United States News

See other United States News Articles

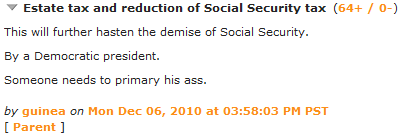

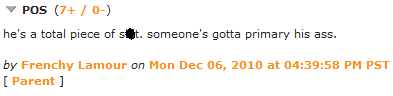

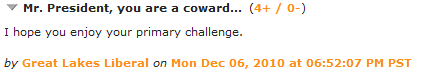

Title: Liberal Democrats Revolt Over Obama Compromise, Call him a piece of "S**t," Demand Primary Challenge

Source:

[None]

URL Source: http://punditpress.blogspot.com/201 ... mocrats-revolt-over-obama.html

Published: Dec 7, 2010

Author: punditpress

Post Date: 2010-12-07 11:42:14 by no gnu taxes

Keywords: None

Views: 8916

Comments: 34

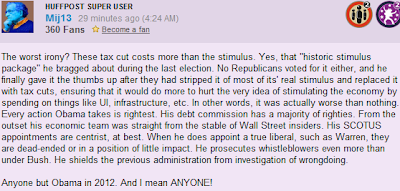

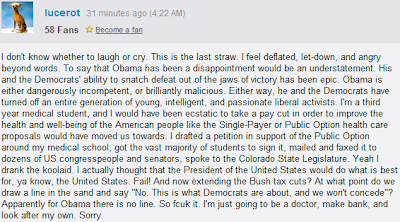

President Obama has compromised with Republicans over the last several days. You read that right. In order to secure some of his economic policies, Obama conceded Republicans that taxes for higher-earners should remain cut. In return, despite the fact that they did not get all of their economic wishes, some Congressional Republicans have promised their vote. While President Obama may be trying to give himself a pat on the back now that he has secured more votes, one group of people are furious with the President: his base. Once the compromise was announced, across the internet thousands of liberal democrats took to their keyboards to bash the Commander in Chief they so blindly followed for the last two years. For example, the liberal site The Huffington Post had over 20,000 comments on their article announcing the deal. The liberal site Daily Kos had nearly 1,000 comments on their article, entitled "President Obama announces deal to continue Bush tax policy." Here are just a few comments from Daily Kos that show the tremendous displeasure that liberals have with their President (with some language cleaned up): Clearly those that supported the President just two years ago are starting to leave him in droves. This could lead to an incredibly interesting 2012 primary season and could be extremely beneficial to Republicans that election year.

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

Begin Trace Mode for Comment # 26.

#1. To: no gnu taxes (#0)

The GOP allowed Obama to save a little face which is going to come back and bite them. This 13 month extension on unemployment is entirely too long. It is going to create even more of a welfare state. 29 posted on Mon Dec 06 2010 19:03:28 GMT-0500 (EST) by tobyhill [ Post Reply | Private Reply | To 1 | View Replies] http://www.freerepublic.com/focus/f-news/2638397/posts?page=29#29

(laughing) Just wait til 2012, when Owe-bama is forced to take a stand on taxation during the campaign. Boehner and company OWNED Owe-bama last night.

And the Republicans are forced to take a stand on spending and the deficit, both of which they just agreed to further expand.... (are we supposed to already forget all those GOP arguments about cutting spending and the deficit?)

Just wait til 2012, when Owe-bama is forced to take a stand on taxation during the campaign. And the Republicans are forced to take a stand on spending and the deficit, both of which they just agreed to further expand.... Yup...but that won't be a problem for the Presidential Nominee. And the fact remains its still Owe-bama's Washington, no matter how much you want to pretend otherwise. 2/3rds of the Federal Government is under Democrat control til January of 2013.

It very could be if they have to run against their own party. It's going to be very hard for a Republican to run on cutting the deficit if the GOP can't cut the deficit despite holding power of the purse. And then there's that little issue called "the economy" which the GOP just agreed to help stimulate.

