Economy

See other Economy Articles

Title: ARE YOU SEEING WHAT I’M SEEING? [Financial Collapse Continues]

Source:

[None]

URL Source: http://www.theburningplatform.com/?p=40366

Published: Sep 17, 2012

Author: Admin

Post Date: 2012-09-17 18:02:58 by Capitalist Eric

Keywords: None

Views: 9461

Comments: 22

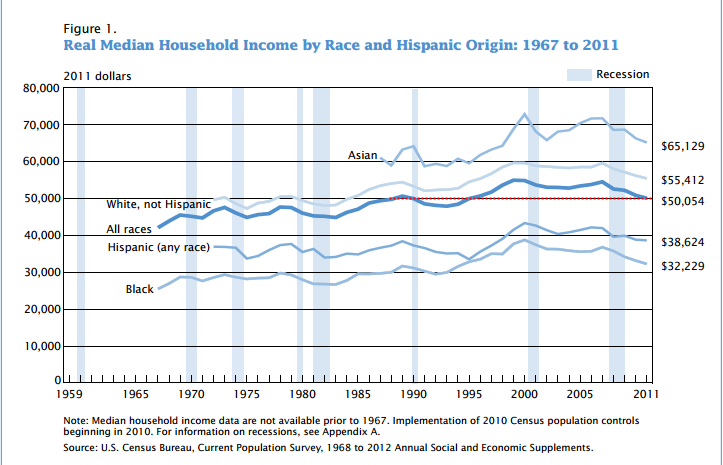

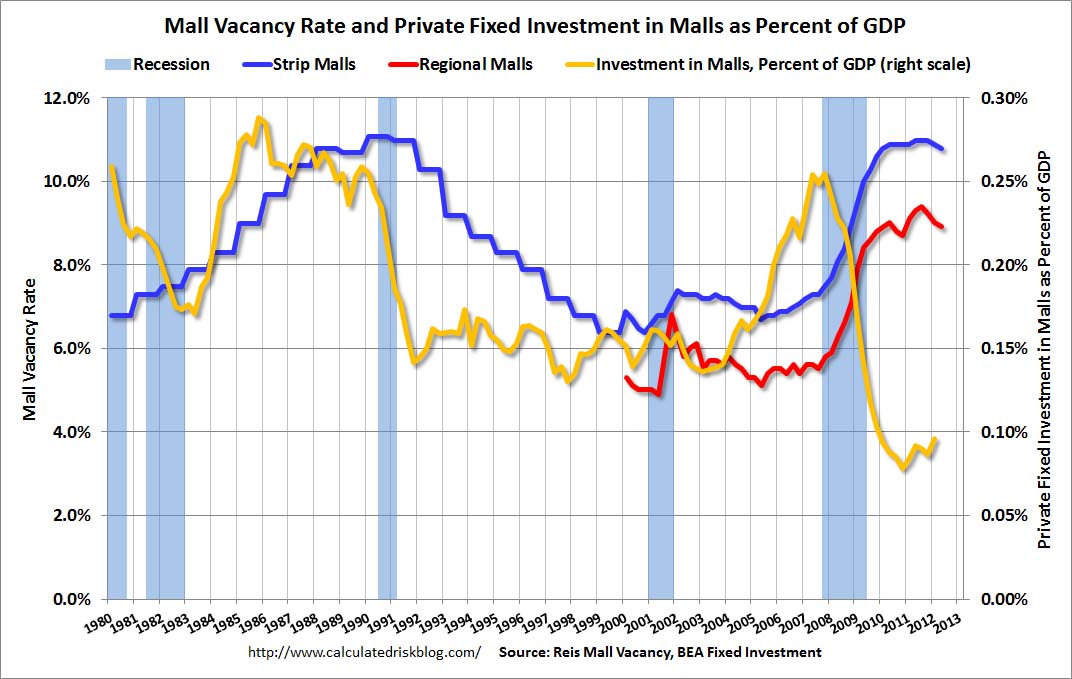

Is it just me, or are the signs of consumer collapse as clear as a Lowes parking lot on a Saturday afternoon? Sometimes I wonder if I’m just seeing the world through my pessimistic lens, skewing my point of view. My daily commute through West Philadelphia is not very enlightening, as the squalor, filth and lack of legal commerce remain consistent from year to year. This community is sustained by taxpayer subsidized low income housing, taxpayer subsidized food stamps, welfare payments, and illegal drug dealing. The dependency attitude, lifestyles of slothfulness and total lack of commerce has remained constant for decades in West Philly. It is on the weekends, cruising around a once thriving suburbia, where you perceive the persistent deterioration and decay of our debt fixated consumer spending based society. The last two weekends I’ve needed to travel the highways of Montgomery County, PA going to a family party and purchasing a garbage disposal for my sink at my local Lowes store. Montgomery County is the typical white upper middle class suburb, with tracts of McMansions dotting the landscape. The population of 800,000 is spread over a 500 square mile area. Over 81% of the population is white, with the 9% black population confined to the urban enclaves of Norristown and Pottstown. The median age is 38 and the median household income is $75,000, 50% above the national average. The employers are well diversified with an even distribution between education, health care, manufacturing, retail, professional services, finance and real estate. The median home price is $300,000, also 50% above the national average. The county leans Democrat, with Obama winning 60% of the vote in 2008. The 300,000 households were occupied by college educated white collar professionals. From a strictly demographic standpoint, Montgomery County appears to be a prosperous flourishing community where the residents are living lives of relative affluence. But, if you look closer and connect the dots, you see fissures in this façade of affluence that spread more expansively by the day. The cheap oil based, automobile dependent, mall centric, suburban sprawl, sanctuary of consumerism lifestyle is showing distinct signs of erosion. The clues are there for all to see and portend a bleak future for those mentally trapped in the delusions of a debt dependent suburban oasis of retail outlets, chain restaurants, office parks and enclaves of cookie cutter McMansions. An unsustainable paradigm can’t be sustained. The first weekend had me driving along Ridge Pike, from Collegeville to Pottstown. Ridge Pike is a meandering two lane road that extends from Philadelphia, winds through Conshohocken, Plymouth Meeting, Norristown, past Ursinus College in Collegeville, to the farthest reaches of Montgomery County, at least 50 miles in length. It served as a main artery prior to the introduction of the interstates and superhighways that now connect the larger cities in eastern PA. Except for morning and evening rush hours, this road is fairly sedate. Like many primary routes in suburbia, the landscape is engulfed by strip malls, gas stations, automobile dealerships, office buildings, fast food joints, once thriving manufacturing facilities sitting vacant and older homes that preceded the proliferation of cookie cutter communities that now dominate what was once farmland. I should probably be keeping my eyes on the road, but I can’t help but notice the telltale signs of an economic system gone haywire. As you drive along, the number of For Sale signs in front of homes stands out. When you consider how bad the housing market has been, the 40% decline in national home prices since 2007, the 30% of home dwellers underwater on their mortgage, and declining household income, you realize how desperate a home seller must be to try and unload a home in this market. The reality of the number of For Sale signs does not match the rhetoric coming from the NAR, government mouthpieces, CNBC pundits, and other housing recovery shills about record low inventory and home price increases. The Federal Reserve/Wall Street/U.S. Treasury charade of foreclosure delaying tactics and selling thousands of properties in bulk to their crony capitalist buddies at a discount is designed to misinform the public. My local