International News

See other International News Articles

Title: Iceland did it the Right Way

Source:

Newsvine

URL Source: http://truthlover.newsvine.com/_new ... -harmful-unless-you-were-a-wea

Published: Feb 3, 2011

Author: Bloomberg.com

Post Date: 2011-02-03 21:09:23 by jwpegler

Keywords: None

Views: 13575

Comments: 40

Iceland did not bail out the banks or the bank investors and its economy is thriving, proving that the the US-Irish model of bailing out the banks with taxpayer money was harmful unless you were a wealthy bank investor On his second day as head of Iceland's third-largest bank, Arni Tomasson faced a crisis: The bank was out of cash. "Everybody was panicked -- depositors, creditors, banks around the world." Unlike other nations, including the U.S. and Ireland, which injected billions of dollars of capital into their financial institutions to keep them afloat, Iceland placed its biggest lenders in receivership. It chose not to protect creditors of the country's banks, whose assets had ballooned to $209 billion, 11 times gross domestic product.With the economy projected to grow 3 percent this year, Iceland's decision to let the banks fail is looking smart -- and may prove to be a model for others. Three banks had become the largest companies in Iceland, creating thousands of well-paid positions and controlling the top trade associations, says Oddsson, who oversaw the privatization of Iceland's state-owned lenders as prime minister. Their headquarters were the largest buildings in Reykjavik, dwarfing the parliament. "Nobody wanted to listen when the party was on," says Oddsson, 63, now editor of Morgunbladid, one of the largest dailies in the country, with a circulation of about 50,000. It was Oddsson's decision not to build up the central bank's foreign currency reserves from 2005 to 2008 that made a bailout impossible. "They were collecting debt in such a fast pace, it would be stupid for us to build a mountain they could lean on if they failed," Oddsson says. "The creditors that were lending to the banks recklessly had to face the losses." "Iceland did the right thing by making sure its payment systems continued to function while creditors, not the taxpayers, shouldered the losses of banks," says Nobel laureate Joseph Stiglitz, an economics professor at Columbia University in New York. Van der Knaap, who has advised Iceland's bank resolution committees:. "Even Irish banks aren't too big to fail." Today, Iceland is recovering. The three new banks had combined profit of $309 million in the first nine months of 2010. GDP grew for the first time in two years in the third quarter, by 1.2 percent, inflation is down to 1.8 percent and the cost of insuring government debt has tumbled 80 percent. Stores in Reykjavik were filled with Christmas shoppers in early December, and bank branches were crowded with customers.

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

#1. To: All, Capitalist eric, go65 (#0)

I just love the truth

Japan refused to let it's banks fail in the early 90s (even though the Clinton administration urged them to do so). They have been in 20 year rolling recession. The U.S. didn't let it's banks fail two years ago. Now we're stuck in a jobless "recovery". There is an important lesson to be learned here. If something goes wrong -- don't allow the government to prolong the pain. Let the market fix it immediately and quickly.

We had this same discussion a few weeks ago and you argued that Iceland wasn't recovering, I'm glad to see you realize you were wrong. And you might want to read the article, Iceland's government was deeply involved in managing the banks failures. They didn't just stand back and let the financial system collapse.

Since January 3, 2011, Republicans have controlled the power of the purse.

Agreed. The same goes for raising the debt cieling. Leave it stay as-is, and let the goobermint default. It'll suck for all the goobermint parasites and welfare families for a while, but we'll get through it. If they DON'T default, and continue to print money...? We'll ALL suffer for a VERY long time.

"There will be no more money when the U.S. dollar has no value, until that time we can keep printing more." -- go65, LF's answer to Ben Bernanke --

The government doesn't have to default. If the government doesn't raise the debt ceiling, they can only spend what they take in. That about $2 trillion. The entire federal budget was $2 trillion in 2002. We only have to cut back to 2002 spending levels to stop borrowing. Yes, we'll have to prioritize paying interest on the debt, so we don't default This is quite doable. Do you think we'll do it??? No way.

We only have to cut back to 2002 spending levels to stop borrowing. Only if we assume no negative economic impact as a result of a $1.4 trillion spending cut in one year. I can sell you some real estate on Mars if you don't think that sort of cut wouldn't kick of a 1930's style depression.

