Economy

See other Economy Articles

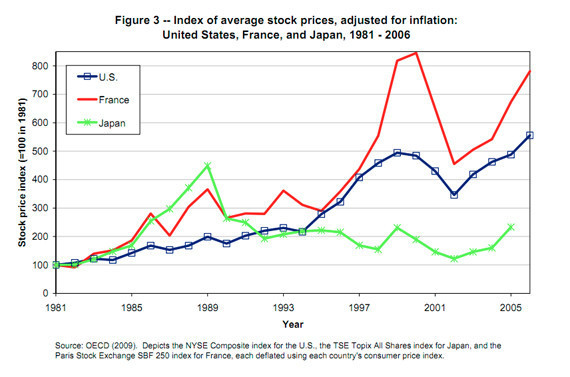

Title: Stocks Of Socialized Countries Have Outperformed U.S. Since Reagan Era

Source:

huffingtonpost.com

URL Source: http://www.huffingtonpost.com/2011/ ... countries-reagan_n_882270.html

Published: Jun 22, 2011

Author: Alex Wagner

Post Date: 2011-06-22 22:23:39 by Godwinson

Keywords: None

Views: 48952

Comments: 67

Stocks Of Socialized Countries Have Outperformed U.S. Since Reagan Era Alex Wagner First Posted: 06/22/11 02:49 PM ET Updated: 06/22/11 03:35 PM ET American traders aren't likely to take kindly to the suggestion that big government might be good for the stock market. But data from a paper on the job- and income-growth of top earners shows that stock prices in some socialized countries, relative to themselves and adjusted for inflation, have done considerably better than those in the U.S over the last two and a half decades. Specifically, during the twenty five years after Ronald Reagan took office -- a pro-market honeymoon that Ryan Chittum of the Columbia Journalism Review this week termed "the ascent of laissez-faire economic policies" -- French stock prices have performed significantly better than Americans ones, according to the report by Jon Bakija, Adam Cole, and Bradley Heim. A further examination of the 39-year period extending from the end of the Nixon administration until 2008 shows the Swedish economy, known for its high taxes and heavy regulation, growing at a significantly higher rate than the US. The authors conclude that big government might not actually stand in contradiction to a productive economy: "Countries with typically high levels of government involvement in the economy, such as Sweden, Denmark and Canada, do not appear to have experienced stifled economic growth relative to countries where government involvement is more limited, like the US," the report says. With bastions of socialism -- Sweden Canada and France -- outpacing American market prices, does this mean it's time for Wall Streeters to start calling croissants "Freedom bagels?" Probably not. According to Jacob Funk Kirkegaard, a research fellow specializing in European economies at the Peterson Institute for International Economics, the disparity between the American and European markets might have more to do with the period in question than governmental forces. "In 1981, [Francois] Mitterand was elected president of France, and the first thing he did was to nationalize a bunch of French businesses and most of the banking system," Kirkegaard explained. "But going forward, France has moved quite dramatically towards a market-oriented economy, though not anywhere near the scope of market and economic freedom as perceived in the U.S." If Swedish and French markets have shown considerable strength compared to American ones, Kirkegaard posited that "these countries benefited from a more rapid shift to a market economy than in the U.S. over this period. The starting point was much more hostile. That’s what you see in the growth." That said, Kirkegaard also dismissed the traditional American capitalist contention that socialism is bad for market growth: "A lot of the finger-pointing we do at these countries is totally misleading. It's a myth." Kirkegaard says that many socialized governments provide critical support for business growth, including first class infrastructure built by the public sector, retraining of workers and public education systems that result in better-prepared workforces, comparative to the US. "There are a lot of areas where the role of government is a benefit for the businesses in these countries." "The idea that they are socialists and condemned to living in these bread bin-style housing complexes is illusional," he said. "It's ideological slander." Compare the stocks of Japan, France, and U.S., or get the report here:

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

Comments (1-21) not displayed.

.

.

.

#22. To: mininggold (#20)

That's close to the average which I believe is 25%...2009 I paid 28% eff...

America...My Kind Of Place... "I truly am not that concerned about [bin Laden]..." "THE MILITIA IS COMING!!! THE MILITIA IS COMING!!!" I lurk to see if someone other than Myst or Pookie posts anything...

Huh?

America...My Kind Of Place... "I truly am not that concerned about [bin Laden]..." "THE MILITIA IS COMING!!! THE MILITIA IS COMING!!!" I lurk to see if someone other than Myst or Pookie posts anything...

