International News

See other International News Articles

Title: Gold, Dollar, Euro & China: Four To Tango in 2011

Source:

[None]

URL Source: [None]

Published: Dec 30, 2010

Author: Dian L. Chu

Post Date: 2010-12-30 13:35:00 by Capitalist Eric

Keywords: None

Views: 549

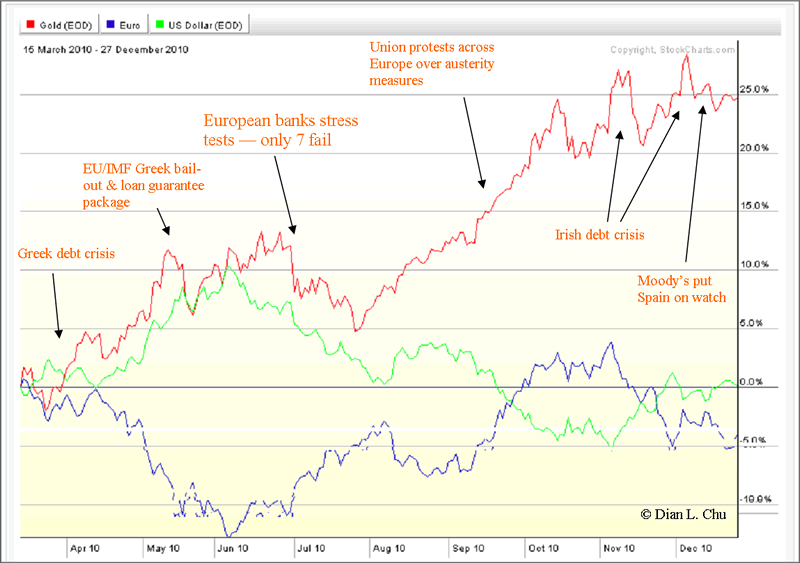

For the most part of 2010, the typical image of Europe—one of cultural sophistication—has been replaced by widespread riots, burning cars, large scale strikes over labor reform and unemployment resulting from austerity measures amid a sovereign debt crisis in the region. Gold Chart’s European Tale: Disclosure: No Postions Dian L. Chu, M.B.A., C.P.M. and Chartered Economist, is a market analyst and financial writer regularly contributing to Seeking Alpha, Zero Hedge, and other major investment websites. Ms. Chu has been syndicated to Reuters, USA Today, NPR, and BusinessWeek. She blogs at Economic Forecasts & Opinions. © 2010 Copyright Dian L. Chu - All Rights Reserved

Fear about defaults and more bailouts throughout the European Union (UN) has formed a dark storm cloud hanging over the otherwise robust global rally, and pushed Gold to an all-time high of $1,432.50 an ounce on Dec. 7.

The market’s emotion related to the European debt crisis is clearly reflected through the interaction between Dollar, Euro and Gold, where you can literally trace the timeline of significant macroeconomic events in Europe and the United States (See Chart).

The general pattern is simple - Whenever there’s bad news out of Europe, investors first course of action is to dump Euro and go into gold and dollar as the two top safe haven choiceshttp://www.marketoracle.co.uk.and vice versa.

Conventional Wisdom Rewritten

Historically, gold is seen as the ultimate hedge against inflation and dollar weakness with a typical inverse relationship with the U.S. dollar. Meanwhile, Euro had been:gaining on the dollar as the choice of global reserve currency over the past decade mostly on concerns over the mountainous debt of the U.S. government.

However, the conventional wisdom has been totally rewritten by the global financial crisis, the European debt crisis, and the:unprecedented and synchronized global quantitative easing. As horrendous as the U.S. budget deficit and debt situation is, compared with the depth and breadth of European debt woes, investors now see euro as the risky currency, while dollar has regained its safe haven status as Gold.

China In The Gold House:

So, how will the dynamics between Dollar, Euro and Gold play out in 2011?

At current price levels, the main gold buying action will come from investors and funds as inflation and currency hedge as well as price speculation, instead of from jewelry demand. From that perspective, there’s a fourth major player, in the name of China, emerging in the global gold market.

Bullion Vault noted that with savings-deposit rates now more than 2% below the rate of consumer-price inflation, China has fast become the world's No.2 source of physical gold demand. In fact, China recently revealed that its gold imports rose almost 500% year-over-year to 209 tons during the first ten months of this year.

China’s Surging Gold Trade

People’s Daily Online also noted the explosive growth in China's private gold investment market. In the first three quarters, the individual customers in Shanghai Gold Exchanges neared 1.6 million; gold trade exceeded 4,600 tons and its turnover topped 1.1 trillion Yuan, both rising sharply. That means Chinese has traded more gold than the total global identifiable demand (about 3,201 tons) over the first nine months of the year.

Love of Gold — A Chinese Tradition  The surge in China gold demand seems to have befuddled some including:Richard Daughty (aka The Mogambo Guru) at The Daily Reckoning who wrote “http://www.marketoracle.co.uk.there is nothing about Chinese trusting gold for the last few thousand years or so.”

The surge in China gold demand seems to have befuddled some including:Richard Daughty (aka The Mogambo Guru) at The Daily Reckoning who wrote “http://www.marketoracle.co.uk.there is nothing about Chinese trusting gold for the last few thousand years or so.”

Well, let me set the record straight here.:The Chinese, like many other Asian countries, have a tradition of reserving and investing in gold for thousands of years. Gold and real estate are typically the top two investment choices mainly due to a distrust of paper instruments resulting from much turmoil throughout the region’s history.

