International News

See other International News Articles

Title: How the World’s Biggest Corporation Secretly Uses Tax Havens to Dodge Taxes

Source:

Americans for Tax Fairness

URL Source: http://www.americansfortaxfairness.org/walmart-tax-havens/

Published: Jun 18, 2015

Author: Americans for Tax Fairness

Post Date: 2015-06-18 12:36:36 by Willie Green

Keywords: None

Views: 1511

Comments: 12

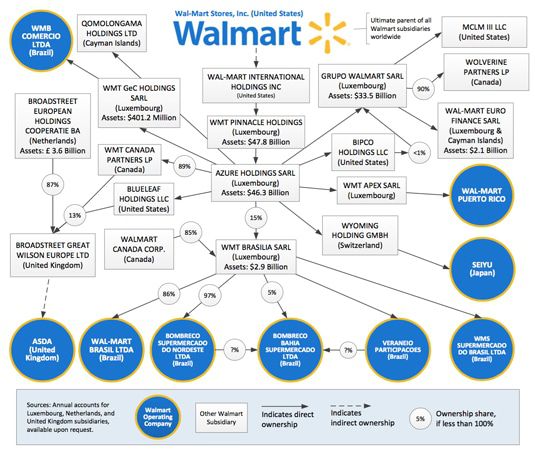

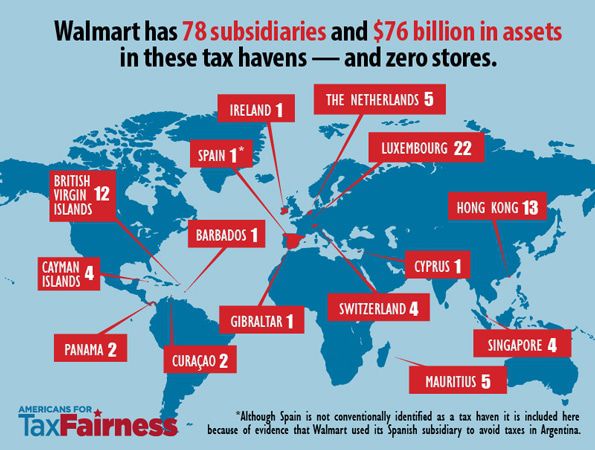

A groundbreaking report reveals that Walmart has built a vast, undisclosed network of 78 subsidiaries and branches in 15 overseas tax havens, which may be used to minimize foreign taxes where it has retail operations and to avoid U.S. tax on those foreign earnings. These secretive subsidiaries have never been subject to public scrutiny before. They have remained largely invisible, in part because Walmart fails to list them in its annual 10-K filings with the U.S. Securities and Exchange Commission (SEC). Walmart’s preferred tax haven is Luxembourg, dubbed a “magical fairyland” for corporations looking to shelter profits from taxation. The report, The Walmart Web: How the World’s Biggest Corporation Secretly Uses Tax Havens to Dodge Taxes, is the first-ever comprehensive documentation of the company’s use of tax havens. The full report is available here, and for the report’s Key Findings, click here. Most people know that Walmart is the world’s biggest corporation. Virtually no one knows that Walmart has an extensive and secretive web of subsidiaries located in countries widely known as tax havens. Typically, the primary purpose for a corporation to set up subsidiaries in tax havens where it has little to no business operations and few, if any, employees is to pay little, if any, taxes and to maintain financial secrecy. All told it has 78 subsidiaries and branches in 15 offshore tax havens, none of them publicly reported before. They have remained invisible to experts on corporate tax avoidance in part because of the way Walmart has filed information about them to the U.S. Securities and Exchange Commission (SEC). Walmart may be skirting the law as there is a legal requirement to list subsidiaries that account for greater than 10 percent of assets or income. It has 22 shell companies there – 20 established since 2009 and five in 2015 alone. Walmart does not have one store there. Walmart has transferred ownership of more than $45 billion in assets to Luxembourg subsidiaries since 2011. It reported paying less than 1 percent in tax to Luxembourg on $1.3 billion in profits from 2010 through 2013. At least 25 out of 27 (and perhaps all) of Walmart’s foreign operating companies (in the U.K. Brazil, Japan, China and more) are owned by subsidiaries in tax havens. All of these companies have retail stores and many employees. Walmart owns at least $76 billion in assets through shell companies domiciled in the tax havens of Luxembourg ($64.2 billion) and the Netherlands ($12.4 billion) – that’s 90 percent of the assets in Walmart’s International division ($85 billion) or 37 percent of its total assets ($205 billion). It is using tax-haven subsidiaries to minimize foreign taxes where it has retail operations and to avoid U.S. tax on those foreign earnings. Walmart apparently hopes the U.S. Congress will reward its use of tax havens by enacting legislation that would allow U.S.-based multinationals to pay little U.S. tax when repatriating current low-taxed foreign earnings (such as to fund infrastructure spending) and pay no tax with the adoption of a territorial tax system. Among the issues to pursue: Download the full report here. Key Findings

Walmart has established a vast and relatively new web of subsidiaries in tax havens, while avoiding public disclosure of these subsidiaries.

