Economy

See other Economy Articles

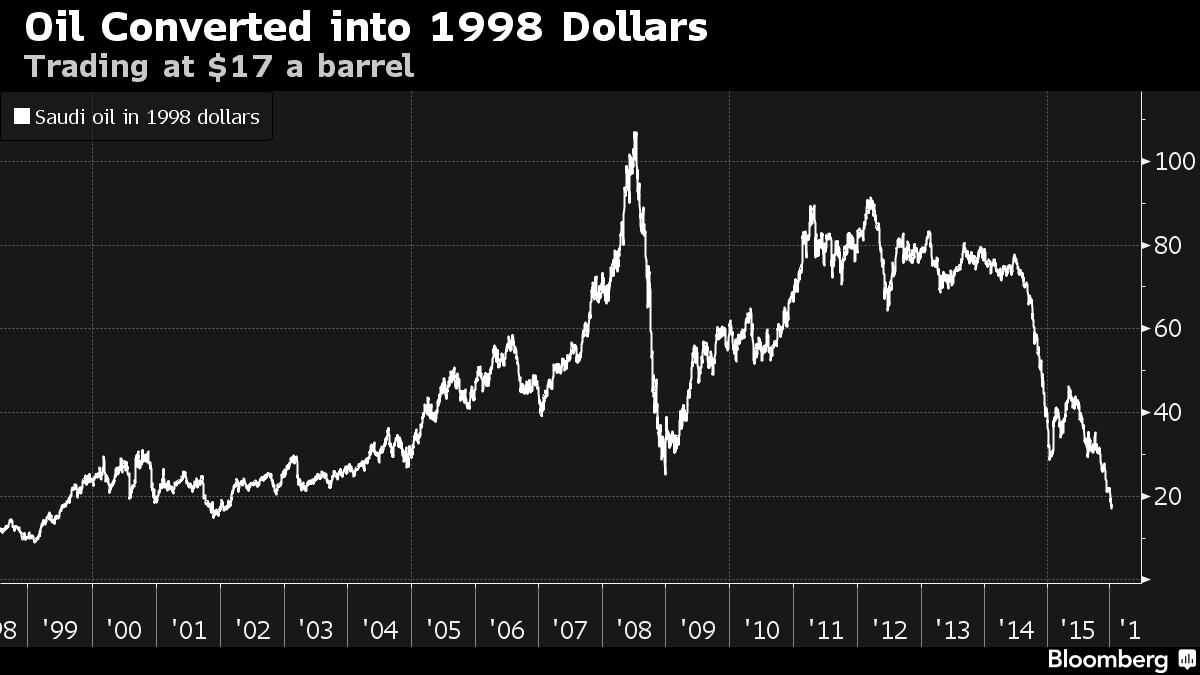

Title: The Real Price of Oil Is Far Lower Than You Realize

Source:

soso

URL Source: http://www.bloomberg.com/news/artic ... -spending-cuts-and-even-smiles

Published: Jan 15, 2016

Author: Grant Smith, BloombergBusiness

Post Date: 2016-01-15 14:21:03 by SOSO

Keywords: None

Views: 1726

Comments: 10

The Real Price of Oil Is Far Lower Than You Realize by Grant Smith January 13, 2016 — 5:01 PM MST Updated on January 14, 2016 — 1:54 AM MST While oil prices flashing across traders’ terminals are at the lowest in a decade, in real terms the collapse is even deeper. West Texas Intermediate futures, the U.S. benchmark, sank below $30 a barrel on Tuesday for the first time since 2003. Actual barrels of Saudi Arabian crude shipped to Asia are even cheaper, at $26 -- the lowest since early 2002 once inflation is factored in and near levels seen before the turn of the millennium. Slumping prices are a critical signal that the boom in lending in China is “unwinding,” according to Adair Turner, chairman of the Institute for New Economic Thinking. Slowing investment and construction in China, the world’s biggest energy user, is “sending an enormous deflationary impetus through to the world, and that is a significant part of what’s happening in this oil-price collapse,” Turner, former chairman of the U.K. Financial Services Authority, said in an interview with Bloomberg Television. The nation’s economic expansion faltered last year to the slowest pace in a quarter of a century. “You see a big destruction in the income of the oil and commodity producers,” Turner said. Saudi prices would be less than $17 a barrel when converted into dollar levels for 1998, the year oil sank to its lowest since the 1980s. The benefit for consumers from historically low oil prices is being blunted by changes in fuel taxation and a reduction in subsidies, according to Paul Horsnell, head of commodities research at Standard Chartered Plc in London. “But it certainly shows that current prices are very low by any description,” he said. Poster Comment: Deja vu all over again? Don't think so. Is this really being driven by supply conditions? I don't think so.