Since January 3, 2011, Republicans have controlled the power of the purse.

Just not the whole truth.

Merchants have no country. The mere spot they stand on does not constitute so strong an attachment as that from which they draw their gains. Thomas Jefferson

Cutting 1.4 trillion in spending along with radical tax simplification would make America the best place to invest and create jobs in the world.

No kidding! The country secured over $10 billion in loans from the IMF and other countries to stabilize its currency and financial sector, and to back government guarantees for foreign deposits in Icelandic banks. GDP fell 6.8% in 2009, and unemployment peaked at 9.4% in February 2009. GDP fell 3.4% in 2010. Since the collapse of Iceland's financial sector, government economic priorities have included: stabilizing the krona, reducing Iceland's high budget deficit, containing inflation, restructuring the financial sector, and diversifying the economy. Three new banks were established to take over the domestic assets of the collapsed banks. Two of them have foreign majority ownership, while the State holds a majority of the shares of the third. British and Dutch authorities have pressed claims totaling over $5 billion against Iceland to compensate their citizens for losses suffered on deposits held in the failed Icelandic bank, Landsbanki Islands. Iceland agreed to new terms with the UK and the Netherlands to compensate British and Dutch depositors, but the agreement must first be approved by the Icelandic President. Iceland began EU accession negotiations with the EU in July 2010, however, public support has dropped substantially because of concern about losing control over fishing resources and in reaction to measures taken by Brussels during the ongoing Eurozone crisis. https://www.cia.gov/library/publications/the-world-factbook/geos/ic.html Sorry for the cut and paste but I don't KNOW this stuff.

Merchants have no country. The mere spot they stand on does not constitute so strong an attachment as that from which they draw their gains. Thomas Jefferson

I like JW, but when facts get in the way of spin, he chooses spin.

Since January 3, 2011, Republicans have controlled the power of the purse.

Only if you set up some sort of extermination facilities for the millions of new unemployed as a result of another economic crash. One can look at recent history and see how countries that implemented austerity saw no decrease in deficits. One can look at how cutting spending in 1937 triggered an economic decline. Or one can simply cling to fantasies with no basis in reality.

Since January 3, 2011, Republicans have controlled the power of the purse.

One can look at how cutting spending in 1937 triggered an economic decline. Those countries do get anti-austerity riots. Along with economic decline came an interest in Communism. FDR's "Socialist" programs saved Capitalism.

Merchants have no country. The mere spot they stand on does not constitute so strong an attachment as that from which they draw their gains. Thomas Jefferson

No country ever cut its way to prosperity, but yet even the most die-hard Conservative argues that WWII was an economic catalyst for the country.

Since January 3, 2011, Republicans have controlled the power of the purse.

Untrue. The economic catalyst was Truman's refusal after the war to listen to nutty Keynesians who wanted to keep the war economy in tact, by building tanks and parking them in the desert. Truman told the Keynesian kooks to take a hike. He cut spending from 52% of GDP in 1945 to 20% in 1948. The economy boomed. Truman saved capitalism, not Roosevelt. The big spending programs of Hoover and Roosevelt took what should have been another steep, but short economic downturn, and turned it into a 15 year long Great Depression. The economy was worse at the end of the 1930s that it was when Roosevelt took office. We're seeing the same thing today with Obama's wasteful stimulus, healthcare nightmare, and destructive environmental regulations.

Ping

Untrue? So you are arguing that the U.S. economy didn't prosper as a result of our entering WWII in 1941? I'm supposed to ignore data showing a 50% growth in US GDP from 1940-1945? What's next JP, are you going to argue that the GI bill didn't spur growth either?

Since January 3, 2011, Republicans have controlled the power of the purse.

