Economy

See other Economy Articles

Title: Derivatives: The Unregulated Global Casino for Banks [AMAZING INFOGRAPHICS]

Source:

[None]

URL Source: http://demonocracy.info/infographic ... derivatives/bank_exposure.html

Published: Apr 20, 2012

Author: Demon-Ocracy.Info

Post Date: 2012-04-20 17:34:58 by Capitalist Eric

Keywords: None

Views: 535

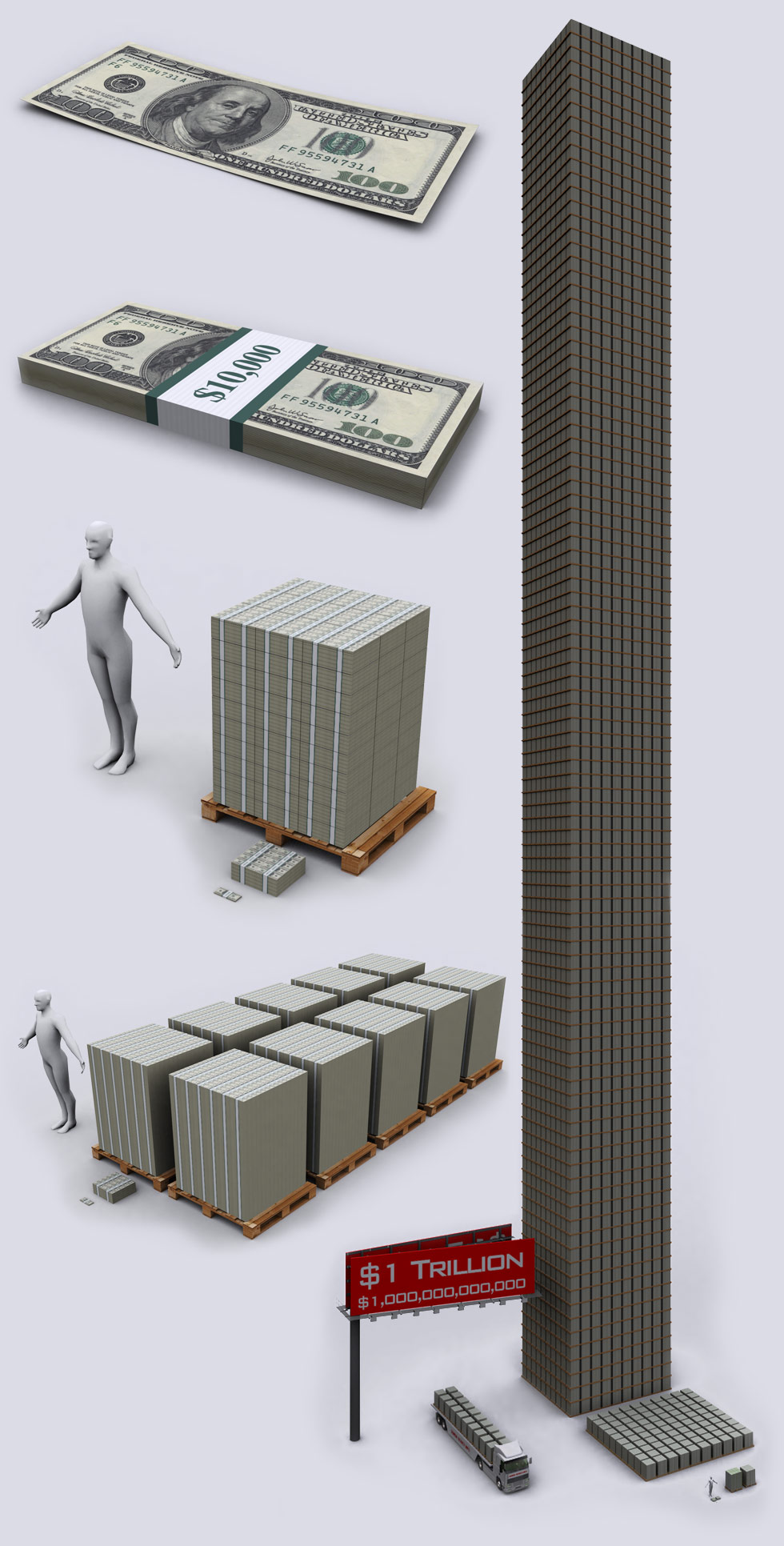

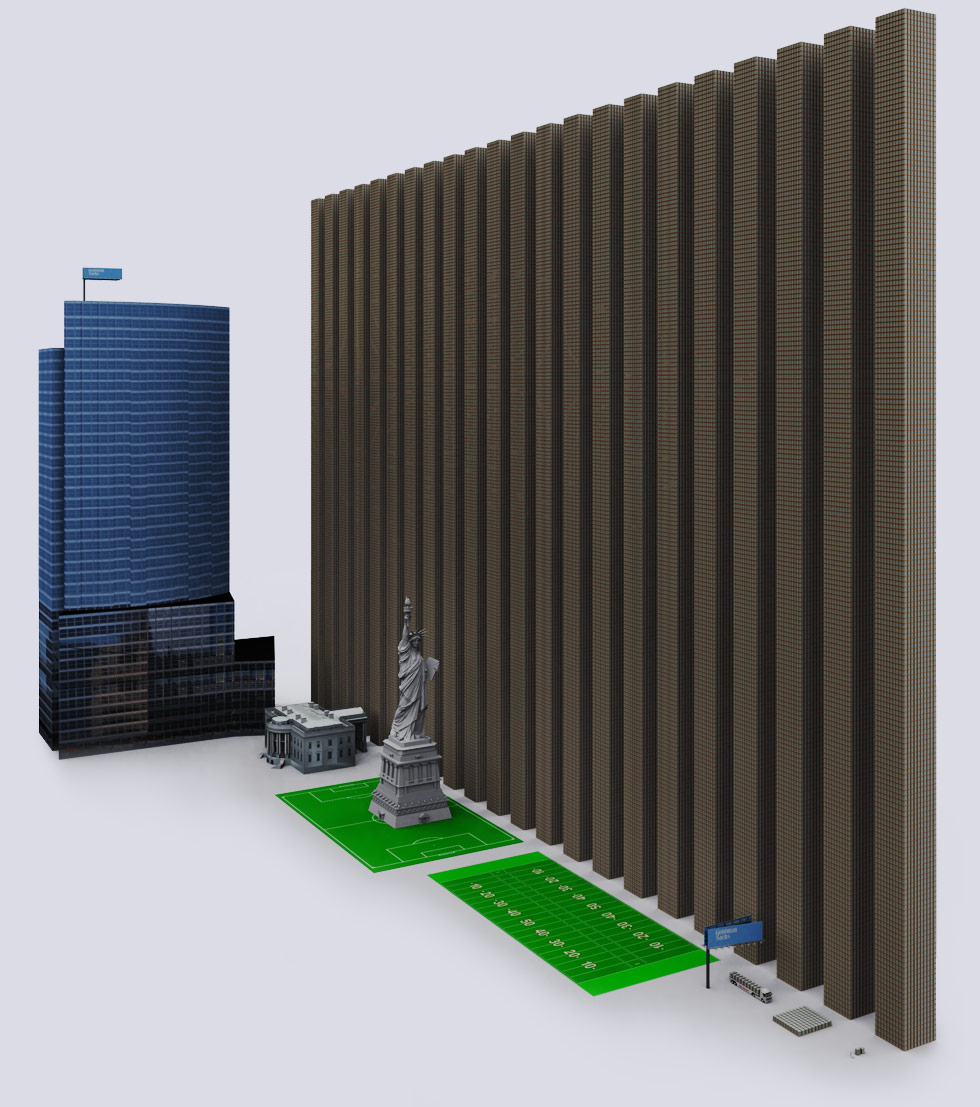

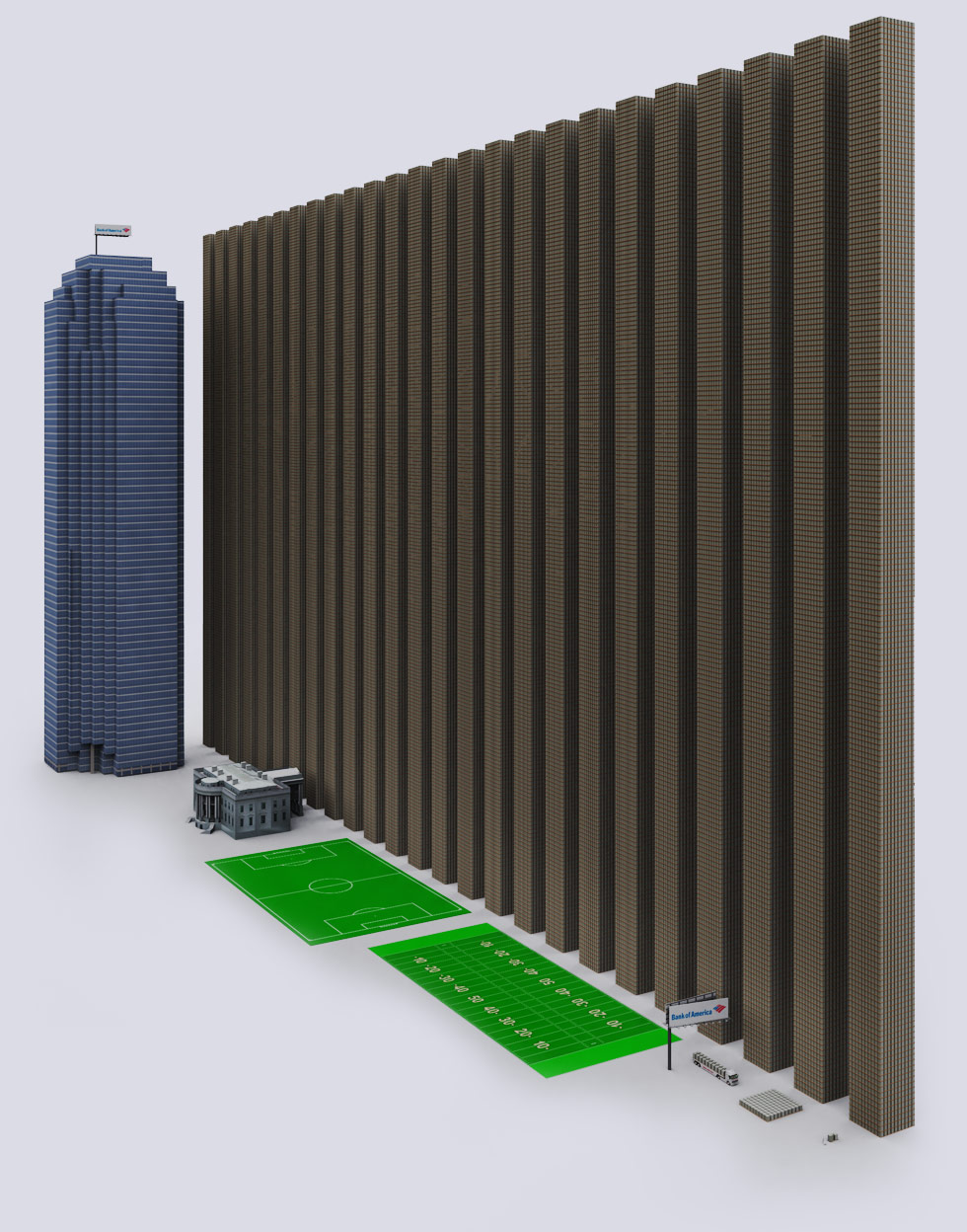

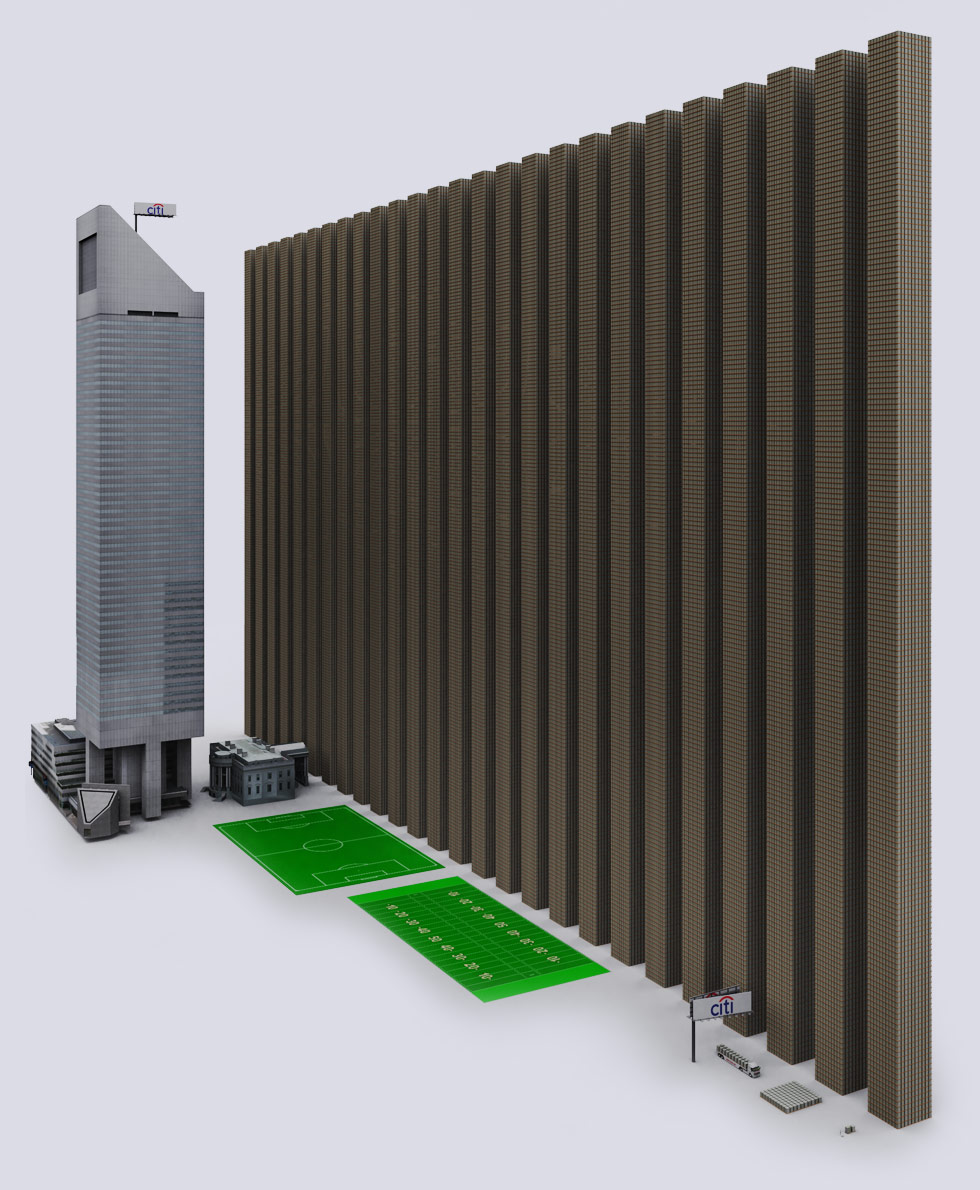

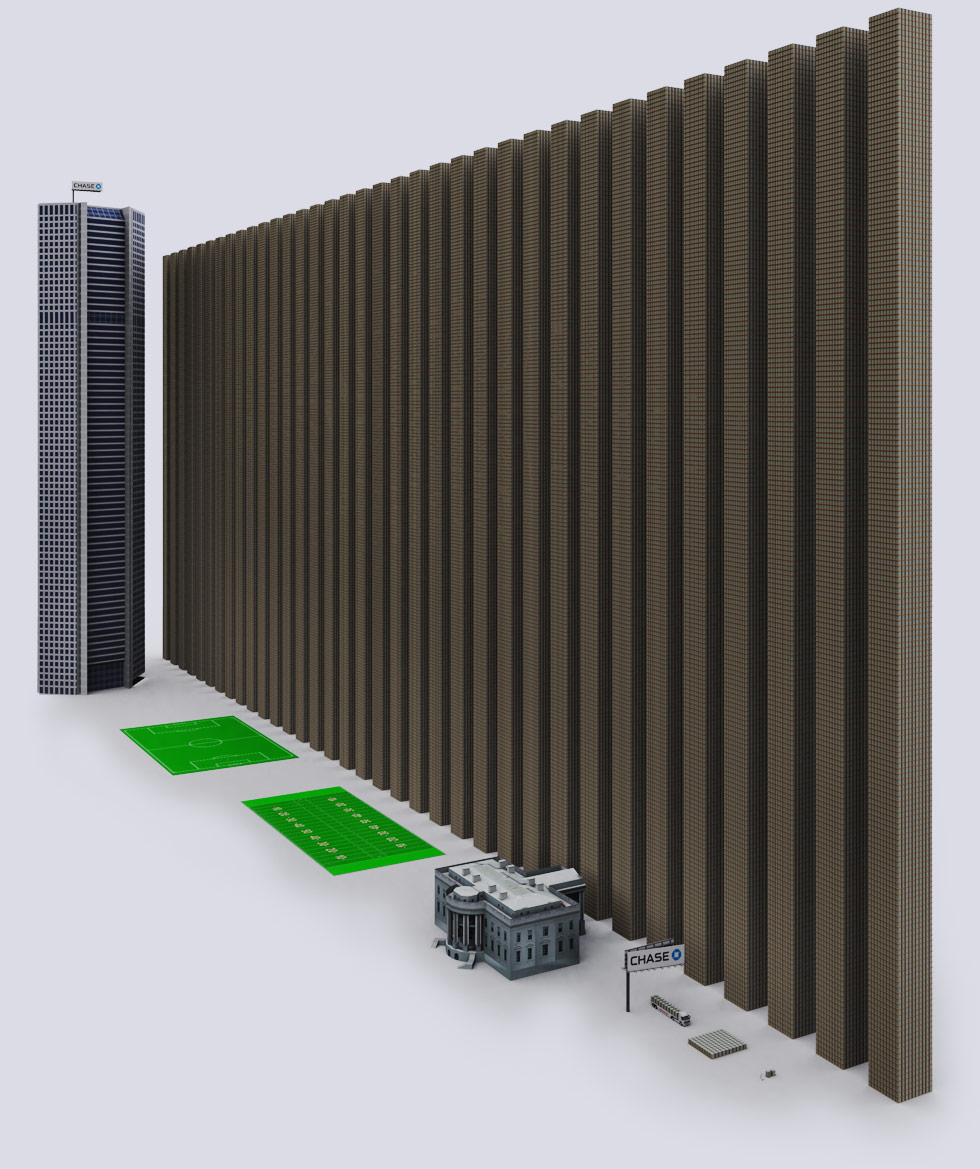