paper lists foreclosures in the community every Monday morning. In 2009 it would extend for four full pages. Today, it still extends four full pages. The fact that Wall Street bankers have criminally forged mortgage documents, people are living in houses for two years without making mortgage payments, and the Federal Government backing 97% of all mortgages while encouraging 3.5% down financing does not constitute a true housing recovery. Show me the housing recovery in these charts. Existing home sales are at 1998 levels, with 45 million more people living in the country today. New single family homes under construction are below levels in 1969, when there were 112 million less people in the country. Another observation that can be made as you cruise through this suburban mecca of malaise is the overall decay of the infrastructure, appearances and disinterest or inability to maintain properties. The roadways are potholed with fading traffic lines, utility poles leaning and rotting, and signage corroding and antiquated. Houses are missing roof tiles, siding is cracked, gutters astray, porches sagging, windows cracked, a paint brush hasn’t been utilized in decades, and yards are inundated with debris and weeds. Not every house looks this way, but far more than you would think when viewing the overall demographics for Montgomery County. You wonder how many number among the 10 million vacant houses in the country today. The number of dilapidated run down properties paints a picture of the silent, barely perceptible Depression that grips the country today. With such little sense of community in the suburbs, most people don’t even know their neighbors. With the electronic transfer of food stamps, unemployment compensation, and other welfare benefits you would never know that your neighbor is unemployed and hasn’t made the mortgage payment on his house in 30 months. The corporate fascist ruling plutocracy uses their propaganda mouthpieces in the mainstream corporate media and government agency drones to misinform and obscure the truth, but the data and anecdotal observational evidence reveal the true nature of our societal implosion. A report by the Census Bureau this past week inadvertently reveals data that confirms my observations on the roadways of my suburban existence. Annual household income fell in 2011 for the fourth straight year, to an inflation-adjusted $50,054. The median income — meaning half earned more, half less — now stands 8.9% lower than the all-time peak of $54,932 in 1999. It is far worse than even that dreadful result. Real median household income is lower than it was in 1989. When you understand that real household income hasn’t risen in 23 years, you can connect the dots with the decay and deterioration of properties in suburbia. A vast swath of Americans cannot afford to maintain their residences. If the choice is feeding your kids and keeping the heat on versus repairing the porch, replacing the windows or getting a new roof, the only option is survival. All races have seen their income fall, with educational achievement reflected in the much higher incomes of Whites and Asians. It is interesting to note that after a 45 year War on Poverty the median household income for black families is only up 19% since 1968. Now for the really bad news. Any critical thinking person should realize the Federal Government has been systematically under-reporting inflation since the early 1980’s in an effort to obscure the fact they are debasing the currency and methodically destroying the lives of middle class Americans. If inflation was calculated exactly as it was in 1980, the GDP figures would be substantially lower and inflation would be reported 5% higher than it is today. Faking the numbers does not change reality, only the perception of reality. Calculating real median household income with the true level of inflation exposes the true picture for middle class America. Real median household income is lower than it was in 1970, just prior to Nixon closing the gold window and unleashing the full fury of a Federal Reserve able to print fiat currency and politicians to promise the earth, moon and the sun to voters. With incomes not rising over the last four decades is it any wonder many of our 115 million households slowly rot and decay from within like an old diseased oak tree. The slightest gust of wind can lead to disaster. Eliminating the last remnants of fiscal discipline on bankers and politicians in 1971 accomplished the desired result of enriching the top 0.1% while leaving the bottom 90% in debt and desolation. The Wall Street debt peddlers, Military Industrial arms dealers, and job destroying corporate goliaths have