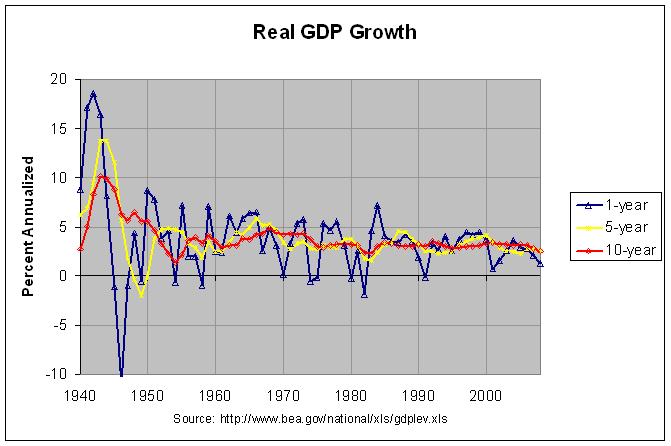

That's absolutely false. US GDP Growth: In chart form: Care to rethink your argument that spending increases hurt growth and spending cuts help it?

Since January 3, 2011, Republicans have controlled the power of the purse.

GDP that went to military spending, not consumer goods which also dramatically raised the country's debt. If that pace of spending had continued after the war, the country would have collapsed under the debt. Your original assertion was that you can't cut your way into prosperity. That's what the Keynsians told Truman. He didn't listen and cut government spending by 60% of GDP in less than 3 years and ignited the golden days of American prosperity. We only need to cut spending by about 28% of GDP to balance the budget, not 60%.

From http://libertysflame.com/cgi-bin/readart.cgi?ArtNum=17080&Disp=0 To properly look at GDP in terms of actual economic progress one must back out all the borrowing that takes place during the same period. That is, the proper way to look at GDP is to subtract back out that which is paid for not with today’s output, but with promises to pledge tomorrow’s. The reason for this is clear – you may in fact only spend a dollar once. When looked at this way one gets a very different view of “growth” in the economy, and the depth of the hole we have dug for ourselves becomes clear. There has been NO actual positive GDP growth during the entire period from 1953 onward – until the 4th quarter of 2009, and since 1980 the true GDP numbers, when one looks at output (not what one “pulls forward” via debt) has been hideously bad. The spike upward in actual debt-adjusted growth that began in the 4th quarter of 2009 and peaked in the 1st quarter of 2010 was due to total systemic debt reduction – the very thing the government is trying to prevent, but which is necessary to bring the economy back into balance. This, incidentally, is why median incomes haven’t moved upward at all in the last decade and why it seems to be harder and harder every year to maintain a middle-class lifestyle - and has been since the 1950s. The loss of purchasing power in real terms, the drive to “two income” households and finally the wild screams from the media, government, and lastly Bernanke’s recent assertion that “QE2” has been a “success” because the stock market has gone up all underlie the truth – we have not grown the economy at all during the last sixty years! Instead we serially pulled out the credit card and said “Charge It!”, continually rolling over the debt and adding more to it. If you look at the stock market, one has to ask – when did it start to “take off”? In 1991 the S&P 500 printed 300 and the Dow stood at 2,500. That was the start of the monstrous "bull run" in stocks. Exactly none of the alleged “stock market appreciation” has come from actual economic growth since that time. It has all come from ever-increasing amounts of leverage (debt) that, when subtracted back out of the change in GDP, show that on an actual output basis the economy of the United States has not printed a positive number the entire time. Nobody in the media – or government – will talk about this, despite the fact that the there’s little room for argument on the mathematical facts – they’re right there in the government data. (1 image) since go56 doesn't like to debate FACTS with me, he has me on bozo. So you might want to repost this chart to him, along with the relevant article information, and watch him choke on his argument... Because the chart above rams his argument right down his friggin' THROAT.

Only an opium-smoking FOOL would think that when you've maxed out your credit cards, and can no longer make minimum payments, that raising the limits on the credit is a good idea. Either that, or you're a socialist ass-hat, who thinks "There will be no more money when the U.S. dollar has no value, until that time we can keep printing more." And yes, that IS from LF's answer to Ben Bernanke, go65, our disfunctional, delusional socialist of the forum.

The numbers are extraordinarily misleading because they include in the GDP money wasted on tanks and military equipment that don't increase the wealth of a society. Truman cut government spending as a percentage of GDP by 60% in less than 3 years. Did the economy collapse into another depression? Nope. Why not? According to you it should have been devastating. It wasn't. Private sector activity expanded to fill the space that wasteful government activity occupied during the war. Then it grew from that new economic footing. If Truman would have kept wasting money on unnecessarily government programs, the economy would have collapsed under a mountain of debt and hyperinflation. The same is true today, only we don't have to cut government spending by 60% of GDP. Only 28%.

