International News

See other International News Articles

Title: Global markets buckle on fears of new financial meltdown

Source:

L.A. Times

URL Source: http://www.latimes.com/business/la- ... rkets-20110923,0,7054864.story

Published: Sep 23, 2011

Author: Walter Hamilton, Tom Petruno and Tiffany

Post Date: 2011-09-23 19:06:21 by Capitalist Eric

Keywords: None

Views: 1910

Comments: 5

Asian and European stocks spiral downward. The Dow Jones industrial average plunges almost 400 points toward its worst week since the depths of Wall Street's collapse in 2008. The strain of deteriorating economic conditions and the failure of governments to contain the damage are raising fears that a new financial market meltdown may be unavoidable. The grim mood was evident worldwide as a cascade of selling in stocks and commodities was triggered by concerns that policymakers lack the firepower and political consensus to revive their faltering economies. The Federal Reserve's latest move to push interest rates lower failed to assuage investors, who appear to be giving in to anxieties about a double-dip recession. Global markets buckled Thursday. Asian and European stocks spiraled downward and pulled the Dow Jones industrial average down almost 400 points toward its worst week since the depths of Wall Street's meltdown in 2008. Even gold wasn't a safe place to turn. Meanwhile, interest rates on U.S. Treasury bonds fell to lows not seen since the 1940s as investors rushed to lock in yields. "The fear is that this is another event of the magnitude of 2008," said John Bollinger, head of Bollinger Capital Management in Manhattan Beach. "This is entirely being driven by fear." The hailstorm of selling came a day after the Federal Reserve unveiled its latest unorthodox attempt to spur growth. Investors doubted the move would have a measurable effect, and many were jolted by the central bank's bluntly worded rationale, which warned of "significant downside risks" to the economy. Just as massive loan losses at Wall Street banks threatened the global economy three years ago, stubbornly high U.S. unemployment and persistent European government debt problems have shaken confidence today. The fear is evident among ordinary Americans such as Darla Davis. Dismayed about the economy and the stock market, the part-time teacher's aide from Frazier Park is considering a return to full-time work to prop up her family's income. "I can't afford to lose any more money," Davis said. "It's just not stable. I think the economy is going to tank." Davis, 52, pulled her money out of a mutual fund two years ago after it lost one-quarter of its value, and stashed the proceeds in a low-yielding retirement account. The bottom-line worry is that politicians around the globe can't — or won't — take the steps necessary to breathe life into battered economies. The Fed's latest plan is to adjust the mix of U.S. Treasury bonds in its massive portfolio. The central bank plans to sell shorter-term U.S. Treasury bonds and use the proceeds to buy longer-term Treasuries. With short-term interest rates already near zero, the Fed is hoping to pull longer-term rates lower and spur consumers and businesses to spend more. But by telling the world that it will buy longer-term bonds, the Fed in effect recommended that other investors do the same. Many did exactly that on Thursday, selling anything seen as riskier than government bonds. "It looks like the Fed told people to run for cover," said Keith Wirtz, who oversees nearly $17 billion as chief investment officer at Fifth Third Asset Management in Cincinnati. Though a pair of U.S. economic reports Thursday were mildly encouraging, investors focused on disappointing data from China, whose rapid growth has been a buoy for the rest of the world. Investors fear that any slowing of China's growth could hit Europe and the U.S. The latest steps by the Fed illustrate the severity of the deadlock in Washington, where Democratic calls for additional growth measures have been countered by a Republican push to slash government spending. Republican congressional leaders wrote to Fed Chairman Ben S. Bernanke this week urging the Fed not to take any more stimulus steps. House Speaker John A. Boehner (R-Ohio) on Thursday said the central bank was "enabling" Washington's political gridlock by again intervening in the economy. "We continue to have concerns with the activities of the Fed because it appears to us that they're taking actions because they don't believe the political system can do what needs to be done," Boehner said. In Europe, the situation may be more dire as the inability of policymakers to solve Greece's debt crisis over the last two years has allowed its problems to ripple into Italy, Spain and other struggling economies. The stock market's slump this week resumes the sell-off that slammed share prices in early August. The Dow dived 2,000 points, or nearly 16%, from July 21 to Aug. 10. Markets were hammered in part by Standard & Poor's decision Aug. 5 to downgrade the U.S. government's debt rating for the first time in history. Also Graphic: Bond yields and gold prices over time Stocks, gold tumble as investors rush to bonds Greece unveils more austerity measures Since mid-August, U.S. stocks have traded back and forth. Even after Thursday's dive, the Dow is slightly above its summer low reached Aug. 10, and is down 7.3% year to date. But if the market's drop accelerates, "it becomes self-fulfilling" as more investors decide to sell, said Michael Brandes, head of fixed-income strategy at Citi Private Bank in New York. On Wall Street, there is increasing discussion of the U.S. being in a so-called liquidity trap, similar to what Japan fell into in the 1990s: Interest rates keep falling, but it fails to spur borrowing and spending because consumers and investors have no confidence that the economy will get better. "You could make the argument that we've hit a liquidity trap," Brandes said. "There is a lot of cash around, but everyone is sitting around just looking at each other, and no one is spending and no one is hiring." Still, many analysts say the U.S. economy hasn't fallen off a cliff. Whether it will depends on how American consumers react to the latest market turmoil because consumer spending accounts for two-thirds of economic activity. "The key is whether consumers keep spending and don't make sharp cutbacks as they did in 2008," said Dean Maki, chief economist at Barclays Capital in New York. Consumer spending has held up better than many analysts have predicted, but that could be upset by the steady patter of disheartening news. Davis, the teacher's aide, has reined in her spending until she feels more comfortable. "I'm unwilling to purchase," she said. "I shop sales, I don't travel as much and I look for free activities."