This is one of your more laughable assertions. Owe-bama holds veto power. Owe-bama controls Washington via his position as POTUS, and Dems holding the Senate. Which means Owe-bama can't run against a 'GOP congress'. And if he attempts to run against the GOP House, he'll get laughed out of any room that has a viable cross section of voters. Finally, a GOP Presidential Nominee won't be required, nor expected, to defend the GOP controlled House given its unlikely that nominee will be FROM the GOP House. The 2012 election cycle will be about the most important issue facing EVERY American, the economy. If unemployment is at 7% or above, Owe-bama gets fired ala Jimmy Carter. If by some miracle its below 7%, he has a slim chance of reelection.

Well then, I guess that leaves the Democrats off the hook for anything that happened between 2006 and 2008. Finally, a GOP Presidential Nominee won't be required, nor expected, to defend the GOP controlled House given its unlikely that nominee will be FROM the GOP House. Hmmm - The two-percenters owe Congressional Republicans BIG TIME and thanks to their hefty tax cut can afford any candidate of their choice.

And yet you blamed the economic collapse on Pelosi and Reid. Didn't Bush have that same power when he was POTUS? And please tell us how the government will spend any money without the Republican controlled house first approving it?

Owe-bama holds veto power. Owe-bama controls Washington via his position as POTUS... And yet you blamed the economic collapse on Pelosi and Reid. Didn't Bush have that same power when he was POTUS? Wrong again, congressman Grayson. I blame it primarily on Freddie Mac and Fannie Mae, and that runs over the course of a dozen different US Congress's. And please, you need to accept Bush isn't POTUS, Owe-bama is. That cleared up, I've also assigned blame on Bush and the previous GOP congress many many times, you know this, everybody in this forum knows this...so why pretend otherwise? Its a waste of time, doesn't advance your political viewpoint an inch. Guess you feel the need to compensate for something, huh?

Ok, you were wrong about that as has been demonstrated numerous times given that Fannie and Freddy were late to the sub-prime game and had a much lower stake in sub-prime mortgages than private organizations such as countrywide. Yes, I'm aware that Obama is POTUS, and I give thanks everyday that he's got that job and not John McCain. And, you need to accept that as of January 3rd, 2011, the Republican Party will control the House of Representatives, meaning ALL spending starting on January 3rd must be approved by the GOP. See tagline.

Three Ways The CRA Pushed Countrywide To Lower Lending Standards When we discuss the role of the Community Reinvestment Act and other fair lending rules in contributing to lax lending standards, people bent on exonerating the CRA often point out that many of the questionable loans were made by non-depository mortgage companies not covered by the CRA. Barry Ritholtz has been a prominent critic of the theory that the CRA has some culpability for lax lending. He has pointed out that 50% of subprime loans were made by mortgage service companies not subject comprehensive federal supervision. “How was this caused by either CRA or GSEs?” Barry asked. As much as I respect Barry’s formidable analytical powers, I’m afraid he’s taken too narrow of the view of the matter. His question is far easier to answer than he suspects. Regulations often touch those who are not directly regulated. Indeed, the regulation of one group in a marketplace will almost always wind up affecting other groups. More concretely, there are three very specific ways in which the CRA nudged Countrywide and other mortgage companies to adopt lax lending standards. 1. The Creation Of Artificial Demand For Low-Income Mortgages. Banks that were regulated by the CRA often found it difficult to meet their obligations under the CRA directly. Long standing lending practices by local loan officers were a big problem. But as banks expanded their deposit bases and other businesses, they often found that they were at risk of regulators discovering they had fallen behind in making CRA loans. One way of addressing this problem was buying the loans in the secondary market. Mortgage companies like Countrywide began to serve this entirely artificial demand for CRA loans. Countrywide marketed its loans directly to banks as a way for them to meet CRA obligations. "The result of these efforts is an enormous pipeline of mortgages to low- and moderate-income buyers. With this pipeline, Countrywide Securities Corporation (CSC) can potentially help you meet your Community Reinvestment Act (CRA) goals by offering both whole loan and mortgage-backed securities that are eligible for CRA credit,” a Countrywide advertisement on its website read. 2. The Threat Of Regulation Is Often As Good As Regulation. It is highly misleading to claim that just because mortgage companies were not technically under the CRA that they were not required by regulators to meet similar tests. In fact, regulators threatened that if the mortgage companies didn’t step up to the plate by relaxing lending standards they would be brought under the CRA umbrella and required to do so. Here’s how City Journal explains the dynamic: To meet their goals, the two mortgage giants enlisted large lenders—including nonbanks, which weren’t covered by the CRA—into the effort. Freddie Mac began an “alternative qualifying” program with the Sears Mortgage Corporation that let a borrower qualify for a loan with a monthly payment as high as 50 percent of his income, at a time when most private mortgage companies wouldn’t exceed 33 percent. The program also allowed borrowers with bad credit to get mortgages if they took credit-counseling classes administered by Acorn and other nonprofits. Subsequent research would show that such classes have little impact on default rates. Pressuring nonbank lenders to make more loans to poor minorities didn’t stop with Sears. If it didn’t happen, Clinton officials warned, they’d seek to extend CRA regulations to all mortgage makers. In Congress, Representative Maxine Waters called financial firms not covered by the CRA “among the most egregious redliners.” To rebuff the criticism, the Mortgage Bankers Association (MBA) shocked the financial world by signing a 1994 agreement with the Department of Housing and Urban Development (HUD), pledging to increase lending to minorities and join in new efforts to rewrite lending standards. The first MBA member to sign up: Countrywide Financial, the mortgage firm that would be at the core of the subprime meltdown. 3. The CRA Distorted the Mortgage Market. With banks offering mortgages with high loan to value, delayed payment schedules and other enticing features, the mortgage companies would have quickly found themselves unable to compete if they didn’t offer similar loans. The requirement to offer risky loans from banks created a situation where other lenders found they had to offer similar products if they wanted to expand their business. Of course, Angelo Mozillo didn't need very much prompting on this score. He believed exactly what the CRA regulators believed: that these lax lending practices were the wave of the future, democratizing the glories of home ownership. http://www.businessinsider.com/three-ways-the-cra-pushed-countrywide-to-lower-lending-standards-2009-6