Luxembourg, dubbed a “magical fairyland” by one tax expert because of its ability to shelter profits from taxation, has become Walmart’s tax haven of choice.

Walmart has made tax havens central to its growing International division, which accounts for about one-third of the company’s annual profits.

There is evidence that Walmart uses its subsidiaries in tax havens to pursue well-known international tax-avoidance strategies:

Walmart appears to be playing a long game – from tax deferral to profit windfall.

U.S. and foreign authorities should investigate Walmart’s tax avoidance.

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

#1. To: Willie Green (#0)

Google and Apple have also avoided hundreds of billions in taxes via Irish and Dutch tax haven laws. And they are still keeping hundreds of billions overseas, just to avoid paying taxes on it.

You beat me too it. As long as they claim they are a progressive company they get a pass.

I grabbed the low-hanging fruit. I've read about their tax avoidance schemes over the years. This is the first expose I've seen on Walmart so it is worth reading. Looks to me like Walmart is small potatoes compared to Google or Apple or some other big corporations.

Any big global corp will do what it takes not to pay taxes. Even if it means paying another country taxes instead. We live in a broken society.

Good for walmart. Corporate taxes are 100% paid by the consumer.

Baloney... Some people march to a different drummer - and some people POLKA.

Baloney backatcha . . . 1. Taxes are a cost of doing business What is so difficult to understand about this? BTW - if you don't like the fact that LEGAL tax shelters exist, then contact your local rep to lobby to get them changed.

Nonsense. Corporate Income Taxes are a confiscation of a portion of corporate profits, which is calculated AFTER costs are deducted from revenue. Yeah... that's why businesses NEVER go bankrupt... they just "pass along costs to the consumer"... /sarcasm Rufus, it's painfully obvious that you haven't the slightest grasp of fundamental principals of business accounting or economics. Some people march to a different drummer - and some people POLKA.

Baloney... If that were true, then corporations wouldn't using tax shelters to avoid their obligations. Willie, when it comes to economics and finance you are a mental midget. Taxes reduce the Net Income of the corporation. It is Net Income that accures to the benefit of the owners of the corporation, not pre-Tax Income. What the corporation "saves" in income taxes accures directly to the beneift of the owners. Therefore the corporation has the highest incentive of all in minimizing its tax bill, namely, more income available to its owners, i.e. maximizing the wealth of its owners over time. Try to find a clue somewhere. потому что Бог хочет это тот путь

In other words, corporate income taxes are 100% paid by the corporation on behalf of its stockholders, NOT by the consumers or customers. Thank-you for agreeing with me. Some people march to a different drummer - and some people POLKA.

Oh Lord, what a total mental midget you are. From who does a corporation obtain its revenue? HINT: From its customers. What is the definiton of pre- Tax Income? HINT: Revenue less ALL expenses ex. taxes. What is the definition if Net Income? HINT: Income after all expense and taxes. The first measure of corporate financial success is the Net Income available to its shareholders. If a corporation is not earning enough Net Income to attract and keep its owners it will first attempt to increase its revenue by raising prices.......... yes, Dear Misguided Heart, the prices which is paid by its consumers. If for whatever reason it cannot increase its revenue it will seek to reduce its expenses. In any event taxes are paid out of revenue which it obtains from consumers. Period.....over and out. If you still cannot understand that it is the consumer that ultimately pays for the taxes a corporation pays, irrespective of on whose behalf, then take the last word because you are hopeless. потому что Бог хочет это тот путь

Yeah, I guess you're right. Wanna loan me your textbook?

#2. To: TooConservative, willie green (#1)

#3. To: Justified (#2)

#4. To: TooConservative (#3)

#5. To: Willie Green (#0)

#6. To: vikingisaverb (#5)

Corporate taxes are 100% paid by the consumer.

If that were true, then corporations wouldn't using tax shelters to avoid their obligations.

#7. To: Willie Green (#6)

Baloney... If that were true, then corporations wouldn't using tax shelters to avoid their obligations.

2. Costs of doing business are ALWAYS passed on to the consumer.

3. To remain competitive, corporations will ALWAYS find ways to reduce costs of doing business.

4. Ergo, corporations will use whatever LEGAL means available to them to reduce the taxes they pay.

#8. To: Rufus T Firefly (#7)

1. Taxes are a cost of doing business

2. Costs of doing business are ALWAYS passed on to the consumer.

#9. To: Willie Green, vikingisaverb (#6)

Corporate taxes are 100% paid by the consumer.

#10. To: SOSO (#9)

#11. To: Willie Green (#10)

In other words, corporate income taxes are 100% paid by the corporation on behalf of its stockholders, NOT by the consumers or customers.

#12. To: Willie Green (#8)

Rufus, it's painfully obvious that you haven't the slightest grasp of fundamental principals of business accounting or economics.

Top • Page Up • Full Thread • Page Down • Bottom/Latest

[Home] [Headlines] [Latest Articles] [Latest Comments] [Post] [Mail] [Sign-in] [Setup] [Help] [Register]