United States News

See other United States News Articles

Title: Is the USA is in a recession because of high gas prices?

Source:

clarionledger

URL Source: http://www.clarionledger.com/apps/p ... D=/20061102/BIZ/611020363/1005

Published: Nov 2, 2006

Author: USA Today

Post Date: 2006-11-02 15:56:01 by TLBSHOW

Keywords: None

Views: 23592

Comments: 71

Economy slowing; recession in 2007? WASHINGTON — There is little doubt the economy is slowing. What is unclear is how long the decline will last or how deep it will be. The latest evidence of a slowing economy came Wednesday in reports showing a dip in the rate of growth in the manufacturing sector and a further decline in housing construction. Also on Wednesday, Merrill Lynch warned clients that its "recession-risk indicator" is now pointing to a 51 percent chance of a recession in the next year, the highest such odds since the last recession in 2001. The indicator has only twice hit the 51 percent line without being followed by a recession, Merrill Lynch chief North American economist David Rosenberg said in a report titled, On a Knife's Edge. The question of whether there will be a recession is "still a tough call," he says. But "what the indicator represents is, at a minimum, a significant slowing in growth." Joel Naroff of Naroff Economic Advisors says there are still enough factors in the economy's favor to keep it afloat. In particular, job growth is still solid, and wages are rising while interest rates are low, historically speaking. But that doesn't mean the economy is poised for a big takeoff. "I'm not concerned about a recession at all, but I do think that we could be looking at (subpar) growth ... this quarter and the first half of next year," he said.

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

Begin Trace Mode for Comment # 10.

#3. To: All (#0)

Fearing Slow Holiday Sales, Wal-Mart Cuts Prices Expecting a grim November, Wal-Mart Stores said it would immediately slash prices on 100 popular electronics, abruptly rearranging the Christmas calendar for its customers and competitors http://www.nytimes.com/2006/11/03/business/03cnd-walmart.html? ei=5065&en=4f4650f3b08e740e&ex=1163221200&partner=MYWAY&pagewanted=print THE GAS PRICES ARE KILLING EVERYONE TLBSHOW