reaped the benefits of financialization (money printing) while shoveling the costs, their gambling losses, trillions of consumer debt, and relentless inflation upon the working tax paying middle class. The creation of the Federal Reserve and implementation of the individual income tax in 1913, along with leaving the gold standard has rewarded the cabal of private banking interests who have captured our economic and political systems with obscene levels of wealth, while senior citizens are left with no interest earnings ($400 billion per year has been absconded from savers and doled out to bankers since 2008 by Ben Bernanke) and the middle class has gone decades seeing their earnings stagnate and their purchasing power fall precipitously. The facts exposed in the chart above didn’t happen by accident. The system has been rigged by those in power to enrich them, while impoverishing the masses. When you gain control over the issuance of currency, issuance of debt, tax system, political system and legal apparatus, you’ve essentially hijacked the country and can funnel all the benefits to yourself and costs to the math challenged, government educated, brainwashed dupes, known as the masses. But there is a problem for the .01%. Their sociopathic personalities never allow them to stop plundering and preying upon the sheep. They have left nothing but carcasses of the once proud hard working middle class across the country side. There are only so many Lear jets, estates in the Hamptons, Jaguars, and Rolexes the .01% can buy. There are only 152,000 of them. Their sociopathic looting and pillaging of the national wealth has destroyed the host. When 90% of the population can barely subsist, collapse and revolution beckon. As I drove further along Ridge Pike we passed the endless monuments to our spiral into the depths of materialism, consumerism, and the illusion that goods purchased on credit represented true wealth. Mile after mile of strip malls, restaurants, gas stations, and office buildings rolled by my window. Anyone who lives in the suburbs knows what I’m talking about. You can’t travel three miles in any direction without passing a Dunkin Donuts, KFC, McDonalds, Subway, 7-11, Dairy Queen, Supercuts, Jiffy Lube or Exxon Station. The proliferation of office parks to accommodate the millions of paper pushers that make our service economy hum has been unprecedented in human history. Never have so many done so little in so many places. Everyone knows what a standard American strip mall consists of – a pizza place, a Chinese takeout, beer store, a tanning, salon, a weight loss center, a nail salon, a Curves, karate studio, Gamestop, Radioshack, Dollar Store, H&R Block, and a debt counseling service. They are a reflection of who we’ve become – an obese drunken species with excessive narcissistic tendencies that prefers to play video games while texting on our iGadgets as our debt financed lifestyles ultimately require professional financial assistance. What you can’t ignore today is the number of vacant storefronts in these strip malls and the overwhelming number of SPACE AVAILABLE, FOR LEASE, and FOR RENT signs that proliferate in front of these dying testaments to an unsustainable economic system based upon debt fueled consumer spending and infinite growth assumptions. The booming sign manufacturer is surely based in China. The officially reported national vacancy rates of 11% are already at record highs, but anyone with two eyes knows these self-reported numbers are a fraud. Vacancy rates based on my observations are closer to 30%. This is part of the extend and pretend strategy that has been implemented by Ben Bernanke, Tim Geithner, the FASB, and the Wall Street banking cabal. The fraud and false storyline of a commercial real estate recovery is evident to anyone willing to think critically. The incriminating data is provided by the Federal Reserve in their Quarterly Delinquency Report. The last commercial real estate crisis occurred in 1991. Mall vacancy rates were at levels consistent with today. The current reported office vacancy rates of 17.5% are only slightly below the 19% levels of 1991. As reported by the Federal Reserve, delinquency rates on commercial real estate loans in 1991 were 12%, leading to major losses among the banks that made those imprudent loans. Amazingly, after the greatest financial collapse in history, delinquency rates on commercial loans supposedly peaked at 8.8% in the 2nd quarter of 2010 and have now miraculously plummeted to pre-collapse levels of 4.9%. This is while residential loan delinquencies have resumed their upward trajectory, the number of employed Americans has fallen by 414,000 in the last two