Banks make massive profits on derivatives, and when the bubble bursts chances are the tax payer will end up with the bill. $100,000,000 - Plenty to go around for $1,000,000,000 - This is how a billion dollars looks like. $1,000,000,000,000 - When they throw around the word "Trillion" like it is nothing, this is the reality of $1 trillion dollars. The square of pallets to the right is $10 billion dollars. 100x that and you have the tower of $1 trillion that is 465 feet tall (142 meters). BNY has a derivative exposure of $1.375 Trillion dollars. State Street has a derivative exposure of $1.390 Trillion dollars. Morgan Stanley has a derivative exposure of $1.722 Trilion dollars. Wells Fargo has a derivative exposure of $3.332 Trillion dollars. HSBC has a derivative exposure of $4.321 Trilion dollars. Goldman Sachs has a derivative exposure of $44.192 Trillion dollars. Bank of America has a derivative exposure of $50.135 Trillion dollars. Citibank has a derivative exposure of $52.102 Trillion dollars. JP Morgan Chase has a derivative exposure of $70.151 Trillion dollars. Note the little man standing in front of white house. The little worm next to lastfootball field is a truck with $2 billion dollars. LONG STORY: A derivative is a legal bet (contract) that derives its value from another asset, such as the future or current value of oil, government bonds or anything else. Ex- A derivative buys you the option (but not obligation) to buy oil in 6 months for today's price/any agreed price, hoping that oil will cost more in future. (I'll bet you it'll cost more in 6 months). Derivative can also be used as insurance, betting that a loan will or won't default before a given date. So its a big betting system, like a Casino, but instead of betting on cards and roulette, you bet on future values and performance of practically anything that holds value. The system is not regulated what-so-ever, and you can buy a derivative on an existing derivative.