I'm thinking he's another foreign poster.

jwpegler and Republican / conservative apologists spin numbers - they get the wrong conclusions from facts. In any case, the funny part is jwpegler is extolling the so called socialistic models he is afraid to adopt. If Sweden's model is so much better than America's why not adopt it - corporate tax rate and all? Copy Germany? You just said they are less socialistic than America. I dare you. I double dog dare you.

"Keep Your Goddamn Government Hands Off My Medicare!" - Various Tea Party signs.

That'd be a first.

Bye, rat-boy mike. We'll miss you. [NOT] There's no need to prove something that is easily observable, and self-evident. You presume that, just because you say something makes it so. This is a typical attitude of leftists.

Bye, rat-boy mike. We'll miss you. [NOT] Some day you'll be able to claim the same...

America...My Kind Of Place... "I truly am not that concerned about [bin Laden]..." "THE MILITIA IS COMING!!! THE MILITIA IS COMING!!!" I lurk to see if someone other than Myst or Pookie posts anything...

This bulletin presents new estimates showing that the United States has one of the highest effective tax rates on corporate capital in the world at 36 percent, which compares to an average of just 19.5 percent for 79 other countries studied. http://www.cato.org/pubs/tbb/tbb_1008-50.pdf

Now, I know Iām not going to change the minds of any of the True Believersā¦those who read all of Reverend Alās sermons, and say things like, āYou know, global warming can mean warmer OR colder, wetter OR drier, cloudier OR sunnier, windier OR calmer, ā¦ā. Can I get an āamenā??

If Cato is claiming that then the plain and simple truth is that Cato is wrong. Corporate taxes are paid on a graduated scale, based upon income, up to the highest rate. "on corporate capital " Capital isn't what gets taxed.

America...My Kind Of Place... "I truly am not that concerned about [bin Laden]..." "THE MILITIA IS COMING!!! THE MILITIA IS COMING!!!" I lurk to see if someone other than Myst or Pookie posts anything...

I fall into a group of about 5%. You fall into the majority- along with whining-old. How many posts do you have left for today? Bye, rat-boy mike. We'll miss you. [NOT] Income tax alone doesn't provide a complete picture, just as you are claiming statutory income tax rates don't provide a complete picture.

Now, I know Iām not going to change the minds of any of the True Believersā¦those who read all of Reverend Alās sermons, and say things like, āYou know, global warming can mean warmer OR colder, wetter OR drier, cloudier OR sunnier, windier OR calmer, ā¦ā. Can I get an āamenā??

Wha...huh? This is the cold hard fact...publishing the TOP STAUTORY rate as being representative of the ACTUAL rate at which coporate revenues are taxed is SOPHISTRY.

America...My Kind Of Place... "I truly am not that concerned about [bin Laden]..." "THE MILITIA IS COMING!!! THE MILITIA IS COMING!!!" I lurk to see if someone other than Myst or Pookie posts anything...

Claiming income tax alone is representative of a corporation's total tax liability is also sophistry.

Now, I know Iām not going to change the minds of any of the True Believersā¦those who read all of Reverend Alās sermons, and say things like, āYou know, global warming can mean warmer OR colder, wetter OR drier, cloudier OR sunnier, windier OR calmer, ā¦ā. Can I get an āamenā??

I claimed that where, Padlock?

America...My Kind Of Place... "I truly am not that concerned about [bin Laden]..." "THE MILITIA IS COMING!!! THE MILITIA IS COMING!!!" I lurk to see if someone other than Myst or Pookie posts anything...

Infinity. Why?

America...My Kind Of Place... "I truly am not that concerned about [bin Laden]..." "THE MILITIA IS COMING!!! THE MILITIA IS COMING!!!" I lurk to see if someone other than Myst or Pookie posts anything...

Wasn't the crux of the argument that American businesses are relatively overtaxed?

Now, I know Iām not going to change the minds of any of the True Believersā¦those who read all of Reverend Alās sermons, and say things like, āYou know, global warming can mean warmer OR colder, wetter OR drier, cloudier OR sunnier, windier OR calmer, ā¦ā. Can I get an āamenā??