months, 9 million Americans have left the labor force since 2008, and vacancy rates are at or near all-time highs. This doesn’t pass the smell test. The Federal Reserve, owned and controlled by the Wall Street, instructed these banks to extend all commercial real estate loans, pretend they will be paid, and value them on their books at 100% of the original loan amount. Real estate developers pretend they are collecting rent from non-existent tenants, Wall Street banks pretend they are being paid by the developers, and their highly compensated public accounting firm pretends the loans aren’t really delinquent. Again, the purpose of this scam is to shield the Wall Street bankers from accepting the losses from their reckless behavior. Ben rewards them with risk free income on their deposits, propped up by mark to fantasy accounting, while they reward themselves with billions in bonuses for a job well done. The master plan requires an eventual real recovery that isn’t going to happen. Press releases and fake data do not change the reality on the ground. I have two strip malls within three miles of my house that opened in 1990. When I moved to the area in 1995, they were 100% occupied and a vital part of the community. The closest center has since lost its Genuardi grocery store, Sears Hardware, Blockbuster, Donatos, Sears Optical, Hollywood Tans, hair salon, pizza pub and a local book store. It is essentially a ghost mall, with two banks, a couple chain restaurants and empty parking spaces. The other strip mall lost its grocery store anchor and sporting goods store. This has happened in an outwardly prosperous community. The reality is the apparent prosperity is a sham. The entire tottering edifice of housing, autos, and retail has been sustained by ever increasing levels of debt for the last thirty years and the American consumer has hit the wall. From 1950 through the early 1980s, when the working middle class saw their standard of living rise, personal consumption expenditures accounted for between 60% and 65% of GDP. Over the last thirty years consumption has relentlessly grown as a percentage of GDP to its current level of 71%, higher than before the 2008 collapse. If the consumption had been driven by wage increases, then this trend would not have been a problem. But, we already know real median household income is lower than it was in 1970. The thirty years of delusion were financed with debt – peddled, hawked, marketed, and pushed by the drug dealers on Wall Street. The American people got hooked on debt and still have not kicked the habit. The decline in household debt since 2008 is solely due to the Wall Street banks writing off $800 billion of mortgage, credit card, and auto loan debt and transferring the cost to the already drowning American taxpayer. The powers that be are desperately attempting to keep this unsustainable, dysfunctional debt choked scheme from disintegrating by doling out more subprime auto debt, subprime student loan debt, low down payment mortgages, and good old credit card debt. It won’t work. The consumer is tapped out. Last week’s horrific retail sales report for August confirmed this fact. Declining household income and rising costs for energy, food, clothing, tuition, taxes, health insurance, and the other things needed to survive in the real world, have broken the spirit of Middle America. The protracted implosion of our consumer society has only just begun. There are thousands of retail outlets to be closed, hundreds of thousands of jobs to be eliminated, thousands of malls to be demolished, and billions of loan losses to be incurred by the criminal Wall Street banks. My fourteen years working in key positions for big box retailer IKEA has made me particularly observant of the hubris and foolishness of the big chain stores that dominate the retail landscape. There are 1.1 million retail establishments in the United States, but the top 25 mega-store national chains account for 25% of all the retail sales in the country. The top 100 retailers operate 243,000 stores and account for approximately $1.6 trillion in sales, or 36% of all the retail sales in the country. Their misconceived strategic plans assumed 5% same store growth for eternity, economic growth of 3% per year for eternity, a rising market share, and ignorance of the possible plans of their competitors. They believed they could saturate a market without over cannibalizing their existing stores. Wal-Mart, Target, Best Buy, Home Depot and Lowes have all hit the limits of profitable expansion. Each incremental store in a market results in lower profits. My trip to my local Lowes last weekend gave me a glimpse into a future of failure and futility. Until 