Most large banks try to prevent smaller investors from gaining access to the derivative market on the basis of there being too much risk. Deriv. market has blown a galactic bubble, just like the real estate bubble or stock market bubble (that's going on right now). Since there is literally no economist in the world that knows exactly how the derivative money flows or how the system works, while derivatives are traded in microseconds by computers, we really don't know what will trigger the crash, or when it will happen, but considering the global financial crisis this system is in for tough times, that will be catastrophic for the world financial system since the 9 largest banks shown below hold a total of $228.72 trillion in Derivatives - Approximately 3 times the entire world economy. No government in world has money for this bailout. Lets take a look at what banks have the biggest Derivative Exposures and what scandals they've been lately involved in.One Hundred Dollars $100 - Most counterfeited money denomination in the world.

Keeps the world moving.Ten Thousand Dollars $10,000 - Enough for a great vacation or to buy a used car.

Approximately one year of work for the average human on earth.100 Million Dollars

everyone. Fits nicely on an ISO / Military

standard sized pallet.

$1 Million is the cash square on the floor. 1 Billion Dollars

10 pallets of $100 bills. 1 Trillion Dollars

![]()

$2 Billion on Truck Bank of New York Mellon

Considered a too big to fail (TBTF) bank. It is currently facing (among others) lawsuits fraud and contract breach suits by a Los Angeles pension fund and New York pension funds, where BNY Mellon allegedly overcharged the funds on many millions of dollars and concealed it.

State Street Financial

Too big to fail (TBTF) bank. It has been charged by California Attorney General (among other) lawsuits for massive fraud on California's CalPERS and CalSTRS pension funds - similar to BNY (above).

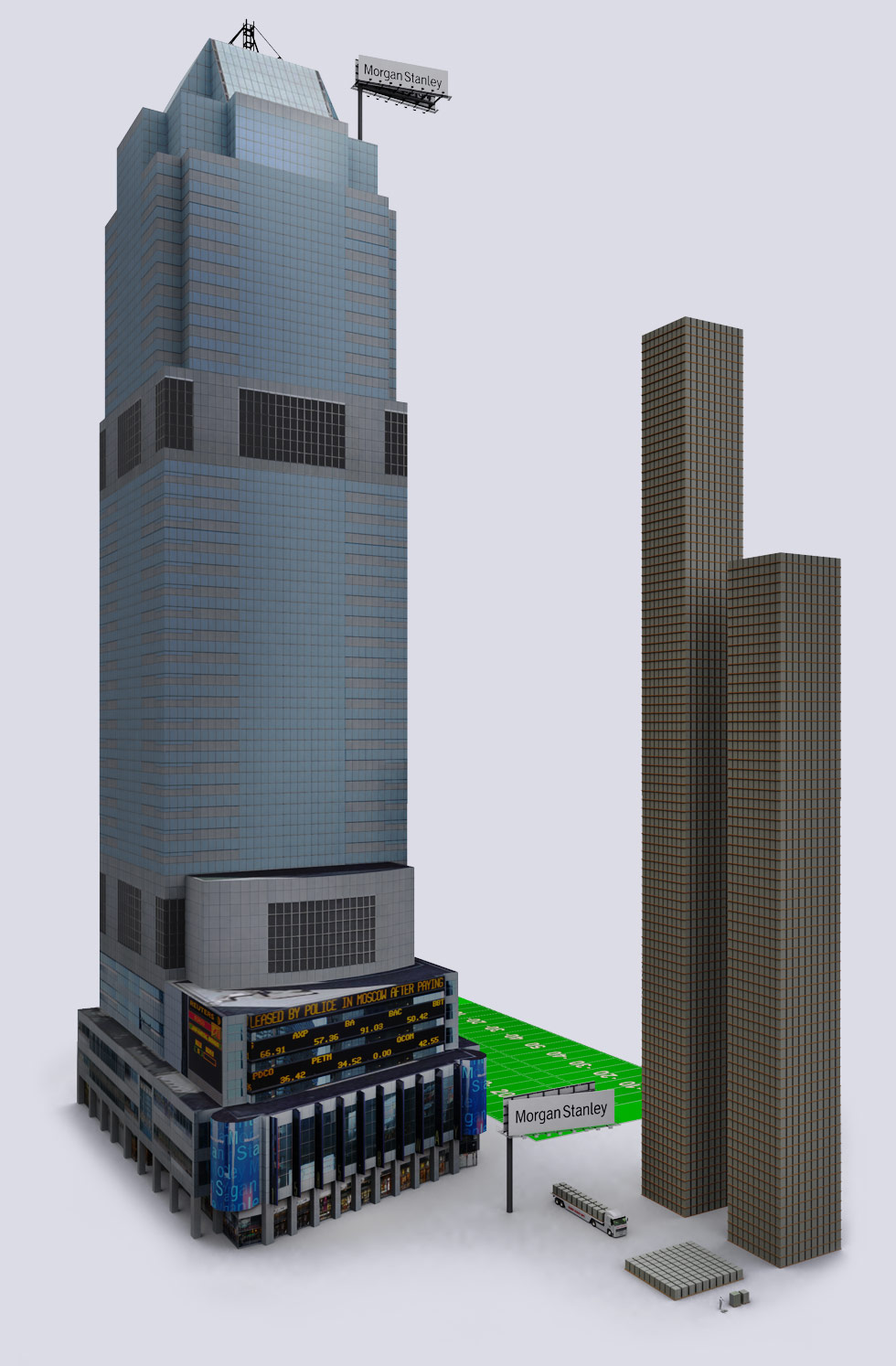

Morgan Stanley

Its a too big to fail (TBTF) bank. It recently settled a lawsuit for over-paying its employees while accepting the