Not this crap again. How many times do you need this debunked? March 18. 2009: ---- http://washingtonindependent.com/34376/battling-the-cra-myth -----

#27. To: no gnu taxes (#26)

And: http://www.businessweek.com/investing/insights/blog/archives/2008/09/community_reinvestment_ac t_had_nothing_to_do_with_subprime_crisis.html

You might try once. This article explains quite thoroughly and succinctly why your quoted sources are FOS.

Top • Page Up • Full Thread • Page Down • Bottom/LatestTo: ejdrapes

#2. To: go65 (#1)

#3. To: Badeye (#2)

Just wait til 2012, when Owe-bama is forced to take a stand on taxation during the campaign.

#4. To: go65 (#3)

#5. To: Badeye (#4)

Yup...but that won't be a problem for the Presidential Nominee.

#8. To: go65 (#5)

It very could be if they have to run against their own party. It's going to be very hard for a Republican to run on cutting the deficit if the GOP can't cut the deficit despite holding power of the purse.

#12. To: Badeye (#8)

Owe-bama holds veto power. Owe-bama controls Washington via his position as POTUS...

#19. To: lucysmom, badeye (#12)

Owe-bama holds veto power. Owe-bama controls Washington via his position as POTUS...

#21. To: go65 (#19)

#22. To: Badeye (#21)

(Edited)

I blame it primarily on Freddie Mac and Fannie Mae, and that runs over the course of a dozen different US Congress's.

And please, you need to accept Bush isn't POTUS, Owe-bama is. That cleared up, I've also assigned blame on Bush and the previous GOP congress many many times, you know this, everybody in this forum knows this...so why pretend otherwise? Its a waste of time, doesn't advance your political viewpoint an inch.

#25. To: go65 (#22)

has been demonstrated numerous times given that Fannie and Freddy were late to the sub-prime game and had a much lower stake in sub-prime mortgages than private organizations such as countrywide.

#26. To: no gnu taxes (#25)

Three Ways The CRA Pushed Countrywide To Lower Lending Standards

“I can state very definitively,” Sandra Braunstein, director of the Federal Reserve’s consumer and community affairs division, said during a House Financial Institutions subcommittee hearing Wednesday, “that from the research we have done, the Community Reinvestment Act is not one of the causes of the current crisis.”

She cited a Federal Reserve Board analysis which found that, in 2006, CRA-covered banks operating in CRA-targeted neighborhoods accounted for just six percent of the risky, high-cost loans largely responsible for the housing crisis. Mortgage loans are considered high-cost when interest rates are at least three percentage points higher than those of conventional mortgages.