2009, I had four choices of Lowes within 15 miles of my house. There was a store 8 miles east, 12 miles west, 15 miles north, and 15 miles south of my house. In an act of supreme hubris, Lowes opened a stores smack in the middle of these four stores, four miles from my house. The Hatfield store opened in early 2009 and I wrote an article detailing how Lowes was about to ruin their profitability in Montgomery County. It just so happens that I meet a couple of my old real estate buddies from IKEA at a local pub every few months. In 2009 one of them had a real estate position with Lowes and we had a spirited discussion about the prospects for the Lowes Hatfield store. He assured me it would be a huge success. I insisted it would be a dud and would crush the profitability of the market by cannibalizing the other four stores. We met at that same pub a few months ago. Lowes had laid him off and he admitted to me the Hatfield store was a disaster. I pulled into the Lowes parking lot at 11:30 am on a Saturday. Big Box retailers do 50% of their business on the weekend. The busiest time frame is from 11:00 am to 2:00 pm on Saturday. Big box retailers build enough parking spots to handle this peak period. The 120,000 square feet Hatfield Lowes has approximately 1,000 parking spaces. I pulled into the spot closest to the entrance during their supposed peak period. There were about 70 cars in the parking lot, with most probably owned by Lowes workers. It is a pleasure to shop in this store, with wide open aisles, and an employee to customer ratio of four to one. The store has 14 checkout lanes and at peak period on a Saturday, there was ONE checkout lane open, with no lines. This is a corporate profit disaster in the making, but the human tragedy far overrides the declining profits of this mega-retailer. As you walk around this museum of tools and toilets you notice the looks on the faces of the workers. These aren’t the tattooed, face pierced freaks you find in many retail establishments these days. They are my neighbors. They are the beaten down middle class. They are the middle aged professionals who got cast aside by the mega-corporations in the name of efficiency, outsourcing, right sizing, stock buybacks, and executive stock options. The irony of this situation is lost on those who have gutted the American middle class. When you look into the eyes of these people, you see sadness, confusion and embarrassment. They know they can do more. They want to do more. They know they’ve been screwed, but they aren’t sure who to blame. They were once the very customers propelling Lowes’ growth, buying new kitchens, appliances, and power tools. Now they can’t afford a can of paint on their $10 per hour, no benefit retail careers. As depressing as this portrait appears, it is about to get worse. This Lowes will be shut down and boarded up within the next two years. The parking lot will become a weed infested eyesore occupied by 14 year old skateboarders. One hundred and fifty already down on their luck neighbors will lose their jobs, the township will have a gaping hole in their tax revenue, and the CEO of Lowes will receive a $50 million bonus for his foresight in announcing the closing of 100 stores that he had opened five years before. This exact scenario will play out across suburbia, as our unsustainable system comes undone. Our future path will parallel the course of the labor participation rate. Just as the 9 million Americans who have “left” the labor force since 2008 did not willfully make that choice, the debt burdened American consumer will be dragged kicking and screaming into the new reality of a dramatically reduced standard of living. Connecting the dots between my anecdotal observations of suburbia and a critical review of the true non-manipulated data bestows me with a not optimistic outlook for the coming decade. Is what I’m seeing just the view of a pessimist, or are you seeing the same thing? A few powerful men have hijacked our economic, financial and political structure. They aren’t socialists or capitalists. They’re criminals. They created the culture of materialism, greed and debt, sustained by prodigious levels of media propaganda. Our culture has been led to believe that debt financed consumption over morality and justice is the path to success. In reality, we’ve condemned ourselves to a slow painful death spiral of debasement and despair. “A culture that does not grasp the vital interplay between morality and power, which mistakes management techniques for wisdom, and fails to understand that the measure of a civilization is its compassion, not its speed or ability to consume, condemns itself to death.” – Chris Hedges

