politics and politicians

See other politics and politicians Articles

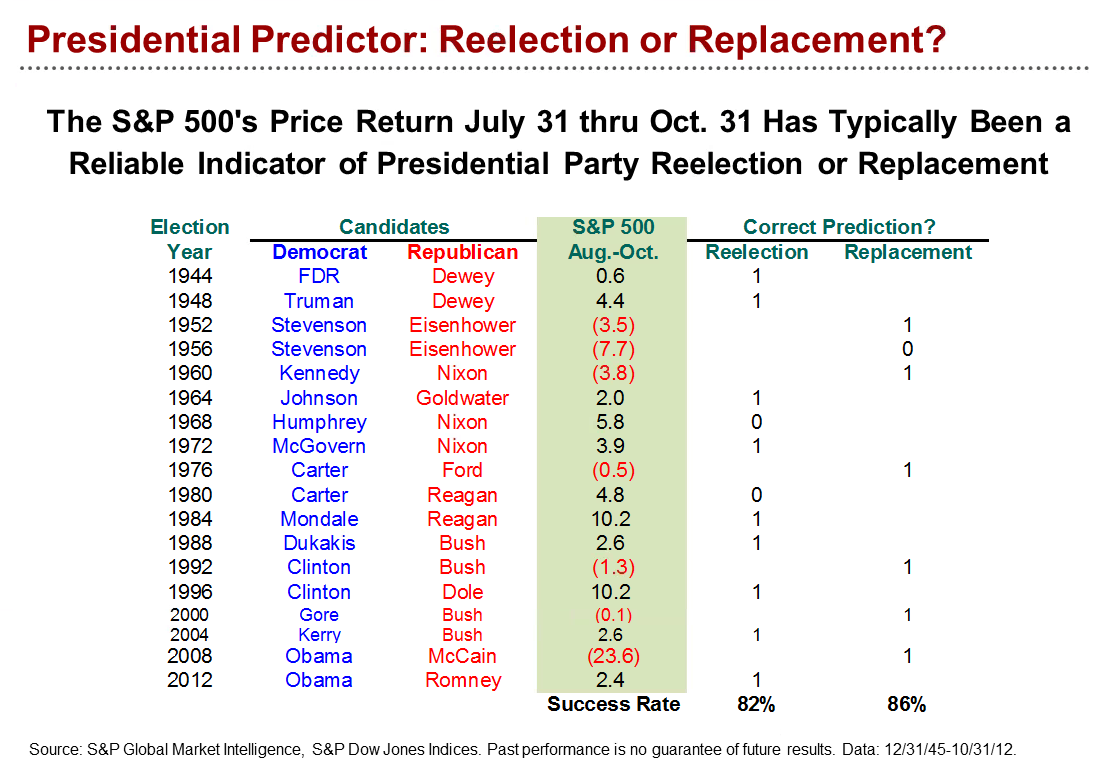

Title: This Chart Predicts Trump Will Win, Unless the S&P Rallies in October

Source:

Bloomberg

URL Source: http://www.bloomberg.com/news/artic ... ess-the-s-p-rallies-in-october

Published: Sep 30, 2016

Author: Suzanne Wooley

Post Date: 2016-09-30 20:50:36 by cranky

Keywords: None

Views: 1390

Comments: 4

Take it with a massive grain of salt, but the stock index has a funny way of predicting the presidential victor. October is the bad boy of the stock market. The Panic of 1907, the Crash of 1929, Black Monday in 1987. It's notable for another reason, too. The performance of Standard & Poor's 500-stock index from July 31 to Oct. 31 has a curious way of predicting the winner of the presidential election. As with every prediction, take it with a giant grain of salt. But the pattern is solid, as shown in this chart by Sam Stovall, equity strategist for S&P Global Market Intelligence . When the stock market ends up for the three-month period, the Democrat wins. When it's negative, the Republican wins. Since this July 31, the S&P is in slightly negative territory. Two times the pattern didn't hold were in 1968 and 1980, when influential third-party candidates were in race, including George Wallace, who took about 14 percent of the popular vote in '68. The pattern also failed in 1956, which Stovall says could be attributed to geopolitical events putting the markets on edge. That was the year of the Suez Crisis and the Hungarian Uprising, he noted. Stovall describes the stock market right now as vulnerable to outside shocks because it is "top-heavy," with a price-to-earning ratio of 25.3 for the trailing 12 months. The last, and only other, time he's seen a higher market P/E was during the tech bubble, when it was almost 32. Nice statistic. But perhaps not enough to comfort the losers.

For those who need a "virtual Valium" for stock market jitters, Stovall pointed out that in November and December of election years the stock market is typically up, regardless of the winning party. If the incumbent's party is reelected, the market goes up 1.7 percent, on average, and rises in price 70 percent of the time. If the incumbent party loses, the market rises 2.3 percent and increases in price 75 percent of the time.

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

#1. To: cranky (#0)

Trump shit all over himself in the debate. The latest polls show it. It's time for him to get serious instead of playing around.

rlk you are a two bit little ass hole unworthy of my pissing on. Crawl back under your rock you socialist piece of shit!

rlk you are a two bit little ass hole unworthy of my pissing on. Crawl back under your rock you socialist piece of shit! Our only hope is a presidential candidate who debates Hillary like an aplogetic guilty little child cowering before his stern mother. He has gone down three to seven points in nearly every state after the debate so far and your solution is to call me names.

That proves how stupid you are, these are your chioices scum, apologize or pray to God we never meet.

#2. To: rlk (#1)

Trump shit all over himself in the debate.

#3. To: John_Henry_DaDum (#2)

(Edited)

Trump shit all over himself in the debate.

#4. To: All (#2)

Crawl back under your rock you socialist piece of shit!

Top • Page Up • Full Thread • Page Down • Bottom/Latest

[Home] [Headlines] [Latest Articles] [Latest Comments] [Post] [Mail] [Sign-in] [Setup] [Help] [Register]