It is mostly this propensity, the clear present danger of an escalating inflation, and rising tensions at neighboring Korea, that are behind the rising gold demand in China

Gold = Financial Competitiveness

What’s more telling is that according to People’s Daily Online, in August, six China ministries, including the People's Bank of China, and the China Securities Regulatory Commission, jointly issued a notice to promote the gold market and positively connected the future development of the gold market with the competitiveness of financial markets.

China is already the world’s top gold producer, but has remained somewhat muted in the global gold market. Now, with the expanding of the Chinese gold market (China just approved its first gold mutual fund on Nov. 29), the increasing investment demand from the Chinese government and / or individual investors will become a major force influencing the world gold market.

China Can’t Save the Euro

Now, let’s take a look at the Euro.

According to data from the Bank for International Settlements (BIS), German and French banks have the largest debt exposure to Ireland and the southern rim of euro zone in the second quarter--so, the European debt crisis most likely will not evolve into a global contagion as many have feared.

Nevertheless, due to the single currency union’s inherent structural weakness, EU has not been able to agree on any meaningful system-wide measures to combat the debt crisis. As such, EU’s country-by-country, crisis-by-crisis approach is only adding market volatility, and further derailing the region. And not even China’s pledge of its $2.7trillion overseas investment fund as European debt rescue could thwart market’s pessimism about the euro.

Spain — Too Big To Bail?

Multiple rating agencies already put Portugal, Spain and Greece on future downgrade watch, while Italy is another highly indebted euro member persistently coming up in market chatters.

Deutsche Bank AG has pegged Portugal as the next seeking a bailout after Greece and Ireland, while Spain is a hidden debt bomb dubbed as “too big to bail” since the size of Spain’s economy (about $1.4 trillion, with 20% jobless rate) is twice that of Greece, Ireland and Portugal combined.

Moody's estimated Spain may have to raise €170 billion from the markets next year, not including the amount banks may need to recapitalize. Bank of England, meanwhile, is not instilling much confidence either by forecasting a possible return to recession in 2011, adding that further quantitative easing may be used, if an "external shock" hits the economy.

Expect A Full-on Assault on Euro

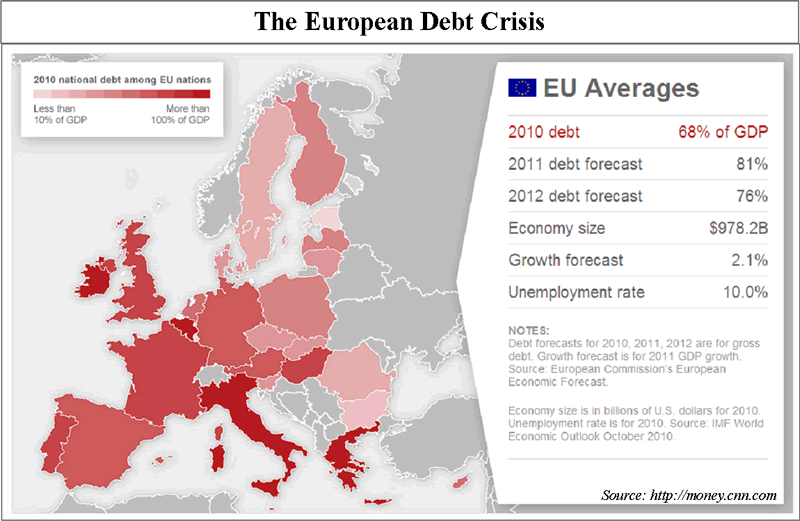

All this is not to say other EU members are in good financial and fiscal fitness either (See Graph). So, if you think the series of down-grades and rising concerns on euro zone countries' debt has worked against the euro this year, expect a fresh new round of downgrades--over debt or growth prospect—to bring about a full-on assault on Euro next year, particularly when you see Spain come up in headlines.

Trouble in Euro should boost Gold while providing support to the Dollar (i.e. the dog with fewer fleas.), which is the scenario that would play out in 2011.

Global Inflation Spike

Inflation is already running rampant in countries like China, Russia and India, mostly driven by food shortages. In Beijing, for example, food costs soared nearly 12% year-on-year in November.:Now, on the heel of U.S. Federal Reserve’s QE2 announcement in Nov, more monetary easing could be expected from central banks to stimulate their economies in 2011. This will only add fuel to the fire of the growing anxiety over rising inflation, and again bode well for gold.

Gold As a Reserve Currency

The shiny yellow metal is headed for a 10th straight annual gain. But with excess liquidity distorting everything, the typical trend and regression analysis will not work any more.

Nonetheless, combining the fundamental factors discussed here and technical signals, I believe Euro could break below $1.25 or even $1.20 sometimes next year, and could be as early as:the first half.::This could drive gold upwards towards the $1,600 levels. U.S. Dollar and Treasury would gain support as safe haven, which could push the bond yield down.

Furthermore, it is:worth noting that Gold priced in Euros has risen more than 38% so far in 2010, reaching a new record high above €34,475 per kilo, far outpacing the Gold’s nominal price gain (in dollar) of around 28%.

So, in a way, gold is treated almost like a second reserve currency replacing the Euro, and you would have gotten a better return getting into gold via Euro.

Post Comment Private Reply Ignore Thread

[Home] [Headlines] [Latest Articles] [Latest Comments] [Post] [Mail] [Sign-in] [Setup] [Help] [Register]