United States News

See other United States News Articles

Title: Palin Responds to Real Time Economics and We Respond

Source:

Wall Street Journal

URL Source: http://blogs.wsj.com/economics/2010 ... time-economics-and-we-respond/

Published: Nov 10, 2010

Author: WSJ

Post Date: 2010-11-10 10:42:42 by go65

Keywords: None

Views: 5020

Comments: 16

Real Time Economics yesterday looked at Sarah Palin’s remarks about monetary policy to a trade association conference. On Monday night, she responded on Facebook: So, imagine my dismay when I read an article by Sudeep Reddy in today’s Wall Street Journal criticizing the fact that I mentioned inflation in my comments about QE2 in a speech this morning before a trade- association. Here’s what I said: “everyone who ever goes out shopping for groceries knows that prices have risen significantly over the past year or so. Pump priming would push them even higher.” Mr. Reddy takes aim at this. He writes: “Grocery prices haven’t risen all that significantly, in fact.” Really? That’s odd, because just last Thursday, November 4, I read an article in Mr. Reddy’s own Wall Street Journal titled “Food Sellers Grit Teeth, Raise Prices: Packagers and Supermarkets Pressured to Pass Along Rising Costs, Even as Consumers Pinch Pennies.” The article noted that “an inflationary tide is beginning to ripple through America’s supermarkets and restaurants…Prices of staples including milk, beef, coffee, cocoa and sugar have risen sharply in recent months.” Now I realize I’m just a former governor and current housewife from Alaska, but even humble folks like me can read the newspaper. I’m surprised a prestigious reporter for the Wall Street Journal doesn’t. - Sarah Palin Sudeep Reddy responds: Our post on Monday examined the assertion that grocery prices “have risen significantly over the past year or so.” That view is not supported by the facts. A broad measure of food prices from the Labor Department shows prices rose at an average annual rate of less than 0.6% in the first nine months of the year. September’s increase in food prices — 1.4% for food and beverages at an annual rate — was low by historical standards.(In fact, the lowest average annual inflation rate on record was 1.4%, in 1992.) Commerce Department inflation data show a similarly slow year-over-year increase for food prices, 1.3%. While some items in the shopping cart have risen in price (ground chuck beef is up 4.8%) and others have decreased (bananas are down 5.3%), overall food price inflation has been historically low for the past year. This is not surprising. Weak demand, high unemployment and thrifty shoppers have led retailers to keep many prices from rising despite the rising cost of some commodities, including coffee and sugar. The Nov. 4 Wall Street Journal article noted, in its first sentence, “the tamest year of food pricing in nearly two decades.” It does indeed report that supermarkets and restaurants are facing cost pressures that could push their retail prices higher — but it hasn’t happened yet on a large scale. Critics of the Fed’s quantitative easing policy are focused primarily on concerns about potential future inflation.

Ever since 2008, people seem inordinately interested in my reading habits. Among various newspapers, magazines, and local Alaskan papers, I read the Wall Street Journal.

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

#1. To: All (#0)

Since when have facts mattered to Palin and her disciples?

Food prices are up if you walk into any grocery store, GO. IN the past two weeks there has been a significant rise in costs. Kroger, Wal Mart, et al have either already raised prices, or announced they are about to.

Obama's first all-by-his-lonesome budget, btw, calls for a $1.17 trillion deficit.

Long before and long after facts and accuracy mattered to the lying leftwingnuts who can't see or refuse to see with their own eyes.

BULLSHIT. You're a shill, go65. Pure and simple. You BELIEVE in the Socialist model, and oBUMa is your HERO. Do you smile when you swallow, after servicing our Socialist-In-Chief? Getting tired of the bozoed calcon following me around on the 'net, wanting to discuss "tossing salad." Sorry, you sick rump-ranger. NOT interested.