I agree with that if the borrowing is for transfer payments and current consumption. If the borrowing is for long-term capital investments that increase productive capacity, then I don't agree.

Honestly, I don't understand why you attempt to debate with go56. He's a nanny-state shill, nothing more... Frankly, it wouldn't surprise me if he were on the government payroll, either as a propagandist on the boards, or simply another government worker-bee (parasite). Why bother?

Only an opium-smoking FOOL would think that when you've maxed out your credit cards, and can no longer make minimum payments, that raising the limits on the credit is a good idea. Either that, or you're a socialist ass-hat, who thinks "There will be no more money when the U.S. dollar has no value, until that time we can keep printing more." And yes, that IS from LF's answer to Ben Bernanke, go65, our disfunctional, delusional socialist of the forum.

He's a nanny-state shill, nothing more... go65 does not toe the leftist line 100% of the time. Unlike Godwinson, he can benefit from seeing the facts.

So we just ignore all the people who got jobs supporting the war effort? Your arguments are laughable today. The data demonstrates that your claim that the economy "boomed" after WWII are patently false.

Since January 3, 2011, Republicans have controlled the power of the purse.

Like GDP dropping when you claim the economy boomed.

Since January 3, 2011, Republicans have controlled the power of the purse.

By that measure how do you think the economy performed during the Reagan years when the national debt tripled? You guys put so little thought into your arguments sometimes.

Since January 3, 2011, Republicans have controlled the power of the purse.

I don't see it. Frankly, he seems impervious to reality.

Only an opium-smoking FOOL would think that when you've maxed out your credit cards, and can no longer make minimum payments, that raising the limits on the credit is a good idea. Either that, or you're a socialist ass-hat, who thinks "There will be no more money when the U.S. dollar has no value, until that time we can keep printing more." And yes, that IS from LF's answer to Ben Bernanke, go65, our disfunctional, delusional socialist of the forum.

So if half the economy is producing tanks, where are we going to get the cars, televisions, etc. for people to buy with the money they earn producing tanks? The only reason that this worked for a short period of time is that they borrowed money from the future to support the war. That is unsustainable. Truman knew it and did something about it. It's now time for us to do something about the debt we've run up.

hmmm, maybe people actually save their money? A strange idea indeed I guess. But I'm still waiting for you to explain how the economy "boomed" after WWII when GDP was flat or falling. Are you using some other measure of economic performance that i don't know about?

Since January 3, 2011, Republicans have controlled the power of the purse.

I've already explained it to you. You're just not getting it. On the other hand, I am still waiting for you to tell me why cutting government spending by 60% of GDP did not produce the kind of economic cataclysm that you claim will happen today if we cut government spending by a mere 28% of GDP.

Yes, you've invented your own measure of economic success and are ignoring GDP data that contradicts your claim. When you can provide some sort of objective measure of data showing the economy 'boomed' in the 1945-50 time-frame please let me know (unemployment tripled during that time frame too, so you might want to ignore that data point as well). The ball is in your court.

Since January 3, 2011, Republicans have controlled the power of the purse.