tax payer funded bailout. Vice Chairman of Morgan Stanley had a license plate that said "2BG2FAIL" on his Porsche Cayenne Turbo. All this while $250 million of bailout money ended up in the hands of Waterfall TALF Opportunity, run by the Morgan Stanley's owners' wives-- Marry a banker for a $250M tax-payer cash injection.

The bank also got a SECRET $2.041 Trillion bailout from the Federal Reserve during the crisis, beyond the tax payer bailout.

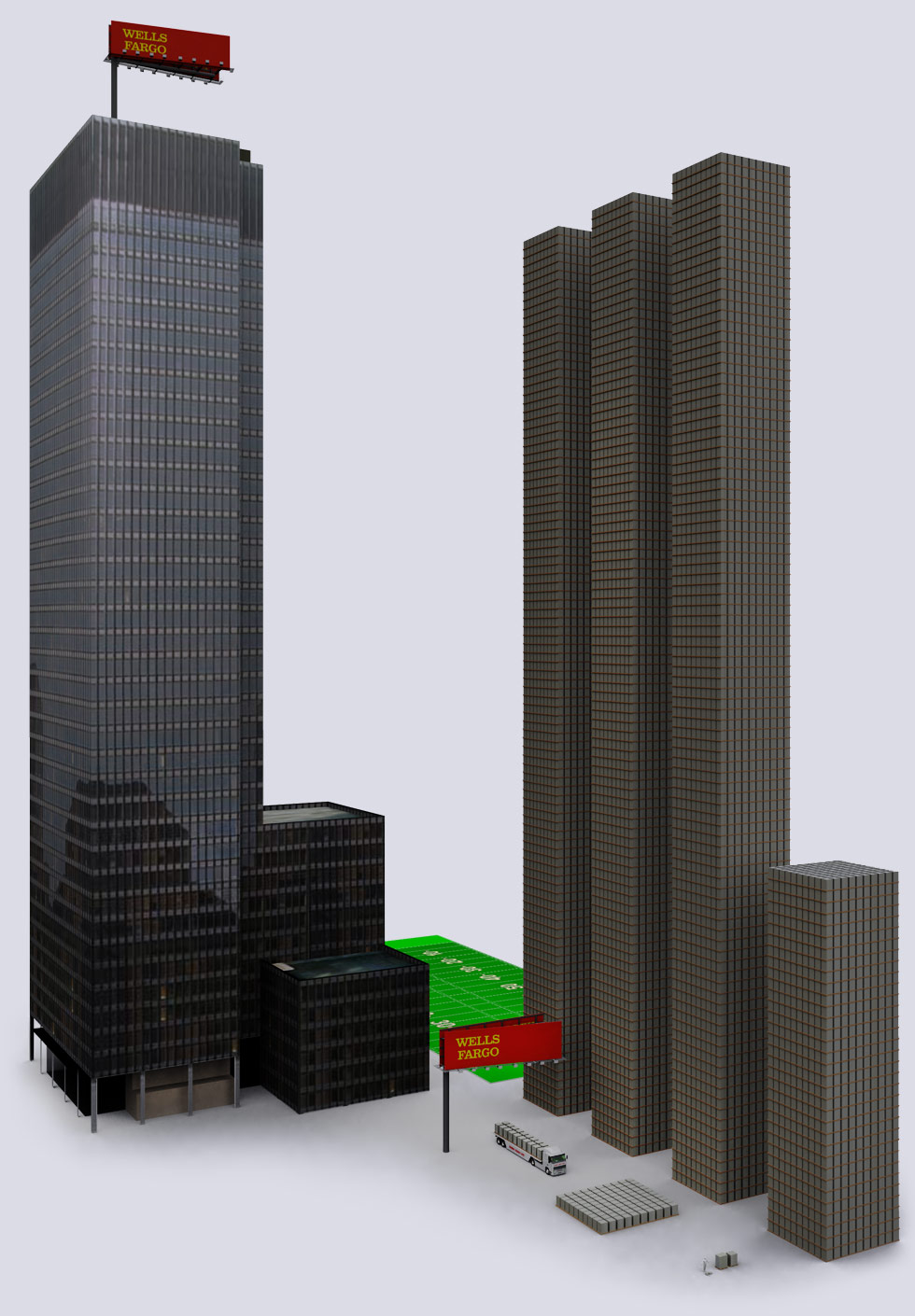

Wells Fargo

Its a too big to fail (TBTF) bank. WF has been charged for its role in allegedly pursuing illegal foreclosures and deceptive loan servicing. Wells Fargo was just slapped with a $85 million fine by Federal Reserve for putting good credit borrowers into bad-credit rating (high rate) loans.

