Business

See other Business Articles

Title: Fed Officials Upgrade Economic Growth Outlook in 2013, 2014

Source:

Bloomberg

URL Source: http://www.bloomberg.com/news/2012- ... owth-outlook-in-2013-2014.html

Published: Sep 13, 2012

Author: Jeff Kearns

Post Date: 2012-09-13 15:53:29 by Brian S

Keywords: None

Views: 3232

Comments: 1

Federal Reserve officials said economic growth will improve faster than they had earlier projected as they embarked on a third round of asset purchases aimed at spurring the expansion. Federal Open Market Committee participants upgraded their estimate for 2013 gross domestic product growth to 2.5 percent to 3 percent, compared with 2.2 percent to 2.8 percent in June. Estimates for 2014 are from 3 percent to 3.8 percent, versus 3 percent to 3.5 percent in the previous forecast, according to the central tendency forecasts, which exclude the three highest and three lowest of 19 projections. The Federal Open Market Committee said today the Fed will expand its holdings of long-term securities with open-ended purchases of $40 billion of mortgage debt a month. Economic growth has been too weak to reduce an unemployment rate stuck above 8 percent for 43 months. Officials forecast today that unemployment will average 7.6 percent to 7.9 percent in the final three months of next year, compared with 7.5 percent to 8 percent at their June meeting. “The labor market looks like it has a very long slog back to normal,” Michael Dueker, a former St. Louis Fed economist who helps oversee $152 billion as chief economist for Seattle- based Russell Investments, said before the Fed meeting. “If you look at the momentum the economy had in the first quarter, there’s no sign of that returning anytime soon.” Thirteen of 19 officials said the first interest-rate increase would be warranted in 2015 or later. The Fed has kept the benchmark lending rate in a record-low range between zero and 0.25 percent since December 2008. Earlier Estimate In 2014, the unemployment rate will be 6.7 percent to 7.3 percent in the fourth quarter, compared with an earlier estimate of 7 percent to 7.7 percent. Fed officials update their economic forecasts four times a year. Twelve members of the FOMC vote on the policy statement, while the interest-rate and economic projections reflect the views of all 19 Fed officials. Not since February has monthly payroll growth topped the 150,000 to 200,000 level Chairman Ben S. Bernanke says is needed to reduce unemployment. Employers added 96,000 jobs in August, down from 141,000 in July, the Labor Department said Sept. 7. The 226,000 average pace of growth in the first quarter of this year plunged to 67,000 in the second quarter. The unemployment rate declined to 8.1 percent last month from 8.3 percent as 368,000 Americans left the labor force. More than 12.5 million in the U.S. are out of work, and more than 5 million have been jobless for at least six months. Key Part Republican presidential candidate Mitt Romney is using unemployment as a key part of his pitch to voters that President Barack Obama doesn’t deserve a second term. Romney suggested in Iowa last week that Obama is relying on the Fed to spur an economic recovery his policies failed to create. The jobless rate has persisted above 8 percent since February 2009, the president’s first full month in office. Speculation that central banks would do more to boost growth is lifting stocks. The Standard & Poor’s 500 Index (SPX) rose to 1,437.92 on Sept. 7, the highest close since January 2008 and within 10 percent of its all-time high in October 2007, after the European Central Bank announced a bond-buying plan. The U.S. economy grew 2 percent in the first quarter of this year before slowing to 1.7 percent in the following three months. GDP will expand 1.8 percent in the third quarter and 2.1 percent in the fourth, according to the median of 76 estimates in a Bloomberg News survey. Depressed Earnings Weaker economic growth has depressed the earnings outlook at U.S. companies from FedEx Corp. (FDX) to Intel Corp. Memphis, Tennessee-based FedEx, operator of the world’s largest cargo airline, said Sept. 4 that declining package volume will reduce profit for the quarter that ended Aug. 31. Intel, the world’s largest semiconductor maker, cut its third-quarter sales forecast Sept. 7 on declining demand for personal computers from corporate customers in a “challenging macroeconomic environment,” according to a statement from the Santa Clara, California-based company. “The economy is frustratingly slow,” Steven Blitz, chief economist at New York-based ITG Investment Research Inc., said before the projections were released. “In the face of uncertainty, people just put their hands in their pockets and stop, and we’re getting a fair bit of that.”

