Opinions/Editorials

See other Opinions/Editorials Articles

Title: Surprise, Surprise! Folks in Highly Taxed Countries Are Happier Than Americans!

Source:

Huffington

URL Source: http://www.huffingtonpost.com/jane- ... iness-countries-_b_894590.html

Published: Jul 11, 2011

Author: Jane White

Post Date: 2011-07-11 13:57:11 by Brian S

Keywords: None

Views: 6895

Comments: 11

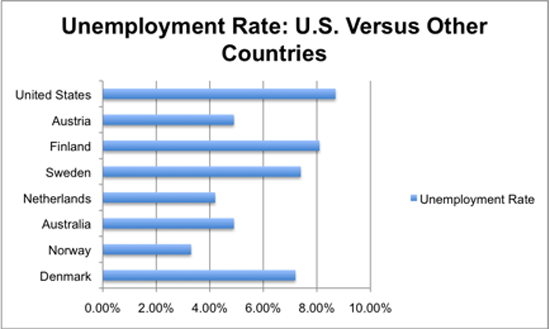

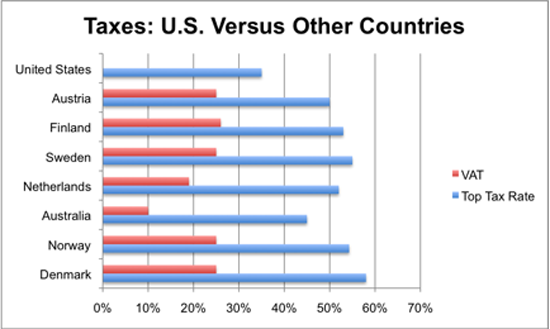

After the OECD created the Better Life Index to discern which are the happiest countries in the world an organization known as 24-7 Wall St. cherry-picked the list to narrow down those countries with the highest economic stability. Most likely, says MSNBC, "the happiest people in the developed world get loads of social services without having to work too hard." Or maybe these lucky folks not only don't have to pay for these services, more of them actually have jobs. With the exception of Canada and Israel, every country on 24-7 Wall St.'s list features a much higher top income tax rate than ours -- currently 35% -- and a value-added, or VAT, tax. What's more, despite the fact that the Tea Party regards high taxes as job killers, all these countries also feature lower unemployment rates than that of the U.S. Below are graphs of seven of the nine "happiest countries," along with their top tax rates and VAT taxes compared to the U.S. Highly Taxed Countries Actually Employ More People When you think about it, when it comes to "net worth" Americans are likely the poorest in the advanced world. Why? Because many life necessities that are subsidized by rich taxpayers in other countries are mostly paid out of pocket by Americans. From college education to health care to retirement, we bankroll more of these costs than any of our peers. American companies also get tax deductions which deprive the government of revenue. According to David Leonhardt of the New York Times, employer deductions for health care and 401(k) contributions alone cost the government more than $316 billion a year. As for potential revenues generated by a VAT, an Urban-Brookings Tax Policy Center paper released last year concluded that a VAT of only 5% on most purchased items would produce $258.6 billion in revenues in 2012, erasing a big chunk of our $1.3 trillion deficit. The question is why are we tip-toeing around a VAT of only 5%? Five of the seven "happy" countries in the graphs have VATs of 25% or more. Instead of just whining about our federal deficits, we ought to calculate how big a VAT or higher income taxes are needed to address our personal deficits that, among other things, result in Americans footing most of the bill for a college education. My goal would be to raise enough taxes to quadruple individual Pell Grants from around $5,000 a year -- covering only about one fourth of the cost of a state college and one-eighth of the tab at a private university. Wonder why tax increases on the top bracket aren't even on the political table? As I've pointed out before, it's Grover Norquist's hijacking of Congress. As Bloomberg BusinessWeek put it, 233 of the 240 House Republicans and 40 of the 47 Republican senators have signed Norquist's so-called Taxpayer Protection Pledge. The good news is that progressives are finally mobilizing their base to demand higher taxes on the rich so that everybody else will prosper. As Huffington Post reporter Michael McAuliff observed last week, a poll commissioned by MoveOn.org and the Progressive Change Campaign Committee found that 80% of voters in the following swing states: Ohio, Missouri, Montana and Minnesota back raising taxes on folks making more than $1 million. Hear that, Michele Bachmann? Majority Leader Harry Reid has called for a vote on doing so and the liberal groups sent out a blast email asking members to contact their senators to back the resolution. If you agree, I'd urge you to do the same.