From a discussion I'm having on the Huffington Post about this article: America also has one of the most complicated tax systems in the world, over 8,000 pages long, which drives up the cost of determining what taxes one has to pay. Americans spend about $500 billion a year just to figure out what taxes they owe. That's enough to run GM, Ford, and maybe Chrysler put together. It's crazy stupid. Sure, politically favored companies who can afford to make the right campaign contributions and hire the right lobbyists can get away without paying much. Obama's buddies over at GE are a good example. But other companies get screwed. This is the problem. The answer is to get rid of most tax deductions and dramatically lower tax rates. This would vastly simplify the tax system and encourage investments in innovation and productive capacity. Obama's deficit commission proposed to do just that. Unfortunately, Obama didn't have the vision, real-world experience, or cajones to promote it. How did the no-nothing left treat Obama's deficit commission proposal? With demagoguery as usual. Yes, some ultra-partisans like Hanity on the so-called "right" did the same thing. They all make me sick. From the government monopoly schools, to unsustainable entitlement programs, to corporate welfare, to the federal tax system, America's system is very, very sick. Most people understand this, yet few politicians have the courage to do something about it. It's doesn't bode well for our future.

So? Adopt Socialistic France or Germany's model. As shown, they out perform the post Reagan American model. You admit that the Socialistic Europeans economies are better than the current American ones.

"Keep Your Goddamn Government Hands Off My Medicare!" - Various Tea Party signs.

...vis-a-vis rates on income...

America...My Kind Of Place... "I truly am not that concerned about [bin Laden]..." "THE MILITIA IS COMING!!! THE MILITIA IS COMING!!!" I lurk to see if someone other than Myst or Pookie posts anything...

Early in the modern computer age, a famous computer scientist (Alan Turing) came up with what is now known as the "Turing Test". The Turing test is a test of a machine's ability to exhibit intelligent behavior. You failed. No matter what the input, your output is exactly the same, perhaps just phrased slightly differently. It would take me about 4 hours to write a Gooberbot that could respond to any question on this board. No one would know the difference between you and the bot.

Try and fog up the facts all you want but the Reaganesque model of society you advocate for is outperformed by the socialistic mixed market economies of the West. You worship a failed god.

"Keep Your Goddamn Government Hands Off My Medicare!" - Various Tea Party signs.

I remember being atatcked on Freerepublic when I mentioned the real estate bubble was real and a bad thing - and buying property in Nevada was a mistake - for some reason -- maybe freppers had a stake in the NV real estate market - Freepers were on a tear on how everyone should leave California and move to Nevada. How that work out?

"Keep Your Goddamn Government Hands Off My Medicare!" - Various Tea Party signs.

Here's your prize, moron: Bye, rat-boy mike. We'll miss you. [NOT] Neo-commie scum. I lasted less than a day before they booted me out during the 2000 election. Freerepublic doesn't want any competition on the right. Paleoconservatives (Buchananites), Libertarians... they are not welcome on freerepublic. They might put up with the dumb ones, outright racists, and other posers so they can make fun at them... but make an intelligent, non-war mongering argument from the right, and bye bye... I never bothered to rejoin with another id. There was no point.

I thought that should have been the focus of welfare reform back in the 90's. Instead of making them take some shitty job , send them to school if they want and are able to so they can be even more productive members of society.

You failed. No matter what the input, your output is exactly the same, perhaps just phrased slightly differently. It would take me about 4 hours to write a Gooberbot that could respond to any question on this board. No one would know the difference between you and the bot. WERD! LOL! That "bot" would be more intellectually honest and decent than this gibbering by rote parrot libTURD fool/tool/whore ever was.

Spoiled, stupid and ignorant, brain dead phuckwads, libTURD fools, tools, and idiots, are the real sickness; the messiah "king" obammy and his regime are only the symptoms.

Oh the irony....lmao

Proxy IP's are amusing.....lmao

You wouldn't know irony if it starched your shirt...

America...My Kind Of Place... "I truly am not that concerned about [bin Laden]..." "THE MILITIA IS COMING!!! THE MILITIA IS COMING!!!" I lurk to see if someone other than Myst or Pookie posts anything...

School education means nothing of you have outsourcing of jobs. Used to be witha high school education you could earn a decent living on a union factory floor. Free trade is ending that.

"Keep Your Goddamn Government Hands Off My Medicare!" - Various Tea Party signs.

If it's so self evident then an 'astute' poster like yourself should be able to post it in 500 words or less. Or just make something up like you usually do so we can all have another good laugh.

What group would that be?

It is our responsibility to protect that child once that child’s born too. When we start debating a budget, let’s make sure we don’t cut 100,000 vaccines. Let’s make sure we’ve got health insurance. We seem to worship what we cannot see, but as soon as that baby’s born, oh no, we don’t want to be intrusive. Texas is going to shrink government until it fits inside a women’s uterus. Senator Leticia Van de Putte

He's talking pre-tax versus post-tax.