Telltale Signs

Extend, Pretend & Depend

The Faces of Failure & Futility

.png)

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

#1. To: Capitalist Eric (#0)

(Edited)

Lunatics: YES!!!!!!!!!!! Normal People: Yawn, no.

. Ya know, that Lowes building would probably make a great indoor skating park, and your customers are aleady in the parking lot. All ya gotta do is get 'em in the door.

This IS the truth of what is happening in this country. God help us all. What an excellent piece this guy wrote. He really did a fine job of laying it all out.

You've got to have the middle class making a living to fill the skating rink.

Yeah, go ahead and sleep. You'll wake up, soon enough.

You've got to have the middle class .... FIFY See Chicago teachers Union for details....;}

Yeah, go ahead and sleep. You'll wake up, soon enough. biff's nicer to you....always a bad sign.....;} Montgomery County is the typical white upper middle class suburb, with tracts of McMansions dotting the landscape. The population of 800,000 is spread over a 500 square mile area. Over 81% of the population is white, with the 9% black population confined to the urban enclaves of Norristown and Pottstown. Try Kunstler's take: "Among the many tragic ramifications of the dynamic is that the final blowout of sprawl-building which ran roughly from the early 1990s to 2007 - and peaked, you may notice, with the final blowout of cheap oil ($11 a barrel in 1999) - became one of two intertwined activities that propped up the US economy. O BTW, will look for the word OIL in the above article....wonder how many times I'll find it....;}

The word 'OIL' found.....ZERO. I’ve come to believe this period will be known as the breakdown of global capitalism. We had the first and second industrial revolutions, the Great Depression when it all broke down, the War and the Long Boom fuelled by cheap energy and commodities as global capitalism was rebuilt, and then the Washington consensus leading to globalism, deindustrialiszation ,offshoring, automation, a massive chasm between the rich and poor, unemployment, social instability, bankrupt governments and the financialization of the economy leading to boom-and-bust. Now that’s run its course, and since 2008 we’ve been witnessing the breakdown, first of economic arrangements and now of political ones. Everywhere around the world governments are spending most of their resources keeping their own people at bay, despite the supposed universal victory for democracy. And globalization and free markets have led to the greatest chasm between the rich and poor our species has ever seen. Bailouts, quantitative easing, The Eurozone debt crisis, empty cities from Spain to China, declining living standards, recrudescent diseases, the pursuit of low-quality, polluting dirty energy sources (tar sands, shale, etc.), climate change causing hurricanes, droughts and melting Arctic ice; all these are past and parcel of a system in total and complete breakdown. So what’s next? The Collapse of Empire and Non Linear abolition of Gradients.

You may be a financial writer... and you may even be qualified to write about finance. But you don't know shit about economics, which is a very different animal. Stick to what you know, instead of pontificating on subjects that you don't know.

But you don't know shit about economics, which is a very different animal. Stick to what you know, instead of pontificating on subjects that you don't know. LOL And since when do two economists agree on anything? It's a subjective "science" at best.