Poster Comment: Thanks "Helicopter Ben" and fake-POTUS Soetero... really appreciate your blatant incompetence...

Traders work on the floor of the New York Stock Exchange. Stocks plunged

Thursday, extending losses for a fourth straight session as the Federal

Reserve's weak outlook for the U.S. economy and disappointing data from

China heightened fears about a global recession.

(Brendan McDermid, Reuters / September 23, 2011)

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

#1. To: Capitalist Eric (#0)

The current crisis is an EU creation, douche...

America...My Kind Of Place... "I truly am not that concerned about [bin Laden]..." "THE MILITIA IS COMING!!! THE MILITIA IS COMING!!!" I lurk to see if someone other than Myst or Pookie posts anything...

The current crisis is due to the fiat-money system, perfected by the Federal Reserve, and adopted by the equally corrupt banks of Europe. Your clear lack of understanding, with regard to the subject of economics, is quite amusing... Keep sucking oBUMa's dick, let me know much it helps you, dumbshit. Oh, and when you lose your job, and you're about to be kicked out of your momma's basement, let us know, so we can LAUGH at your stupid ass... EVERYTHING is going exactly as I have predicted. Oh, they'll do one more round of QE, following your failed Keynesian economic bullshit, and in the end, you'll STILL suffer the results of your own stupidity. The ONLY way it could be better, is if I had a bucket of popcorn and a cold beer, while watching you suffer the results of your lack of vision. May you get EVERYTHING you deserve, punk.

To :Skippy, toe-jam, old man Fred Alzheimers Mertz, _jim, loonymom/ming, e-type-jackoff, goober56, Wrek, calcon, dummy DwarF, continental op, Biff, gobsheit and meguro Blah blah clickity clack blah blah... The current crisis is rooted in the EU not being able to follow its own rules on membership. It was preordained that the EU was going to fail - any group is only as strong as its weakest member, which is an economic observation that has been made for centuries - and such failure has nothing to do with Obama or the FRB, douchebag. You said something stupid - as usual - and won't man up about it.

America...My Kind Of Place... "I truly am not that concerned about [bin Laden]..." "THE MILITIA IS COMING!!! THE MILITIA IS COMING!!!" I lurk to see if someone other than Myst or Pookie posts anything...

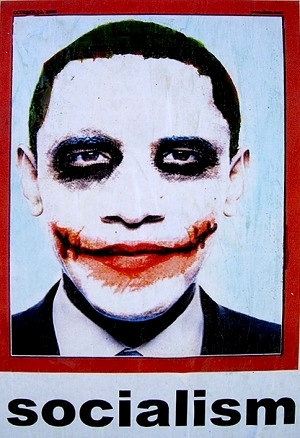

Your typical response. Bookmarked, so that I can routinely use your idiotic words to bitch-slap you with. And I'll enjoy doing it, you fucking moron... Isn't it about time for you to slurp on the presidential staff again? Put up some socialist propaganda, with oBUMa as the poster-child for your failed ideology? To :Skippy, toe-jam, old man Fred Alzheimers Mertz, _jim, loonymom/ming, e-type-jackoff, goober56, Wrek, calcon, dummy DwarF, continental op, Biff, gobsheit and meguro It was an asshole move to ignore the above, asshole.

America...My Kind Of Place... "I truly am not that concerned about [bin Laden]..." "THE MILITIA IS COMING!!! THE MILITIA IS COMING!!!" I lurk to see if someone other than Myst or Pookie posts anything...

--GW Bush

--Sarah Palin's version of "The Midnight Ride of Paul revere"

#2. To: war (#1)

From: Capitalist Eric Message:

You're SOCIALIST morons. ESAD.

#3. To: Capitalist Eric (#2)

--GW Bush

--Sarah Palin's version of "The Midnight Ride of Paul revere"

#4. To: war, capitalist eric (#3)

Blah blah clickity clack blah blah...

From: Capitalist Eric Message:

You're SOCIALIST morons. ESAD.

#5. To: Capitalist Eric (#4)

The current crisis is rooted in the EU not being able to follow its own rules on membership. It was preordained that the EU was going to fail - any group is only as strong as its weakest member, which is an economic observation that has been made for centuries - and such failure has nothing to do with Obama or the FRB, douchebag.

--GW Bush

--Sarah Palin's version of "The Midnight Ride of Paul revere"

Top • Page Up • Full Thread • Page Down • Bottom/Latest

[Home] [Headlines] [Latest Articles] [Latest Comments] [Post] [Mail] [Sign-in] [Setup] [Help] [Register]