time of the year. Even their president agrees: “With lower taxes on America’s middle class and businesses, we will see a new surge of economic growth and development,” Donald Trump said this month, expanding on an earlier promise to cut Uncle Sam’s bill “massively.” But the reality is that the average U.S. worker pays quite a bit less than he would elsewhere in the developed world. And what’s more, this has been the case for a long time. The Organization for Economic Cooperation and Development analyzed how 35 countries tax wage-earners, making it possible to compare tax burdens across the world’s biggest economies. Each year, the OECD measures what it calls the “tax wedge,” the gap between what a worker gets paid and what they actually spend or save. Included are income taxes, payroll taxes, and any tax credits or rebates that supplement worker income. Excluded are the countless other ways that governments levy taxes, such as sales and value-added taxes, property taxes, and taxes on investment income and gains. Guess who came out at the top of the list? No. Not the U.S. At the top are Belgium and France, while workers in Chile and New Zealand are taxed the least. America is in the bottom third. A single worker earning an average wage in Belgium ends up paying a tax rate almost eight times higher than the average single worker in Chile, the OECD found. But one simple number can be deceiving if you’re trying to paint a national picture. Married people and those with children tend to pay different tax rates than single, childless taxpayers. And in most countries, including the U.S., the well-off pay far more than lower-income people. When the OECD analyzed married couples with children, the rankings looked a little different. New Zealand ends up with the lowest rate, while France ranks number one. But let’s get back to America. The average single U.S. worker with no kids earned $52,543 last year and paid a combined $13,649 in payroll taxes, federal income tax, state and local government taxes. Their employer pitched in another $4,020 in payroll taxes. That overall rate, of 31.7 percent, might seem like a lot, but it’s more than 4 points below the OECD average. In every other scenario analyzed by the OECD in its 584-page “Taxing Wages” report, the U.S. tax burden was also below average, from 3 points to almost 6 points depending on the taxpayers’ wages, marital status, and number of children. In fact, the tax burden on most American workers hasn’t budged much over the last two decades, despite tax cuts under former President George W. Bush and upper-income tax hikes under former President Barack Obama. Workers in two of the world’s highest-taxed countries did get some relief last year. The average tax burden for singles fell by 2.5 percentage points in Austria and by 1.3 points in Belgium from 2015 to 2016. Otherwise, the OECD data suggest that a country’s tax burden usually stays remarkably consistent from year to year and decade to decade. The only reliable way to change your tax burden may be to move. Poster Comment:But if you disagree, think about moving to Chile or New Zealand.

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

#1. To: Willie Green (#0)

Unfair comparisons, you have ask what you get for your tax dollar, in Australia, for example, you get universal health care for a slightly lower tax and better welfare, but the US gets aircraft carriers and flying bricks

Paraclete is exactly right on this. For one must not only look at the tax rate, but also what one gets. Americans take home a bit more money. But then, Americans have to pay for health insurance, which is covered in that French number. And Americans have to save and pay for college, which is covered in that French government number. And Americans have to save and invest for their own retirements, all of which is covered in that French number. American families spend on average 7% of their income on health care, 4% on higher education, and 6% on retirement savings. Remember, all of these things are provided for in those higher taxes in, say, France. Add those things together and that 17% of American income - add that to the 21% of income that Americans pay in taxes (according to the article), and you have 38% of the American's total income going to pay for the same things (government, education, medical care and retirement) that the French pay 40% of their incomes to the government to pay for. So, the REAL differential is only 2%...and the difference in pressure on the people. The French do not have student debt, they all have health insurance, and they all have retirement. So the French sense of insecurity is much, MUCH lower than the American sense. The Americans spend just about the same thing as the French do, overall, but Americans are a lot less protected and secure, and have much greater stress and social suffering on account of it. This is because the difference isn't really 2%. It's that in every facet of American expenditure - on government, on health care, on college, on retirement investment, the American providers take MUCH bigger salaries and profits than the French providers do. French doctors earn about half of what the Americans do, and the French spend about 60% of what Americans do on health care. But a good 10% of the health care in America goes to profit for the insurance middlemen. So Americans are really getting a LOT less care for a lot more money. Same thing goes for college. Etc. France and Finland have purposely egalitarian systems, determined to round the bottom up to the middle. America has a decidedly "nobles and peasants" system, with all that means for the bottom 3/4's.

Thanks for the vote of confidence. I expect that if you worked out the costs and benefits of all the systems we would see that the cost benefit might be about the same, but some of the systems are much more effective and efficient at service delivery

#2. To: paraclete (#1)

#3. To: Vicomte13 (#2)

Top • Page Up • Full Thread • Page Down • Bottom/Latest

[Home] [Headlines] [Latest Articles] [Latest Comments] [Post] [Mail] [Sign-in] [Setup] [Help] [Register]