Almost every country in the Middle East is awash in oil, and we have to side with the one that has nothing but joos. Goddamn, that was good thinkin'. Esso posted on 2012-01-13 7:37:56 ET

But you don't know shit about economics, which is a very different animal. Stick to what you know, instead of pontificating on subjects that you don't know. a backhanded comp....well. thanx for small favors...;} As economics is not a science but a religion, I thank you.

I wrote mine before reading yours....great minds, eh? "The BZ reaction is an example of a much-studied category of reactions called “chemical clocks” that include the citric acid cycles that help power your cells, and your heart’s natural pacemaker that rhythmically stimulates heartbeat. Importantly, these kinds of reactions were not understandable from a mechanistic perspective. When Boris Belousov first reported them in the 1950′s, no one would believe that they existed."

Given the fact that you know nothing about the subject [and I'm being kind, here], you're not really qualified to say.

No. What you espouse- peak oil, "global capitalism," etc., are religious viewpoints, NOT supported by any facts. Which leads me right back to my original point: stick to the areas that you're qualified to write on, and where you can verify your points. "Without data, you're just another person with an opinion." -unknown

That's the problem with your type-always making excuses for not finding a job. There's work out there if you're willing to get your hands dirty.

Yet you still can't debunk my statement. Economics is soft, subjective and a pseudoscience at best. It keeps idiots employed, especially those who love to post charts and graphs.

Almost every country in the Middle East is awash in oil, and we have to side with the one that has nothing but joos. Goddamn, that was good thinkin'. Esso posted on 2012-01-13 7:37:56 ET

You just illustrated the invisible hand of the free market at it's finest. Wannabet there is a new CVS by that old Rite Aid, and most Lowes just can't compete with a Home Depot nearby.

Almost every country in the Middle East is awash in oil, and we have to side with the one that has nothing but joos. Goddamn, that was good thinkin'. Esso posted on 2012-01-13 7:37:56 ET

After 7+ years of documenting Oil Consumpiton and Growth or Lack thereof, there really isn't anything to do now but watch and document for the few who survive....;} "And just like that the Chinese growth "miracle" goes poof... as does its steel first, and soon all other commodities (coughcoppercough) that served as the basis of "secured" liability creation. If the above makes readers queasy, it should: after all rehypothecation of questionable assets is precisely what serves as the backbone of that critical component of the shadow banking system: the repo market, where anything goes, and where those who want, can create money virtually out of thin air with impunity as long as nobody checks if the assets used for liability creation are actually in the system. We will soon discover that all other assets: stocks, bonds, commodities (including gold and silver) and finally cash (think deposits) have been comparably rehypothecated and criminally commingled." Read more at globaleconomicanalysis.bl...is%29#mXrZIwjBGsOwy93R.99 Modernity cannibalizes its capital, as such our crisis is irreversible. Conventional marketplace remedies such as debt jubilees/write-offs, re-distribution, bailouts, stimulus, austerity policies, monetary easing, etc. have no effect on outcome other than to worsen conditions. These are efforts to reclaim capital that no longer exists. Consequently, remedies accelerate unraveling process by increasing gross debt (claims against capital) while exposing remaining capital to consumption at higher rates. Economists insist that capital is symbolic (money) rather than material. Capital = resources (Daly), all industrial money is debt. Abstract money is infinitely reproducible, material inputs are not. The central bankers endeavor to reproduce as much of the abstract ‘money’ as possible, hoping that consumption can grow to ‘normal’ levels. The central banks lend, this is all they can do. Central Banks can Only inflate. Deflation shows they walk naked thru the streets.

And even Mish does not want to get it. " Is cash collateral widespread in China? I highly doubt it. So at least in terms of China, a discovery that multiple asset classes were criminally commingled to a significant degree would not be surprising at all. The big question is not whether it happened, but to what degree. Let's just no go overboard thinking rehypothecation is a widespread practice in every asset class around the globe, even if it's likely this is the tip of the iceberg in China. Mike "Mish" Shedlock http://globaleconomicanalysis.blogspot.com Read more at http://globaleconomicanalysis.blogspot.com/2012/09/rehypothecated-ghost-steel-pledged-as.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+MishsGlobalEconomicTrendAnalysis+%28Mish%27s+Global+Economic+Trend+Analysis%29#mXrZIwjBGsOwy93R.99 $1.75 Quadrillion in Debt derivatives. Jon Corzine walking free after blatant theft of customer funds. With only $12 Trillion in actual cash. Hyperinflation is past. Squeezing thru the Cash Door is going to bring Sub atomic particles and Mass Density to mind....;}