As even conservative commentator David Frum admits, Americans may hate taxes but even the right wingnuts will raise hell if someone dares mess with the benefits these taxes provide, like Medicare, as evidenced by the recent Democratic Congressional victory in upstate New York. As Frum put it, Rep. Paul Ryan's crazy plan to "privatize" Medicare would result in senior citizens "paying two-thirds of their health coverage out of pocket by 2030" according to the Congressional Budget Office.

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

#1. To: Brian S (#0)

Americans keep thinking there will be a break down in society and that their neighbors will become cannibals. Paranoid delusions rarely make one happy.

"Keep Your Goddamn Government Hands Off My Medicare!" - Various Tea Party signs.

And you know this how, Euro-peon trash collector?

war has to do something for entertainment. The voices in his head aren't speaking to him and his imaginary friends have found reasons not to come over anymore.

Check ou this delusional obese right winger and then realize why:

"Keep Your Goddamn Government Hands Off My Medicare!" - Various Tea Party signs.

“If you tell a lie big enough and keep repeating it, people will eventually come to believe it. The lie can be maintained only for such time as the State can shield the people from the political, economic and/or military consequences of the lie. It thus becomes vitally important for the State to use all of its powers to repress dissent, for the truth is the mortal enemy of the lie, and thus by extension, the truth is the greatest enemy of the State.” The State can no longer hide the consequences of their 100-year lie. VERY interesting times are ahead.

You're flailing now, Destro. Just take a deep breath and then eat shit and die, Euro-peon punk.

war has to do something for entertainment. The voices in his head aren't speaking to him and his imaginary friends have found reasons not to come over anymore.

You forgot the G-man under the bed.

Von Mises associates any Government involvement in markets as "Socialism" , to mislead people into thinking Government is the enemy , when infact empire is the enemy and empire is Privatized.

What makes you think that people like doom and gloomers Eric, Rudgear, Badeye, no gnu taxes, etc. want to be happy? These people wallow in fear, just like their party does. Being happy is equivalent to having AIDS to them.

Skippy the Dummy's got jokes! Coming from the doom and gloom party of Globullshit Warming, a new Ice Age, a homeless crisis you never hear about unless there is a Republican in office and coal pollution unless China burns it. As far as your AIDS comment goes, its you dipshit Democrats who protect that disease as a lifestyle choice.

war has to do something for entertainment. The voices in his head aren't speaking to him and his imaginary friends have found reasons not to come over anymore.

But 'Doom and gloom' is known to boost the sales of various products. Probably a factor in keeping the population obese, too.

They think fear and misery is evidence of intelligence.

Von Mises associates any Government involvement in markets as "Socialism" , to mislead people into thinking Government is the enemy , when infact empire is the enemy and empire is Privatized.

Huff Puff and msnbc? rotflmao.

Proxy IP's are amusing.....lmao

#2. To: Godwinson (#1)

#3. To: Rudgear (#2)

And you know this how, Euro-peon trash collector?

#4. To: Brian S (#0)

As even

conservative NEO-CON commentator David Frum admits, FIXED.

-- Joseph Goebbels --

#5. To: Godwinson (#3)

#6. To: Godwinson (#1)

Americans keep thinking there will be a break down in society and that their neighbors will become cannibals.

#7. To: Brian S (#0)

#8. To: Skip Intro (#7)

#9. To: Skip Intro (#7)

What makes you think that people like doom and gloomers Eric, Rudgear, Badeye, no gnu taxes, etc. want to be happy? These people wallow in fear, just like their party does.

#10. To: Skip Intro (#7)

What makes you think that people like doom and gloomers Eric, Rudgear, Badeye, no gnu taxes, etc. want to be happy? These people wallow in fear, just like their party does.

#11. To: Brian S (#0)

Top • Page Up • Full Thread • Page Down • Bottom/Latest

[Home] [Headlines] [Latest Articles] [Latest Comments] [Post] [Mail] [Sign-in] [Setup] [Help] [Register]