From http://libertysflame.com/cgi-bin/readart.cgi?ArtNum=17080 To properly look at GDP in terms of actual economic progress one must back out all the borrowing that takes place during the same period. That is, the proper way to look at GDP is to subtract back out that which is paid for not with today’s output, but with promises to pledge tomorrow’s. The reason for this is clear – you may in fact only spend a dollar once. When looked at this way one gets a very different view of “growth” in the economy, and the depth of the hole we have dug for ourselves becomes clear. There has been NO actual positive GDP growth during the entire period from 1953 onward – until the 4th quarter of 2009, and since 1980 the true GDP numbers, when one looks at output (not what one “pulls forward” via debt) has been hideously bad. The spike upward in actual debt-adjusted growth that began in the 4th quarter of 2009 and peaked in the 1st quarter of 2010 was due to total systemic debt reduction – the very thing the government is trying to prevent, but which is necessary to bring the economy back into balance. This, incidentally, is why median incomes haven’t moved upward at all in the last decade and why it seems to be harder and harder every year to maintain a middle-class lifestyle - and has been since the 1950s. The loss of purchasing power in real terms, the drive to “two income” households and finally the wild screams from the media, government, and lastly Bernanke’s recent assertion that “QE2” has been a “success” because the stock market has gone up all underlie the truth – we have not grown the economy at all during the last sixty years! Instead we serially pulled out the credit card and said “Charge It!”, continually rolling over the debt and adding more to it. If you look at the stock market, one has to ask – when did it start to “take off”? In 1991 the S&P 500 printed 300 and the Dow stood at 2,500. That was the start of the monstrous "bull run" in stocks. Exactly none of the alleged “stock market appreciation” has come from actual economic growth since that time. It has all come from ever-increasing amounts of leverage (debt) that, when subtracted back out of the change in GDP, show that on an actual output basis the economy of the United States has not printed a positive number the entire time. Nobody in the media – or government – will talk about this, despite the fact that the there’s little room for argument on the mathematical facts – they’re right there in the government data. (1 image)

Only an opium-smoking FOOL would think that when you've maxed out your credit cards, and can no longer make minimum payments, that raising the limits on the credit is a good idea. Either that, or you're a socialist ass-hat, who thinks "There will be no more money when the U.S. dollar has no value, until that time we can keep printing more." And yes, that IS from LF's answer to Ben Bernanke, go65, our disfunctional, delusional socialist of the forum.

Ping to 32.

Only an opium-smoking FOOL would think that when you've maxed out your credit cards, and can no longer make minimum payments, that raising the limits on the credit is a good idea. Either that, or you're a socialist ass-hat, who thinks "There will be no more money when the U.S. dollar has no value, until that time we can keep printing more." And yes, that IS from LF's answer to Ben Bernanke, go65, our disfunctional, delusional socialist of the forum.

Because to talk about it leads unfortunately for them to a demand to be held accountable and to fix. Neither of which is acceptable to the elites.

Well, [war's] got to do something for attention, his multiple personalities aren't speaking to him any more, and his imaginary friends keep finding excuses not to come over.

Or the non-elite socialists. After all, as Margaret Thatcher flatly stated, "socialism works until you run out of other peoples' money." The socialists do NOT want to address the fact that globally, we are indeed at that point.

Only an opium-smoking FOOL would think that when you've maxed out your credit cards, and can no longer make minimum payments, that raising the limits on the credit is a good idea. Either that, or you're a socialist ass-hat, who thinks "There will be no more money when the U.S. dollar has no value, until that time we can keep printing more." And yes, that IS from LF's answer to Ben Bernanke, go65, our disfunctional, delusional socialist of the forum.

We're still paying back the money we borrowed to finance Kemp-Roth.

You have repeatedly said that the economy will collapse if the government cuts spending to balance the budget. Truman cut government spending by 60%. The economy did not collapse. The private sector did boom as it replaced military products with consumer goods very quickly. The Keynesian nut cases wanted to keep the war time economy in tact by building tanks and parking them in the desert. He didn't listen . It's a good thing he didn't. We shouldn't listen to the Keynesian nut cases today.

Nope, I have said that if there are massive short term cuts the economy will collapse. I have also repeatedly said that modest cuts coupled with tax hikes and reforming our tax structure to promote growth is the best way to close the deficit. Unemployment tripled and GDP growth was virtually non-existent from 1946-50, but you want to ignore that.

Since January 3, 2011, Republicans have controlled the power of the purse.

Truman cut government spending by 60% in 3 years. 60% !!!!! The largest cuts were up front. The economy did not collapse.