Since such symptoms are so easily observed (and documented, in the graphs), it seems not quite invisible. I'd rather make the bet that you're pulling things out of your ass, and attempting to pass them off as "facts." Not that you would do such a thing, eh? LOL. "Without data, you're just another person with an opinion." - unknown

You might as well make a statement that the moon is made of cottage-cheese, and demand I "refute" that statement, as well. You don't fool anybody with your Alice-In-Wonderland logic.

Documentation does not confer understanding, much less causality or correlations. The latter is especially important, because not having all relevant factors included in the mix relegates such studies and conclusions useless. Too many variables to account for, both due to financial shenanigans (market manipulation by heavy-hitters) and especially political games... You can observe and report... but making predictions without the accomodation of all variables is foolish. There you go again, attempting to mix economics with finance... two very different animals. Stick with what you know.

ARE YOU SEEING WHAT I’M SEEING?

Say hi to your mom for me.

#2. To: Capitalist Eric (#0)

#3. To: Capitalist Eric (#0)

#4. To: Logsplitter (#2)

#5. To: Biff Tannen (#1)

Capitalist Eric: ARE YOU SEEING WHAT I’M SEEING?

Butthead: Normal People: Yawn, no.

"I am relying on my personal experience with Morons, which have been universally positive." -jwpegler

#6. To: SJN (#4)

You've got to have the middle class making a living to fill the skating rink.

#7. To: Capitalist Eric (#5)

Capitalist Eric: ARE YOU SEEING WHAT I’M SEEING? Butthead: Normal People: Yawn, no.

#8. To: All (#7)

(Edited)

#9. To: mcgowanjm (#8)

I’ve come to believe this period will be known as the breakdown of global capitalism.

"I am relying on my personal experience with Morons, which have been universally positive." -jwpegler

#10. To: Capitalist Eric (#9)

You may be a financial writer... and you may even be qualified to write about finance.

#11. To: Capitalist Eric (#9)

You may be a financial writer... and you may even be qualified to write about finance.

#12. To: mininggold (#10)

LOL And since when do two economists agree on anything? It's a subjective "science" at best.

#13. To: mininggold (#10)

since when do two economists agree on anything? It's a subjective "science" at best.

"I am relying on my personal experience with Morons, which have been universally positive." -jwpegler

#14. To: mcgowanjm (#11)

As economics is not a science but a religion, I thank you.

"I am relying on my personal experience with Morons, which have been universally positive." -jwpegler

#15. To: SJN (#4)

#16. To: Capitalist Eric (#13)

(Edited)

Given the fact that you know nothing about the subject [and I'm being kind, here], you're not really qualified to say.

#17. To: Capitalist Eric (#0)

Telltale Signs

#18. To: Capitalist Eric (#14)

What you espouse- peak oil, "global capitalism," etc., are religious viewpoints, NOT supported by any facts.

#19. To: All (#18)

#20. To: mininggold (#17)

You just illustrated the invisible hand of the free market at it's finest.

Wannabet there is a new CVS by that old Rite Aid, and most Lowes just can't compete with a Home Depot nearby.

"I am relying on my personal experience with Morons, which have been universally positive." -jwpegler

#21. To: mininggold (#16)

you still can't debunk my statement.

"I am relying on my personal experience with Morons, which have been universally positive." -jwpegler

#22. To: mcgowanjm (#18)

After 7+ years of documenting ... Oil Consumpiton and Growth or Lack thereof, there really isn't anything to do now but watch

We will soon discover that all other assets: stocks, bonds, commodities (including gold and silver) and finally cash (think deposits) have been comparably rehypothecated and criminally commingled."

"I am relying on my personal experience with Morons, which have been universally positive." -jwpegler

Top • Page Up • Full Thread • Page Down • Bottom/Latest

[Home] [Headlines] [Latest Articles] [Latest Comments] [Post] [Mail] [Sign-in] [Setup] [Help] [Register]