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

#1. To: TooConservative (#0)

ping

потому что Бог хочет это тот путь

If they are so low how come it hasn't translated to 1998 prices at the pump, the oil companies are still getting rich charging us 2013 prices. This is all smoke and mirrors as Saudi and the US try to beggar Russia. The only impact China has is a lessening of domestic demand

Well now, no-one in the business media or elsewhere has seemed to notice this. I certainly have. But then again I have firmly believed for decades with strong justification that the oil/refined products price game is rigged, at least to the extent that prices do not reflect free market supply-demand conditions. потому что Бог хочет это тот путь

http://inside.mines.edu/~jjechura/Refining/01_Introduction.pdf This is a link to a darn good presentation on the economics of the U.S. crude refining sector. The charts on Crack Spreads (starting on page 23) is quite informative. Would you like to guess where the crack spread has been recently?

потому что Бог хочет это тот путь

For a number of years Putin was imploring Russian business and administrative leaders to wean country from dependence on export of resources and on import of food. Now is a golden opportunity to do just that and to restructure economy.

Not only for Russia. The Russian economy is really small in comparison with other nations and is hurting from low energy prices but Europe is vulnerable being too dependent on Russian energy. The expenditure Putin is putting into Syria is a smoke screen to cover the internal problems. The Russian bloc is just 3% of the world economy

Not only for Russia. The Russian economy is really small in comparison with other nations and is hurting from low energy prices but Europe is vulnerable being too dependent on Russian energy. It is quite different. Europe was not in a trap of being natural resource exporter but needed market for their value added products. European problems are mainly cultural and demographic. Is the present crisis helpful in solving them? Perhaps the influx of refugees will play a role?

The influx of refugees will serve to polarise Europe. Already right wing organisations are forming to oppose refugees and this could mean the rise of an ugly european militantism. We have short memories, we have forgotten what was done in Europe last century in the name of race or homeland

It will wake them up, they will start to think. Cannot hurt.

On the contrary it gives a cause to the neonazi and the extreme right wing and the general populance will turn a blind eye. Merkel has sown the wind and will reap a whirlwind

#2. To: SOSO (#0)

But it certainly shows that current prices are very low by any description

#3. To: paraclete, TooConservative, All (#2)

If they are so low how come it hasn't translated to 1998 prices at the pump, the oil companies are still getting rich charging us 2013 prices.

#4. To: paraclete, TooConservative, All (#2)

#5. To: paraclete (#2)

This is all smoke and mirrors as Saudi and the US try to beggar Russia.

#6. To: A Pole (#5)

Now is a golden opportunity to do just that and to restructure economy.

#7. To: paraclete (#6)

"Now is a golden opportunity to do just that and to restructure economy."

#8. To: A Pole (#7)

European problems are mainly cultural and demographic. Is the present crisis helpful in solving them? Perhaps the influx of refugees will play a role?

#9. To: paraclete (#8)

The influx of refugees will serve to polarize Europe.

#10. To: A Pole (#9)

It will wake them up, they will start to think. Cannot hurt.

Top • Page Up • Full Thread • Page Down • Bottom/Latest

[Home] [Headlines] [Latest Articles] [Latest Comments] [Post] [Mail] [Sign-in] [Setup] [Help] [Register]