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

#1. To: Brian S (#0)

(Edited)

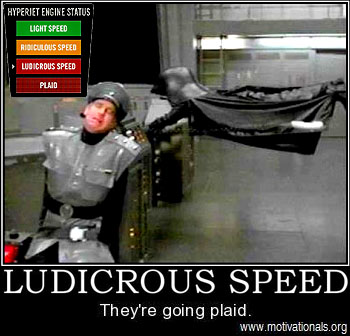

Let's use a movie analogy, to more accurately reflect the Fed statements: Bernank translation: the shit's so bad, we've decided that running the presses at light speed is too slow! We'll have to go to...Ludicrous Speed!!! Colonel Sandurz: Are you all right, sir? -------------------------------------------------------------------------------- I haven't decided if Helicopter Ben is the real-life version of Dark Helmet, or Colonel Sandurz. We are so screwed.

Federal Reserve officials said economic growth will improve faster than they had earlier projected as they embarked on a third round of asset purchases aimed at spurring the expansion.

Dark Helmet: No-no-no, light speed is too slow!

Dark Helmet: We passed 'em! Stop this thing!

Colonel Sandurz: Light speed too slow?

Dark Helmet: Yes, we'll have to go right to... Ludicrous speed!

[The entire crew gasps.]

Colonel Sandurz: Ludicrous speed?! Sir, we've never gone that fast before! I don't know if this ship can take it!

Dark Helmet: What's the matter Colonel Sandurz? Chicken?

Colonel Sandurz: [stuttering, sounding much like a chicken] Prepare ship-- [more clearly] Prepare ship for ludicrous speed! Fasten all seat belts, seal all entrances and exits, close all shops in the mall! Cancel the three ring circus! Secure all animals in the zoo--

Dark Helmet: Give me that, you petty excuse for an officer! Now hear this! Ludicrous speed--

Colonel Sandurz: Sir, hadn't you better buckle up?

Dark Helmet: Aw, buckle this! Ludicrous speed, go!

[Dark Helmet is screaming as he sees various warp trails on the monitor. Meanwhile, there are signs lighting up indicating "LIGHT SPEED", "RIDICULOUS SPEED", and a flashing "LUDICROUS SPEED" sign]

Dark Helmet: What have I done?! My brains are going into my feet!

[Spaceball One passes Lone Starr's Winnebago, leaving a trail of plaid light behind them]

Barf: ... What the hell was that?

Lone Starr: Spaceball One.

Barf: They've gone to plaid!

Colonel Sandurz: We can't stop, it's too dangerous! We have to slow down first!

Dark Helmet: Bullshit! Stop this thing, I order you! Sto-o-o-o-p!

[Colonel Sandurz reaches out and uses the emergency brake, which has a "Never use" warning on it. Helmet goes flying forward, while screaming, into a control panel, denting it and his helmet severely.]

Dark Helmet: [slightly dazed] Fine. How have you been?

Colonel Sandurz: Very good, sir. It's a good thing you were wearing that helmet.

Dark Helmet: Yeah.

Colonel Sandurz: What should we do now, sir?

Dark Helmet: Well, are we stopped?

Colonel Sandurz: We're stopped, sir.

Dark Helmet: Good. Why don't we take a five minute break?

Colonel Sandurz: Very good, sir.

Dark Helmet: Smoke if you got 'em. [Falls over]

"I am relying on my personal experience with Morons, which have been universally positive." -jwpegler

Top • Page Up • Full Thread • Page Down • Bottom/Latest

[Home] [Headlines] [Latest Articles] [Latest Comments] [Post] [Mail] [Sign-in] [Setup] [Help] [Register]