Economy

See other Economy Articles

Title: Ron Paul: Gold, Commodity Prices “Big Event” Signaling Economic Collapse

Source:

Infowars.com

URL Source: http://www.infowars.com/ron-paul-go ... t-signaling-economic-collapse/

Published: Apr 6, 2011

Author: Kurt Nimmo

Post Date: 2011-04-06 13:00:05 by Hondo68

Keywords: staggering and deleterious deb, precipitously falling dollar, creeping inflation

Views: 3267

Comments: 3

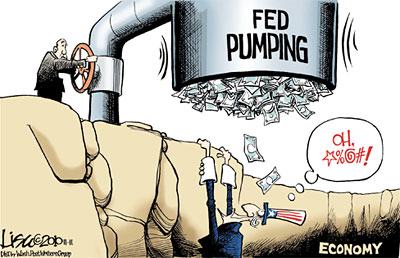

Skyrocketing gold, silver, oil and other commodity prices, a brazen attempt by the Federal Reserve to monetize a staggering and deleterious debt, a precipitously falling dollar, creeping inflation – these are elements of a “big event,” Ron Paul told Alex Jones on Tuesday. “It's huge, and it has started,” Paul said, and it may be identified as such within 30 days. “I believe it is the beginning" you and others have been talking about commodity prices going up.” The Texas Congressman noted that even the former boss of the Federal Reserve, Alan Greenspan, has warned about out of control inflation. “A necessary condition for long-term unemployment is low inflation,” Greenspan said recently. “If the Fed does its job and stabilizes the inflation rate, that's the maximum that the central bank can do.” Greenspan failed to mention the fact that when the Federal Reserve prints a new fresh new batch of fiat paper money, it unleashes a devastating round of inflation. Quantitative Easing initiated by the Fed is just that – cranking up the printing machines. It created $600 billion out of thin air to purchase Treasuries and another nearly $300 billion for mortgage-backed securities. Pumping all that money into the economy is an engine for creating inflation. It won't end with QE2, though. The plan to print gobs of money is open-ended. Late last year, the Fed said it will “regularly review the pace of its securities purchases and the overall size of the asset-purchase program in the light of incoming information and will adjust the program as needed.” As Lew Rockwell noted with tongue firmly planted in cheek, it makes sense to refer to it as QE[n], because the Fed has hinted it will soon begin QE3. “These various attempts to restore the inebriated happy time have unpredictable and uncontrollable effects,” said Rockwell in mid-March. “Bernanke would drive us right into hyperinflation to save his industries. Savers living on pensions just don't have the political clout to stop the money machine,” he added. “Inflation is when they print the money and create the credit out of thin air,” Paul told Jones and his audience, “and then the price increases come afterwards.” Both gold and silver reached stellar new highs today based on fears that the central bank's monetary policies will lead to an increase in interest rates in response to galloping inflation. Both China and the EU ratcheted up their interest rates modestly this week. Paul noted that the record-breaking rise in the price of gold is a barometer pointing to the fact that the dollar continues to decrease in value. Gold, he said, is the ultimate test to determine the state of the dollar. “Devaluation, it's not good for anybody.” In addition to base metals, the price of other commodities – particularly oil and food – have shot through the stratosphere and give no indication of coming back down to earth anytime soon. An op-ed posted on the NASDAQ website calls current Fed boss Bernanke a myopic Dr. Frankenstein who created the inflation monster now ravaging the world economy. “Frankenstein had his monster and Ben has his and his monster is commodity price inflation,” writes Phil Flynn. “Fed Chairman Ben Bernanke might not see what is coming,” that is to say interest rate increases from China and Europe and inflation on gasoline and food prices. As Alex Jones noted during the interview, warnings about inflation are coming from all quarters, most recently from Wal-Mart CEO Bill Simon, who said there will be "serious" inflation in the months ahead for clothing, food and other products. “The solution to inflation is not having a Federal Reserve run by somebody like Bernanke,” said Paul, who is currently the chairman of the House Subcommittee on Domestic Monetary Policy. Ron Paul is in a position to rake Bernanke over the coals in the months ahead as the bankster created Frankenstein monster of inflation ravages the nation.

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

#1. To: hondo68, all (#0)

Remember last year when that idiot Weiner wanted to 'investigate' Glenn Beck and Goldline? Every time I read about golds price going up I remember that and laugh.

I hear you knockin...go back where you been....

Wanted to? He did investigate them.

Apparently not. What does that have to do with anything, Boofer? Goldline was selling coins at values in exponential excess of their melt value. You have no issue with that? Call your broker and tell him you want to buy 1000 shares of C @ $451.00

Apparently not.

#2. To: Badeye (#1)

Remember last year when that idiot Weiner wanted to 'investigate' Glenn Beck and Goldline?

Inarticulate Insights,

By Boofer

#3. To: Badeye (#1)

(Edited)

Every time I read about golds price going up I remember that and laugh.

Inarticulate Insights,

By Boofer

Top • Page Up • Full Thread • Page Down • Bottom/Latest

[Home] [Headlines] [Latest Articles] [Latest Comments] [Post] [Mail] [Sign-in] [Setup] [Help] [Register]