http://www.sunherald.com/mld/sunherald/business/15898450.htm

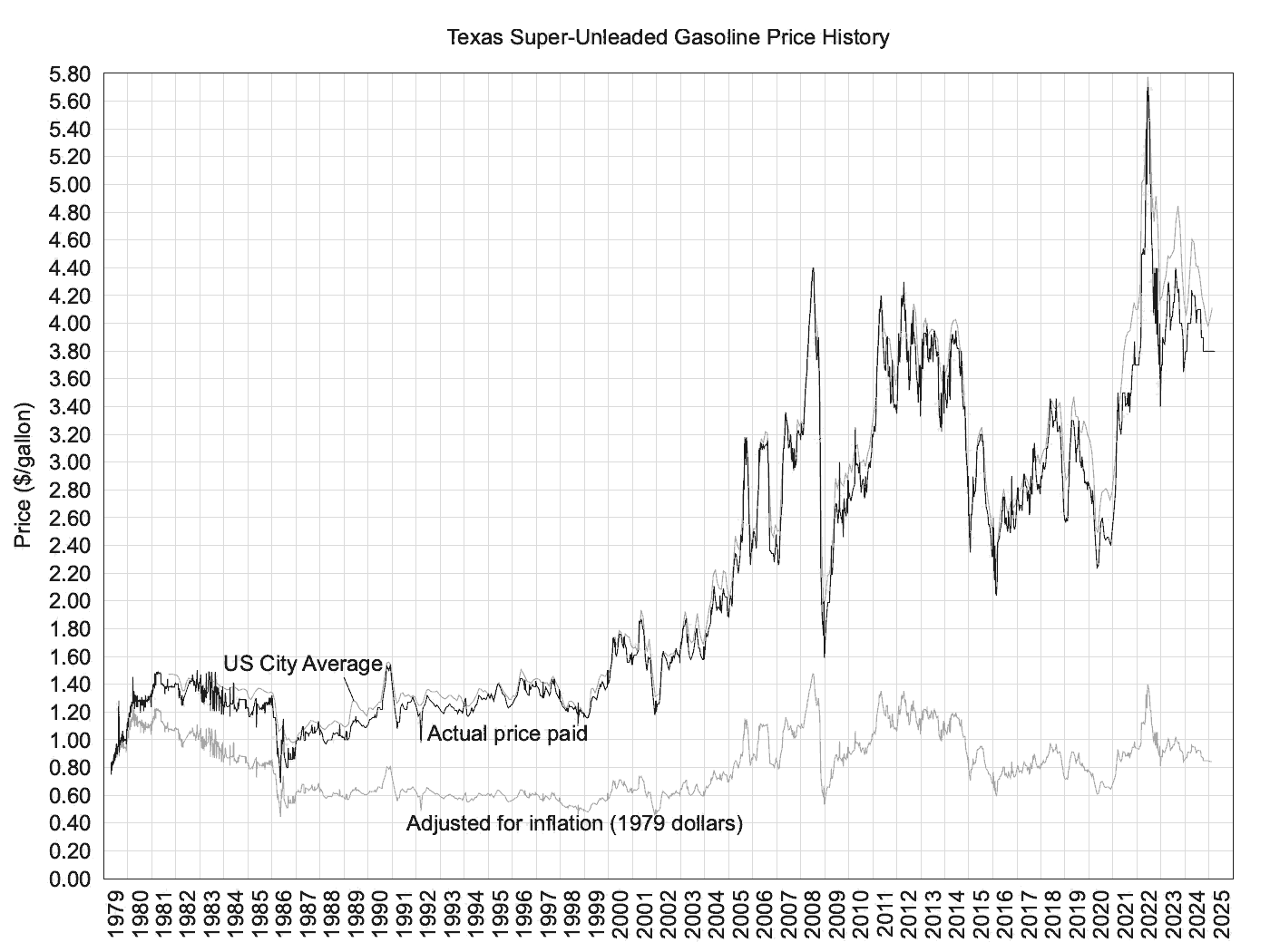

Check out the adjusted for inflation. Price of gas is relatively constant over time, taking inflation into account and with respect to all things we buy.

"Nationwide, prices have also started rising in many areas," AAA Texas spokeswoman Rose Rougeau says. "Oil industry analysts are saying that could be the result of OPEC's announcement last month that it is reducing crude oil production." http://sanantonio.bizjournals.com/sanantonio/stories/2006/10/30/daily37.html

So, a 'halt' is equal to an increase? You are a fucking moron.

Experts Predict Wave of Bankruptcies "The American consumer is arguably the weakest link in the credit chain," a financial advisor says. Helen Shaw, http://CFO.com November 10, 2006 Most professionals involved in bankruptcy restructuring expect a rise in bankruptcies within the next 12 to 18 months, according to a survey. Over 70 percent of 90 restructuring pros in a survey by the American Bankruptcy Institute and Daily Bankruptcy Review expect that U.S.corporate restructurings will increase. Respondents to the July survey included attorneys, distressed- debt investors, financial advisors, investment bankers, and lenders. The survey participants differ on the most likely trigger for the next wave of bankruptcies. But 48 percent predict that it will be interest rates. The other triggers respondents cited were: home prices, 15 percent; commodity prices, 13 percent; global competition, 7 percent; and the equity bear market, 5 percent. Others think that a decline in consumer spending and unfunded pension plans will be possible triggers. But the impetus might not be so concrete. "I don't think it's going to be an event that's the trigger," stated John Penn, a partner at law firm Haynes and Boone, "I think it's going to be more a realization that credit quality matters," he said in the joint ABI and Daily Bankruptcy Review report on the survey, which was released today. Respondents also listed the industries they expect will be the most affected by corporate bankruptcies. Eighty percent expect the real estate and construction industry to be "very" or "extremely" vulnerable to an economic downtown. Over two-thirds believe that retail is as vulnerable to an economic downturn. Also cited among the most likely industries to experience bankruptcies in the coming months were: airlines, 67 percent; manufacturing, 63 percent; and transportation, 49 percent. "The sectors [that are] close to the default line are those that deal specifically with the consumer," said Anders Maxwell, managing director of financial advisory firm Peter J. Solomon Co., during a Webinar announcing the survey results. "The American consumer is arguably the weakest link in the credit chain." Maxwell added that the creditworthiness of the average American corporation is weaker than it was 15 to 20 years ago. "That is masked today by staggering liquidity," he said. The most frequently used metric for predicting whether a company might file for bankruptcy protection is operating cash flow – 54 percent of survey respondents refer to it when trying to predict whether a company will remain solvent. Up until now this year, only a handful of companies with over $1 billion in liabilities have gone bankrupt, Edward Altman, a professor at the Stern School of Business, New York University, noted during the Webinar. That number is small relative to 2004 and 2005, when there were 10 large corporate bankruptcies in the United States in both years. An increase in restructurings is a certainty, he warns. "It will happen, but no one knows when," said Altman.

There are no replies to Comment # 10. End Trace Mode for Comment # 10.

Top • Page Up • Full Thread • Page Down • Bottom/LatestNovember 3, 2006

#4. To: All (#3)

Foreclosures up sharply nationwide

#5. To: TLBSHOW (#4)

#6. To: Biff Tannen (#5)

The three-month uninterrupted fall of retail gas prices came to a halt this week, according to AAA Texas' Weekend Gas Watch.

#8. To: TLBSHOW (#6)

#10. To: Biff Tannen (#8)

http://www.cfo.com/printable/article.cfm/8135376/c_8158206?f=options

Replies to Comment # 10.

[Home] [Headlines] [Latest Articles] [Latest Comments] [Post] [Mail] [Sign-in] [Setup] [Help] [Register]