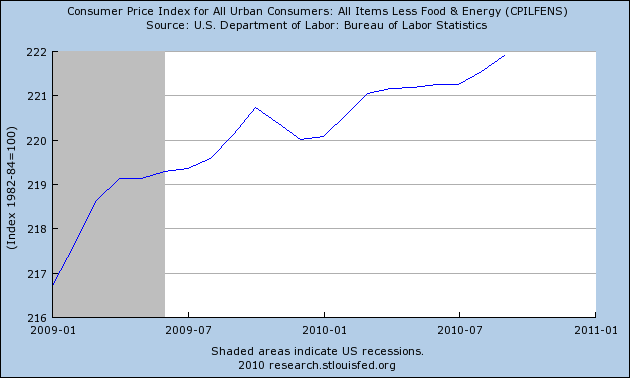

Like YOU worry about facts. Robert Wenzel writes: With commodity prices soaring, Paul Krugman is in a trap with his deflation call, so he has decided to turn to Richard "I am not a crook" Nixon to explain why price inflation is really not happening. The problem with this is that core CPI was designed at the request of Tricky Dick Nixon to hide real inflation. Here's the story of what went down: Kevin Phillips, a political and economic commentator for more than three decades and onetime Nixon strategist, reports that President Richard Nixon asked his Federal Reserve chairman, Arthur Burns, to concoct a new inflation number that would be split off from traditional headline CPI, dubbed “core” inflation—and thus make inflation look less threatening. Phillips says in the 1990s, the CPI was subjected to three other adjustments, all delivering a downward bias and all dubious: This is the index that Krugman has decided to base his deflation case on. Yes, deflation! Even though the manipulated core index is up! I an not making this up. Here's Krugman: There’s really nothing here to shake my view that deflation, not inflation, is the threat. Here's the core CPI starting Jan 2009: Using this sleazy core index, Krugman then divides the PPI by it. Which proves that Krugman once again doesn't understand the business cycle, since coming out of a recession, it will be capital goods prices and raw materials prices that climb first. Thus, he is trying to prove his deflation case by showing what any decent business cycle theorist would understand to be the way you would expect prices to move before you get inflation at the consumer level. Getting tired of the bozoed calcon following me around on the 'net, wanting to discuss "tossing salad." Sorry, you sick rump-ranger. NOT interested.

Sad to see you sink to such levels that I no longer wish to read your comments. See ya later, perhaps.

Never swear "allegiance" to anything other than the 'right to change your mind'!

The truth IS an ugly thing, isn't it? You'll get over it.

Getting tired of the bozoed calcon following me around on the 'net, wanting to discuss "tossing salad." Sorry, you sick rump-ranger. NOT interested.

A few weeks ago Eric referred me to the writings of Eustace Mullins: There's not much of a point in paying attention to any of his rants.

In 1968, Mullins authored a tract.... blah blah blah... Ignoratio Elenchi. Absolutely classic red-herring!!! You'll say or do ANYTHING, to stay willfully ignorant, WON'T you? I've said for a long time, that be a liberal/socialist/communist, you have to be willfully ignorant, or mentally deranged. That is to say, stupid or insane. You're BOTH. You prefer ignorance to knowledge. You prefer lies over the truth. You're an idiot. Thanks for the laughs!!!

Getting tired of the bozoed calcon following me around on the 'net, wanting to discuss "tossing salad." Sorry, you sick rump-ranger. NOT interested.

off to filter-land you go. bye bye.

nope: Food prices are up if you walk into any grocery store, nope: They are up significantly to anyone who does the family food shopping. Even the chart that is posted proves it!

Food prices are up in every grocery store in American TODAY, GO. There are plenty of news articles detailing it.

Obama's first all-by-his-lonesome budget, btw, calls for a $1.17 trillion deficit.

Just wait til the super inflation kicks in next year.

Obama's first all-by-his-lonesome budget, btw, calls for a $1.17 trillion deficit.

Ever hear of the Boy who cried wolf?

You're becoming a bit psychotic on economic related topics.

Obama's first all-by-his-lonesome budget, btw, calls for a $1.17 trillion deficit.

Our post on Monday examined the assertion that grocery prices “have risen significantly over the past year or so.” That view is not supported by the facts.

On January 3, 2011 the GOP assumes responsibility for deficit spending.

#2. To: go65 (#1)

#3. To: go65 (#1)

Since when have facts mattered to Palin and her disciples?

#4. To: go65 (#0)

That view is not supported by the facts.

#5. To: go65 (#1)

Since when have facts mattered to Palin and her disciples?

How the Government Lies About Low CPI Inflation, Krugman Deflation Propaganda

Krugman tells us to forget about the prices that are going up. They are too volatile, he tells us. He says that what we should focus on are tricky sticky price indexes, specifically, core CPI.

Writes Phillips:Richard Nixon, besides continuing the unified budget, developed his own taste for statistical improvement. He proposed albeit unsuccessfully—that the Labor Department, which prepared both seasonally adjusted and non-adjusted unemployment numbers, should just publish whichever number was lower. In a more consequential move, he asked his second Federal Reserve chairman, Arthur Burns,to develop what became an ultimately famous division between "core" inflation and headline inflation. It the Consumer Price Index was calculated by tracking a bundle of prices, so- called core inflation would simply exclude, because of "volatility," categories that happened to he troublesome: at that time, food and energy. Core inflation could he spotlighted when the headline number was embarrassing, as it was in 1973 and 1974. (The economic commentator Barry Ritholtz has joked that core inflation is better called "inflation ex- inflation"—i.e., inflation after the inflation has been excluded.)