In March 2019, Wachovia (owned by Wells Fargo) paid $110 million fine for allowing transactions connected to drug smuggling and a $50 million fine for failing to monitor cash used to ship 22 tons of cocaine. It also failed to monitor $378.4 billion (that's $378400 millions dollars) worth of transactions to Mexican "casas de cambio" (think WesternUnion, anonymous cash transfer) usually linked to drug cartels. Beyond that, WF lets its' VIP employees live in foreclosed mansions. WF knows how to cash your legit check, then claim "fraud" and close your account. WF also re-orders your transactions to create more overdraft fees. Wells Fargo's Wachovia also got a SECRET $159 billion bailout from the Federal Reserve.

Wells Fargo paid NO taxes in 2008-2010 and had a tax rate of NEGATIVE 1.4% while making

$49 billion in profit during the same time.

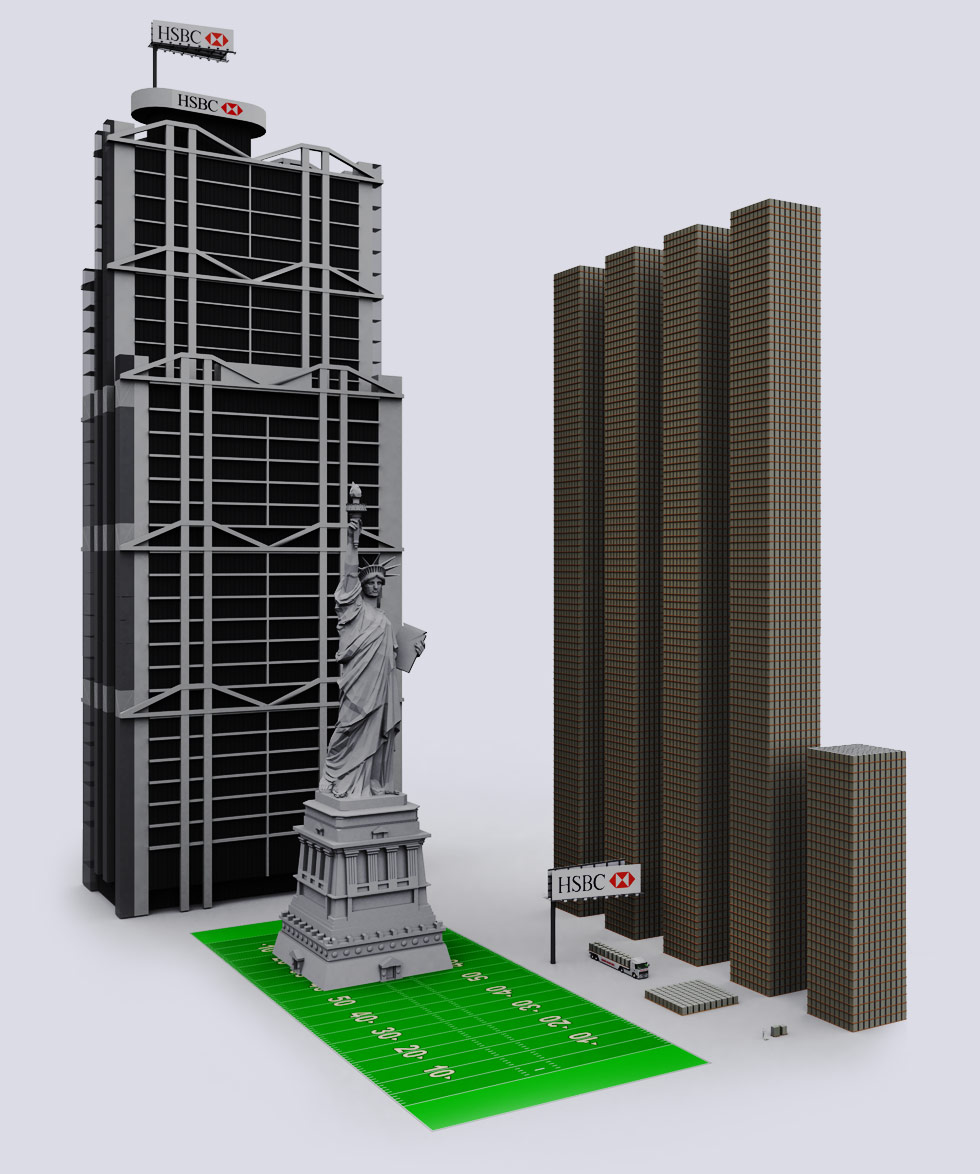

HSBC

HSBC is a Hong Kong based bank and its original name is

The Hongkong and Shanghai Banking Corporation Limited.

You will find HSBC working a lot with JP Morgan Chase.

Both HSBC and JP Morgan Chase have strong interest in gold & precious metals. HSBC and JP Morgan Chase are often involved together in financial scandals.

Lately HSBC has been sued for allegedly funneling more than $8.9 billion to the largest ponzi-scheme in history - Bernie Maddof's investment business.

HSBC (along w/ JP Morgan Chase) has been sued for alleged conspiracy suppressing the price of silver and gold, partially through precious metal DERIVATIVES and making billions of dollars on it. State of Hawaii is suing HSBC (and other banks) for deceptive credit card lending practices.