Where are you getting your information? http://www.house.gov/jec/fiscal/budget/surplus2/surplus2.htm The overwhelming reason for the vanishing surplus was an increase in federal outlays of over 30 percent in a single year. Over 60 percent of the increase in spending related to national security and foreign affairs. The heating up of the Cold War after the Berlin Crisis of 1948 no doubt contributed to this. Military budgets were increased considerably, and foreign aid spending soared with the beginning of the Marshall Plan. The $9 billion spending increase dwarfed the $2.2 billion in tax reductions arising from changes in individual income taxation (e.g., the introduction of the joint return). The high wartime marginal tax rates remained. President Truman, however, blamed the 1948 tax reduction for keeping debt reduction from being greater, but the data suggest this was a distinctly secondary factor.11 Truman was pushing, often unsuccessfully, an expensive domestic spending agenda, including a national health insurance program. The near disappearance of the budget surplus, very dear to Truman's heart, was also not primarily a consequence of the relatively mild 1949 recession, which was only a factor in the last half of that fiscal year.12 Since January 3, 2011, Republicans have controlled the power of the purse.

Socialism is a philosophy of failure, the creed of ignorance, and the gospel of envy, its inherent virtue is the equal sharing of misery. -- Winston Churchill

#2. To: All (#0)

(Edited)

Socialism is a philosophy of failure, the creed of ignorance, and the gospel of envy, its inherent virtue is the equal sharing of misery. -- Winston Churchill

#3. To: jwpegler (#2)

Today, Iceland is recovering. The three new banks had combined profit of $309 million in the first nine months of 2010. GDP grew for the first time in two years in the third quarter, by 1.2 percent, inflation is down to 1.8 percent and the cost of insuring government debt has tumbled 80 percent. Stores in Reykjavik were filled with Christmas shoppers in early December, and bank branches were crowded with customers.

http://www.libertysflame.com/cgi-bin/readart.cgi?ArtNum=16702&Disp=4#C4

#4. To: jwpegler (#2)

There is an important lesson to be learned here. If something goes wrong -- don't allow the government to prolong the pain. Let the market fix it immediately and quickly

#5. To: Capitalist Eric (#4)

(Edited)

The same goes for raising the debt cieling. Leave it stay as-is, and let the goobermint default.

"Everything that can be invented has been invented."-- Charles Duell, Commissioner of US Patent Office, 1899

#6. To: jwpegler (#5)

If the government doesn't raise the debt ceiling, they can only spend what they take in. That about $2 trillion. The entire federal budget was $2 trillion in 2002.

#7. To: jwpegler (#1)

I just love the truth

#8. To: go65 (#6)

Only if we assume no negative economic impact as a result of a $1.4 trillion spending cut in one year.

"Everything that can be invented has been invented."-- Charles Duell, Commissioner of US Patent Office, 1899

#9. To: go65 (#3)

And you might want to read the article, Iceland's government was deeply involved in managing the banks failures. They didn't just stand back and let the financial system collapse.

#10. To: lucysmom, jwpegler (#9)

No kidding!

#11. To: jwpegler (#8)

Cutting 1.4 trillion in spending along with radical tax simplification would make America the best place to invest and create jobs in the world.

#12. To: go65 (#11)

One can look at recent history and see how countries that implemented austerity saw no decrease in deficits.

#13. To: lucysmom, jwpegler (#12)

Along with economic decline came an interest in Communism. FDR's "Socialist" programs saved Capitalism.

#14. To: go65 (#13)

(Edited)

even the most die-hard Conservative argues that WWII was an economic catalyst for the country... No country ever cut its way to prosperity

"Everything that can be invented has been invented."-- Charles Duell, Commissioner of US Patent Office, 1899

#15. To: All, Capitalist eric, go65 (#14)

"Everything that can be invented has been invented."-- Charles Duell, Commissioner of US Patent Office, 1899

#16. To: jwpegler (#14)

Untrue. The economic catalyst was Truman's refusal after the war to listen to nutty Keynesians who wanted to keep the war economy in tact, by building tanks and parking them in the desert.

#17. To: jwpegler (#15)

(Edited)

Truman told the Keynesian kooks to take a hike. He cut spending from 52% of GDP in 1945 to 20% in 1948. The economy boomed.

1941: 19%

1942: 15.2%

1943: -1.88%

1944: 28.14%

1945: -.75

1946: - 1%

1947: - .6%

1948: 7.6%

1949: -3.7%

#18. To: go65, capitalist eric (#16)

Untrue? So you are arguing that the U.S. economy didn't prosper as a result of our entering WWII in 1941? I'm supposed to ignore data showing a 50% growth in US GDP from 1940-1945?