“So I can tell you,” Braunstein said, “if that’s where you’re going, that CRA was not the cause of this loan crisis.”

Yet the Fed’s research points to a different reality. “Our analysis of the data finds no evidence, in fact, that CRA lending is in any way responsible for the current crisis,” Fed board member Elizabeth Duke said in a speech before representatives of the banking industry last month. “The CRA is designed to promote lending in low- to moderate-income areas; it is not designed to encourage high-risk lending or poor underwriting.”

Advocates are quick to point out that the CRA includes a safety and soundness provision that discourages bad loans. “It has a built-in check saying that [banks] have to lend in a way that’s good for the institution and good for the community,” said Danna Fisher, legislative director at the National Low Income Housing Coalition.

Replies to Comment # 26. Fresh off the false and politicized attack on Fannie Mae and Freddie Mac, today we’re hearing the know-nothings blame the subprime crisis on the Community Reinvestment Act — a 30-year-old law that was actually weakened by the Bush administration just as the worst lending wave began. This is even more ridiculous than blaming Freddie and Fannie.

The Community Reinvestment Act, passed in 1977, requires banks to lend in the low-income neighborhoods where they take deposits. Just the idea that a lending crisis created from 2004 to 2007 was caused by a 1977 law is silly. But it’s even more ridiculous when you consider that most subprime loans were made by firms that aren’t subject to the CRA. University of Michigan law professor Michael Barr testified back in February before the House Committee on Financial Services that 50% of subprime loans were made by mortgage service companies not subject comprehensive federal supervision and another 30% were made by affiliates of banks or thrifts which are not subject to routine supervision or examinations. As former Fed Governor Ned Gramlich said in an August, 2007, speech shortly before he passed away: “In the subprime market where we badly need supervision, a majority of loans are made with very little supervision. It is like a city with a murder law, but no cops on the beat.”

Not surprisingly given the higher degree of supervision, loans made under the CRA program were made in a more responsible way than other subprime loans. CRA loans carried lower rates than other subprime loans and were less likely to end up securitized into the mortgage-backed securities that have caused so many losses, according to a recent study by the law firm Traiger & Hinckley (PDF file here).

Finally, keep in mind that the Bush administration has been weakening CRA enforcement and the law’s reach since the day it took office. The CRA was at its strongest in the 1990s, under the Clinton administration, a period when subprime loans performed quite well. It was only after the Bush administration cut back on CRA enforcement that problems arose, a timing issue which should stop those blaming the law dead in their tracks. The Federal Reserve, too, did nothing but encourage the wild west of lending in recent years. It wasn’t until the middle of 2007 that the Fed decided it was time to crack down on abusive pratices in the subprime lending market. Oops.

Better targets for blame in government circles might be the 2000 law which ensured that credit default swaps would remain unregulated, the SEC’s puzzling 2004 decision to allow the largest brokerage firms to borrow upwards of 30 times their capital and that same agency’s failure to oversee those brokerage firms in subsequent years as many gorged on subprime debt. (Barry Ritholtz had an excellent and more comprehensive survey of how Washington contributed to the crisis in this week’s Barron’s.)

There’s plenty more good reading on the CRA and the subprime crisis out in the blogosphere. Ellen Seidman, who headed the Office of Thrift Supervision in the late 90s, has written several fact-filled posts about the CRA controversey, including one just last week. University of Oregon professor and economist Mark Thoma has also defended the CRA on his blog. I also learned something from a post back in April by Robert Gordon, a senior fellow at the Center for American Progress, which ends with this ditty:

It’s telling that, amid all the recent recriminations, even lenders have not fingered CRA. That’s because CRA didn’t bring about the reckless lending at the heart of the crisis. Just as sub-prime lending was exploding, CRA was losing force and relevance. And the worst offenders, the independent mortgage companies, were never subject to CRA — or any federal regulator. Law didn’t make them lend. The profit motive did. And that is not political correctness. It is correctness.

#29. To: go65 (#26)

How many times do you need this debunked?

End Trace Mode for Comment # 26.

[Home] [Headlines] [Latest Articles] [Latest Comments] [Post] [Mail] [Sign-in] [Setup] [Help] [Register]