DZ Bank in Germany is suing HSBC (and JP Morgan) for deceptive (lying) practices when selling home-loan-backed securities.

HSBC is also under investigation for laundering billions of dollars.

Goldman Sachs

The $1 Trillion pillars towers are double-stacked @ 930 feet (248 m).

The White House is standing next to the Statue of Liberty.

Goldman Sachs has advantage over other banks because it has awesome

connections in US Government. A lot of former Goldman employees hold high-level

US Government positions (chart).

Mitt Romney's top donor is Goldman Sachs, and one of Obama's best donors.

Ex-CEO of Goldman Sachs, Hank Paulson became the Secretary of Treasury under Bush and

during the 2008 financial crisis authored the TARP bill demanding $700 billion bail-out.

In UK, Goldman Sachs escaped £10 million bill on a failed tax avoidance scheme with help of good connections.

The bank is the largest player in the food commodities market, earned $955m from food speculation in 2009" - That's your $$$.

Goldman Sachs employees are arming themselves with guns in case there is a populist uprising against the bank.

Goldman Sachs calls their investors "muppets". and use clients to make money for themselves, disregarding the clients.

The bank was fined $22 million for sharing valuable nonpublic information with top clients (Think insider trading with best clients).

Goldman Sachs was part-owner America's leading website for prostitution ads until the ownership stake was exposed.

Goldman Sachs helped Greece conceal its debt with secret loans, while simultaneously taking advantage of Greece.

Goldman Sachs got a $814 billion SECRET bailout from the Federal Reserve during the 2008 crisis.

Goldman Sachs got $10 billion of the 2008 TARP bailout, and in the same year paid $10.9 billion in employee compensation and "benefits", while paying a tax rate of 1%. That means an average of $327,000 to each Goldman Sach's employee.

Bank of America

BofA is sticking the tax-payers with a MASSIVE bill, by moving derivatives to

accounts insured by the federal government @ total of $53.7 trillion as of 06/2011.

During 2011-12 BofA has been in need of cash, so Warren Buffett gave BofA $5 billion.

Same year BofA sold its stake in China Construction Bank to raise $1.8 billion in cash.

Bank of America paid $22 million to settle charges of improperly foreclosing on active-duty troops

BofA recruited 3 cyber attack firms to attack WikiLeaks. but the Anonymous hacker group hacked the security firms first.

BofA was sued for $31 billion in home-loan losses in 2011, the bank is involved in many lawsuits, too many to document.

BofA also received a SECRET $1.344 trillion dollar bailout from the Federal Reserve.

Citibank

The $1 Trillion dollar towers are double-stacked @ 930 feet (248 m).

Citibank customers have been arrested for trying to close their accounts, while in in Indonesia a man was interrogated to death in Citibank's special "questioning room". In 2011 Citibank paid a fine of $285 million for selling home-loan backed bonds to investors, while betting they would lose value (think derivatives/insurance). The man in charge of the unit at Citibank became Obama's Chief of Staff. 2 weeks before getting hired by Obama he got $900,000 from Citibank for great performance. This was after Citigroup took out $45 billion in bailout money.

Citibank knowingly passed over bad loans to the Federal Housing Administration to insure.

Citigroup also received a SECRET $2.513 trillion dollar bailout from the Federal Reserve.

JP Morgan Chase

$70 Trillion is roughly the size of the entire world's economy.

The $1 Trillion dollar towers are double-stacked @ 930 feet (248 m).

JP Morgan is rumored to hold 50->80% of the copper market, and manipulated the market by massive purchases. JP Morgan is also guilty of manipulating the silver market to make billions. In 2010 JP Morgan had 3 perfect trading quarters and only lost money on 8 days. Lawsuits on home foreclosures have been filed against JP Morgan. Aluminum price is manipulated by JP Morgan through large physical ownership of material and creating bottlenecks during transport. JP Morgan was among the banks involved in the seizure of $620 million in assets for alleged fraud linked to derivatives. JP Morgan got $25 billion taxpayer in bailout money. It has no intention of using the money to lend to customers, but instead will use it to drive out competition. The bank is also the largest owner of BP - the oil spill company. During the oil spill the bank said that the oil spill is good for the economy.

JP Morgan Chase also received a SECRET $391 billion dollar bailout from the Federal Reserve.

9 Biggest Banks' Derivative Exposure - $228.72 Trillion

There is no government in the world that has this kind of money. This is roughly 3 times the entire world economy. The unregulated market presents a massive financial risk. The corruption and immorality of the banks makes the situation worse.

If you don't want to banks with these banks, but want to have access to free ATM's anywhere-- most Credit Unions in USA are in the CO-OP ATM network, where all ATM's are free to any COOP CU member and most support depositing checks. The Credit Unions are like banks, but invest all their profits to give members lower rates and better service. They don't have shareholders to worry about or have derivatives to purchase and sell.

Keep an eye out in the news for "derivative crisis", as the crisis is inevitable with current falling value of most real assets.

Derivative Data Source: ZeroHedge

Post Comment Private Reply Ignore Thread

[Home] [Headlines] [Latest Articles] [Latest Comments] [Post] [Mail] [Sign-in] [Setup] [Help] [Register]