America...My Kind Of Place... "I truly am not that concerned about [bin Laden]..." "THE MILITIA IS COMING!!! THE MILITIA IS COMING!!!" I lurk to see if someone other than Myst or Pookie posts anything...

Either way, what's he whining about?

It is our responsibility to protect that child once that child’s born too. When we start debating a budget, let’s make sure we don’t cut 100,000 vaccines. Let’s make sure we’ve got health insurance. We seem to worship what we cannot see, but as soon as that baby’s born, oh no, we don’t want to be intrusive. Texas is going to shrink government until it fits inside a women’s uterus. Senator Leticia Van de Putte

That's one of those "How are you today?" questions isn't it? As Tom Likus would ask..."Do you really care?"

America...My Kind Of Place... "I truly am not that concerned about [bin Laden]..." "THE MILITIA IS COMING!!! THE MILITIA IS COMING!!!" I lurk to see if someone other than Myst or Pookie posts anything...

Not much. If it weren't one thing it would be another.

It is our responsibility to protect that child once that child’s born too. When we start debating a budget, let’s make sure we don’t cut 100,000 vaccines. Let’s make sure we’ve got health insurance. We seem to worship what we cannot see, but as soon as that baby’s born, oh no, we don’t want to be intrusive. Texas is going to shrink government until it fits inside a women’s uterus. Senator Leticia Van de Putte

Chyea...have a great weekend out in redwood country...

America...My Kind Of Place... "I truly am not that concerned about [bin Laden]..." "THE MILITIA IS COMING!!! THE MILITIA IS COMING!!!" I lurk to see if someone other than Myst or Pookie posts anything...

My car is in the shop and I'm driving one of those cute little beetles; ah to be young in the 60s again.

It is our responsibility to protect that child once that child’s born too. When we start debating a budget, let’s make sure we don’t cut 100,000 vaccines. Let’s make sure we’ve got health insurance. We seem to worship what we cannot see, but as soon as that baby’s born, oh no, we don’t want to be intrusive. Texas is going to shrink government until it fits inside a women’s uterus. Senator Leticia Van de Putte

Fine. I'll only need two words: "Germany" and "autarky." Thanks for playing. You lose.

Bye, rat-boy mike. We'll miss you. [NOT] One's a nation the other is a existential condition. AN anarchist state can be an "autarky". A military dictatorship can be an "autarky". A commune can be an "autarky". A family can be an "autarky".Unfortunately for you, in most instances, an "autarky" eventually experiences shortages and, in either case of anarchy or dictatorship, "autarky" loses to the survival instinct. If the choice is your window or food for my family, your window will be broken. As an autarky, I claim the right of self-sufficiency and when resources are scarce I'll exercise the right of survival. All of you "Austrians" conveniently ignore Hobbes and Spinoza. Ironic given that a typical argument of yours was once anticipated by Spinoza..."“If facts conflict with a theory, either the theory must be changed or the facts.” You're the Crown Princess of what is in bold.

America...My Kind Of Place... "I truly am not that concerned about [bin Laden]..." "THE MILITIA IS COMING!!! THE MILITIA IS COMING!!!" I lurk to see if someone other than Myst or Pookie posts anything...

I'll only need two words: "Germany" and "autarky." Thanks for playing. You lose. You make no sense as usual, and you seem to be all bluff. Can't you create a coherent sentence with verbs and stuff? And why should I care who wins or loses on a 15 poster chit chat forum?

Couldn't even make it past the first sentence, without calling bullshit. I wonder: do you EVER get anything right? It would seem so far, the answer is a resounding "no."

Bye, rat-boy mike. We'll miss you. [NOT]

Comments (63 - 67) not displayed.

Top • Page Up • Full Thread • Page Down • Bottom/Latest

--GW Bush

--Sarah Palin's version of "The Midnight Ride of Paul revere"

#23. To: jwpegler (#21)

And it's not reported in the corporate tax revenue numbers that the no-nothing left likes to site when making false arguments about the "low" amount of taxes companies in America pay.

--GW Bush

--Sarah Palin's version of "The Midnight Ride of Paul revere"

#24. To: war (#23)

Huh?

#25. To: war, jwpegler (#12)

#26. To: mininggold (#24)

I'm thinking...

#27. To: mininggold (#17)

why don't you just prove me wrong?

#28. To: Capitalist Eric (#26)

That'd be a first.