*Product substitution: If flank steak gets too expensive, people are assumed to shift to hamburger, but nobody is assumed to move up to filet mignon, he says;

*Geometric weighting: Goods and services in which costs are rising most rapidly get a lower weighting for a presumed reduction in consumption

*And, most strangely, hedonic adjustment: An unusual bit of monkeyshines by which the government says that product improvements in things like computers, cell phones or television actually amount to a reduction in price, so a $2000 laptop with a built in camera is less expensive than a $1500 laptop without one.

The key is really not to watch these mumbo jumbo equations designed by Tricky Paul with the help of Tricky Dick, but to keep an eye on money supply growth, in relation to productivity growth and the consumer desire to hold cash. If money growth is sufficient, it will cancel out any downward price pressures from productivity gains. As for the consumer desire to hold cash, we have been through a wretching financial crisis and business cycle down turn. The desire to hold cash has skyrocketed, it's not going to climb from here.

With Ben Bernanke launching the massive QE2, money supply growth will overpower downward price pressure from any productivity gains, but more important, the desire to hold cash is so high that it is unlikely to climb higher. Thus, the new QE2 money will, indeed, start working on pushing prices at the consumer level higher--there will be no further desire to hold cash to absorb the money. Thus, the coming consumer price inflation will be massive.

One other point, and Krugman is correct on this. There is additional demand for commodities from emerging markets, such as China, But this additional demand will do nothing but push prices even higher, than they are already are.

In short, Krugman has made a lot of dumb arguments, but his argument today may very well prove to be his dumbest, most inaccurate, embarrassing argument he has ever written. In time, I expect economists will be using it as an example of total confusion. It is likely to surpass the embarrassing calls of Irving Fisher, who said just weeks before the crash, "Stocks have reached what looks like a permanently high plateau," and the call of New York Fed economists McCarthy and Peach who wrote an entire paper in 2004 explaining why the housing market was not in a bubble.

Yes, write this down. In November 2010, when we are on the edge of huge price inflation at the consumer level, Krugman fears deflation.

#6. To: Capitalist Eric, Do you smile when you swallow, after servicing our Socialist-In-Chief? (#4)

Do you smile when you swallow, after servicing our Socialist-In-Chief?

#7. To: Brian S (#6)

Sad to see you sink to such levels that I no longer wish to read your comments.

#8. To: Brian S, Capitalist Eric (#6)

Sad to see you sink to such levels that I no longer wish to read your comments.

In 1968, Mullins authored a tract, The Biological Jew (Staunton, Va., Faith and Service Books, Aryan League of America, 1968), which includes the following statement about Nazi antisemitism: "Nazism is simply this — a proposal that the German people rid themselves of the parasitic Jews. The gentile host dared to protest against the continued presence of the parasite, and attempted to throw it off." The book also claims that Jews "drink the blood of innocent gentile children" in religious ceremonies, and that this practice represents the essence of Judaism.[5]

On January 3, 2011 the GOP assumes responsibility for deficit spending.

#9. To: go65 (#8)

few weeks ago Eric referred me to the writings of Eustace Mullins:

LMAO!!!!

#10. To: Capitalist Eric (#9)

On January 3, 2011 the GOP assumes responsibility for deficit spending.

#11. To: Badeye (#2)

(Edited)

Food prices are up if you walk into any grocery store,

On January 3, 2011 the GOP assumes responsibility for deficit spending.

#12. To: go65, Badeye (#11)

#13. To: go65 (#11)

#14. To: Ibluafartsky (#12)

They are up significantly to anyone who does the family food shopping. Even the chart that is posted proves it!

#15. To: Badeye (#14)

Just wait til the super inflation kicks in next year.

COMING NEXT YEAR: OBAMA’S INFLATION

By Dick Morris

http://www.dickmorris.com/blog/coming-next-year-obamas-inflation/

March 3, 2009

On January 3, 2011 the GOP assumes responsibility for deficit spending.

#16. To: go65 (#15)

Top • Page Up • Full Thread • Page Down • Bottom/Latest

[Home] [Headlines] [Latest Articles] [Latest Comments] [Post] [Mail] [Sign-in] [Setup] [Help] [Register]