"Everything that can be invented has been invented."-- Charles Duell, Commissioner of US Patent Office, 1899

#19. To: jwpegler (#18)

#20. To: go65 (#17)

(Edited)

Care to rethink your argument that spending increases hurt growth and spending cuts help it?

"Everything that can be invented has been invented."-- Charles Duell, Commissioner of US Patent Office, 1899

#21. To: Capitalist Eric (#19)

(Edited)

the proper way to look at GDP is to subtract back out that which is paid for not with today’s output, but with promises to pledge tomorrow’s

"Everything that can be invented has been invented."-- Charles Duell, Commissioner of US Patent Office, 1899

#22. To: jwpegler (#15)

#23. To: Capitalist Eric (#22)

(Edited)

Honestly, I don't understand why you attempt to debate with go56.

"Everything that can be invented has been invented."-- Charles Duell, Commissioner of US Patent Office, 1899

#24. To: jwpegler (#20)

The numbers are extraordinarily misleading because they include in the GDP money wasted on tanks and military equipment that don't increase the wealth of a society.

#25. To: jwpegler (#23)

go65 does not toe the leftist line 100% of the time. Unlike Godwinson, he can benefit from seeing the facts.

#26. To: jwpegler, capitalist eric (#21)

the proper way to look at GDP is to subtract back out that which is paid for not with today’s output, but with promises to pledge tomorrow’s

#27. To: jwpegler (#23)

Unlike Godwinson, he can benefit from seeing the facts.

#28. To: go65 (#24)

(Edited)

So we just ignore all the people who got jobs supporting the war effort?

"Everything that can be invented has been invented."-- Charles Duell, Commissioner of US Patent Office, 1899

#29. To: jwpegler (#28)

So if half the economy is producing tanks, where are we going to get the cars, televisions, etc. for people to buy with the money they earn producing tanks?

#30. To: go65 (#29)

But I'm still waiting for you to explain how the economy "boomed" after WWII when GDP was flat or falling.

"Everything that can be invented has been invented."-- Charles Duell, Commissioner of US Patent Office, 1899

#31. To: jwpegler (#30)

I've already explained it to you. You're just not getting it.

#32. To: go65 (#26)

By that measure how do you think the economy performed during the Reagan years when the national debt tripled?

#33. To: jwpegler (#30)

#34. To: Capitalist Eric (#32)

Nobody in the media – or government – will talk about this

#35. To: Rudgear (#34)

(Edited)

Neither of which is acceptable to the elites.

#36. To: Capitalist Eric (#35)

After all, as Margaret Thatcher flatly stated, "socialism works until you run out of other peoples' money."

#37. To: go65, capitalist eric (#31)

(Edited)

"Everything that can be invented has been invented."-- Charles Duell, Commissioner of US Patent Office, 1899

#38. To: jwpegler (#37)

You have repeatedly said that the economy will collapse if the government cuts spending to balance the budget.

Truman cut government spending by 60%. The economy did not collapse. The private sector did boom as it replaced military products with consumer goods very quickly.

#39. To: go65 (#38)

(Edited)

I have said that if there are massive short term cuts the economy will collapse

"Everything that can be invented has been invented."-- Charles Duell, Commissioner of US Patent Office, 1899

#40. To: jwpegler (#39)

(Edited)

Truman cut government spending by 60% in 3 years. 60% !!!!! The largest cuts were up front. The economy did not collapse.

The 1948-49 Vanishing of a Surplus

After the conclusion of World War II, defense spending fell dramatically. While taxes were lowered slightly, the huge fall in spending led to surpluses by 1947. By 1948, the defense demobilization was essentially complete, and the Nation ran a healthy surplus of nearly $12 billion - well over 4 percent of GDP, the biggest surplus of modern times. Yet within a year, it was all but gone. Why?

Top • Page Up • Full Thread • Page Down • Bottom/Latest

[Home] [Headlines] [Latest Articles] [Latest Comments] [Post] [Mail] [Sign-in] [Setup] [Help] [Register]