--GW Bush

--Sarah Palin's version of "The Midnight Ride of Paul revere"

#29. To: war (#12)

Anyone citing the US's statutory tax rate is engaging in sophistry.

#30. To: no gnu taxes (#29)

(Edited)

This bulletin presents new estimates showing that the United States has one of the highest effective tax rates on corporate capital in the world at 36 percent, which compares to an average of just 19.5 percent for 79 other countries studied.

--GW Bush

--Sarah Palin's version of "The Midnight Ride of Paul revere"

#31. To: war (#28)

;^)

#32. To: war (#30)

These tax rates take into account the corporate income tax, sales taxes on capital purchases, and other capital-related taxes.

#33. To: no gnu taxes (#32)

(Edited)

Income tax alone doesn't provide a complete picture, just as you are claiming statutory income tax rates don't provide a complete picture.

--GW Bush

--Sarah Palin's version of "The Midnight Ride of Paul revere"

#34. To: war (#33)

These tax rates take into account the corporate income tax, sales taxes on capital purchases, and other capital-related taxes.

#35. To: no gnu taxes (#34)

Claiming income tax alone is representative of a corporation's total tax liability is also sophistry.

--GW Bush

--Sarah Palin's version of "The Midnight Ride of Paul revere"

#36. To: Capitalist Eric (#31)

How many posts do you have left for today?

--GW Bush

--Sarah Palin's version of "The Midnight Ride of Paul revere"

#37. To: war (#35)

#38. To: Godwinson (#0)

"Everything that can be invented has been invented."-- Charles Duell, Commissioner of US Patent Office, 1899

#39. To: jwpegler (#38)

America also has one of the most complicate d tax systems in the world,

#40. To: no gnu taxes (#37)

--GW Bush

--Sarah Palin's version of "The Midnight Ride of Paul revere"

#41. To: Godwinson (#39)

(Edited)

You admit that the Socialistic Europeans economies are better than the current American ones.

"Everything that can be invented has been invented."-- Charles Duell, Commissioner of US Patent Office, 1899

#42. To: jwpegler (#41)

#43. To: mininggold, jwpegler, war (#19)

Actually war was one of the few who predicted the current economic downturn, when all the Bushies were saying move along there was nothing to see.

#44. To: Godwinson (#42)

Try and fog up the facts all you want

#45. To: Godwinson (#43)

(Edited)

Freerepublic

"Everything that can be invented has been invented."-- Charles Duell, Commissioner of US Patent Office, 1899

#46. To: Godwinson (#0)

retraining of workers and public education systems that result in better-prepared workforces

#47. To: jwpegler, Godwinson (#41)

Early in the modern computer age, a famous computer scientist (Alan Turing) came up with what is now known as the "Turing Test". The Turing test is a test of a machine's ability to exhibit intelligent behavior.

#48. To: Godwinson (#42)

Try and fog up the facts all you want

#49. To: Badeye (#48)

Oh the irony....

--GW Bush

--Sarah Palin's version of "The Midnight Ride of Paul revere"

#50. To: NewsJunky (#46)

I thought that should have been the focus of welfare reform back in the 90's. Instead of making them take some shitty job , send them to school if they want and are able to so they can be even more productive members of society.

#51. To: Capitalist Eric (#27)

There's no need to prove something that is easily observable, and self-evident.

#52. To: Capitalist Eric (#31)

I fall into a group of about 5%.

#53. To: lucysmom (#52)

--GW Bush

--Sarah Palin's version of "The Midnight Ride of Paul revere"

#54. To: war (#53)

He's talking pre-tax versus post-tax.

#55. To: lucysmom (#54)

Either way, what's he whining about?

--GW Bush

--Sarah Palin's version of "The Midnight Ride of Paul revere"

#56. To: war (#55)

#57. To: lucysmom (#56)

--GW Bush

--Sarah Palin's version of "The Midnight Ride of Paul revere"

#58. To: war (#57)

#59. To: mininggold (#17)

Instead of your fluffery type hysterics why don't you just prove me wrong?

#60. To: Capitalist Eric (#59)

(Edited)

I'll only need two words: "Germany" and "autarky."

--GW Bush

--Sarah Palin's version of "The Midnight Ride of Paul revere"

#61. To: Capitalist Eric (#59)

Fine.

#62. To: war (#60)

One's a nation the other is a existential condition.

.

.

.

[Home] [Headlines] [Latest Articles] [Latest Comments] [Post] [Mail] [Sign-in] [Setup] [Help] [Register]